Dear online lending companies, please go out and hire additional business development people asap. Your teams will be very busy in 2017 as we are about to see a wave of banks seeking partnerships. We want to make sure that you are ready to close these deals. Sincerely, your friends at LendIt & Lend Academy.

Last week I traveled to North Carolina to speak at the Carolinas Credit Union League Annual Meeting. This was a gathering of CEOs from about 30 of the largest Credit Unions in the Carolinas. Admittedly, these Credit Unions are small potatoes in the broad landscape of banks, but they represented the largest Credit Unions in the Carolinas and it was refreshing to hear from a room full of CEOs that are hungry to do a deal. I presented on bank partnerships and why banks should consider buying, building and partnering with fintech companies.

Originally small banks feared possible disruption but that fear has subsided, now the focus has shifted to collaboration

Both banks and fintech companies have come to the realization that they have core competencies that are complimentary. According to a recent Manatt survey, a whopping 72% of regional and community banks said that they plan to collaborate with a fintech company in the next 12-18 months. In my small sample set, I polled the 30 CEOs in the room and only 3 had already established fintech partnerships (two with NCR for payments and one with a mobile banking developer) and the remainder were eager to find partners.

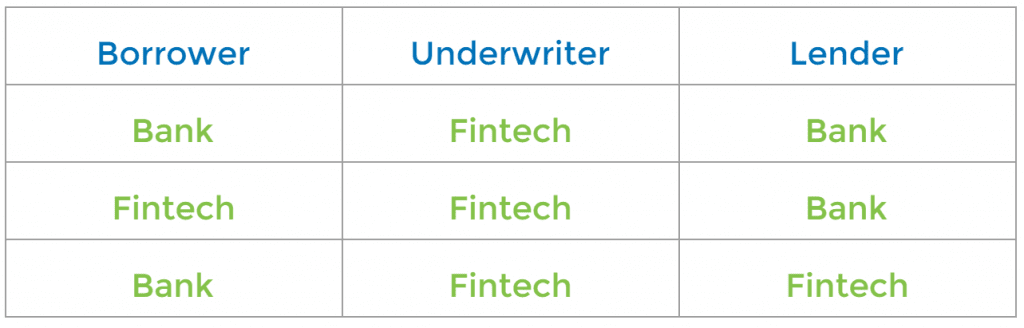

Partnerships have been most frequent. There are three ways that banks can partner with online lenders.

Banks are naturally conservative so it comes as no surprise that the early adopters have chosen to partner with fintech companies rather than buy or build. We expect that partnerships are going to rapidly accelerate in 2017.

Bank partnerships with Online Lenders take three forms as displayed above.

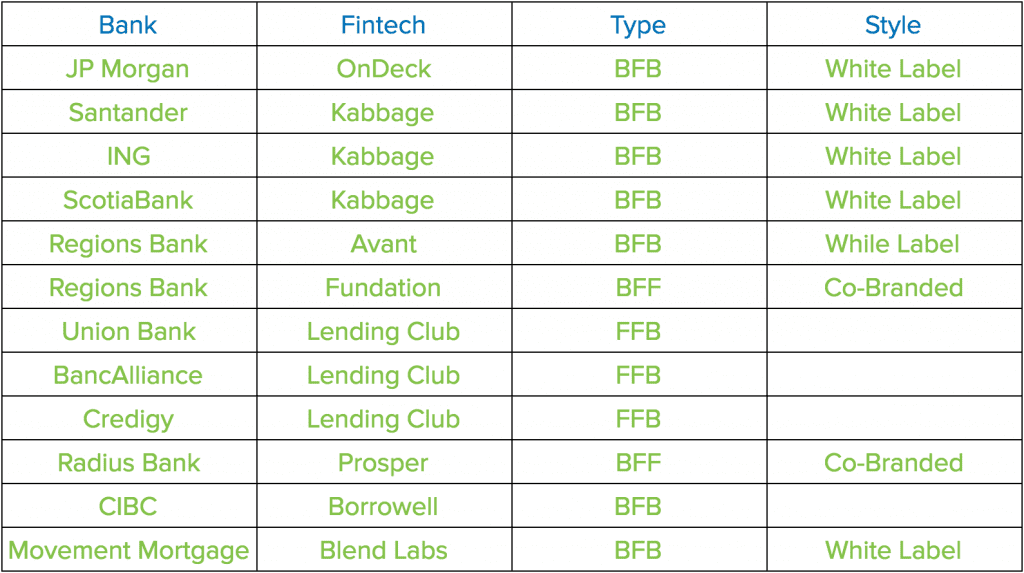

Bank-Fintech-Bank (BFB): In this scenario the bank uses their channel to originate borrowers, the online lender underwrites the loan, and the bank uses its depositor base to fund the loan. Some well known examples of the BFB structure are JP Morgan & OnDeck, Santander & Kabbage, and Regions Bank & Avant.

Fintech-Fintech-Bank (FFB): In this scenario, the online lender uses their own channel to acquire the borrower, they use their technology to underwrite the loan, and the bank provides the lending capital. This is the common partnership pursued by Lending Club, their partnerships with Union Bank and the BancAlliance are both FFB deals.

Bank-Fintech-Fintech (BFF): In this scenario the Bank uses their channel to acquire the borrower but the fintech underwrites the loans and funds it themselves. Examples of this type of partnership include Regions Bank & Fundation as well as Radius Bank & Prosper.

Co-Brand or White Label: Each partnership must also decide whether to co-brand or white label. Regions Bank is most interesting because they chose to white label with Avant but co-brand with Fundation. One analyst I recently talked to suggested that they white labeled consumer lending because they will try to cross sell additional services like checking and savings accounts, whereas small business lending is less strategic and more tactical, it represents a way for to allocate their excess capital efficiently.

Here is a rundown of well known partnerships and their structure:

Check out this Google Sheet that we use to track bank deals. Feel free to add more deals as you see them: Bank Partnerships in Online Lending

There have only been two major banks build their own online origination platforms

Last month Goldman Sachs officially launched Marcus, the first online lending platform built by a bank. This was a major milestone for the industry. It signaled that banks and online lending platforms can co-exist. In this case, Goldman bought GE Capital’s consumer bank, along with $16b in deposits, and it built its online lending platform from scratch. This is an in-house FFB structure where the platform originates the borrower and underwrites the loan, and the bank funds the loan from its balance sheet.

- First major US bank to build an online lending platform

- Bought: deposit platform from GE Capital Bank with $16b in deposits

- Built: online lending platform that offers a lower cost of capital

- Fixed-rate, no-fee loans ranging from $3,500 to $30,000

- APRs 5.99% to 22.99% with a median of 12-13%

- 200 Employees

- FFB – Consumer – In-house

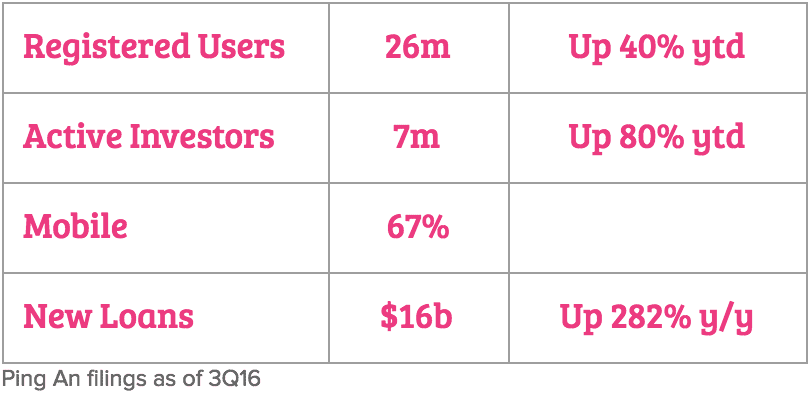

PingAn in China gets the credit as the very first major financial services company to launch an online lending platform when it created Lufax in 2013. It is an amazing case study on just how fast a fintech company can grow inside of a financial services firm. Lufax used PingAn’s resources to rapidly scale its lending operation and also expand into wealth management and institutional trading in a very short amount of time. More recently the firm has acquired 3 additional Ping An subsidiaries and has formed the Lufax Holding Company, which is an $18 billion fintech behemoth, already in the top 5 largest fintech companies in the world. We look forward to Lufax’s IPO sometime in the next 12-18 months.

- First major financial company to build its own online origination platform in 2013

- Scaled Lufax dramatically by fully integrating into Ping An’s infrastructure

- Organically expanded to Wealth Management and Institutional Trading by cross selling Ping An products

- Eventually acquired 3 additional Ping An affiliated companies to form Lufax Holdings, currently valued at $18 billion after 3 years

SunTrust is the only major banks to buy an online origination platform

SunTrust is the only major bank to have actually acquired an online lending platform. Back in 2012 they acquired FirstAgain (now called LightStream) when is was a small startup. Over the past 4 years SunTrust has built LightStream into one of the largest consumer unsecured prime/super prime lenders in the US having originated $1.5b in 2015. They use the FFB structure where the platform originates and underwrites the borrower and the bank uses its deposit base to purchase the loans. For more information on this deal, check out Peter’s podcast where he recently had a fascinating interview with Todd Nelson, CEO of LightStream.

- SunTrust is a top 25 bank, LightStream originated $1.5b in 2015

- One of the largest consumer unsecured lenders in the US

- SunTrust Acquired FirstAgain [LightStream] in Jan 2012

- Positioned as the low cost provider

- Can use bank deposits to its advantage

- Competes in auto finance, home improvement, and debt consolidation

Can’t Get Enough on Bank Partnerships, Tune Into Our Webinar This Wednesday

If you love this topic and you want to learn more, tune into our webinar this Wednesday at 2pm EST. The LendIt team along with Goodwin will host an all-star panel to discuss bank partnerships. We will have Manny Alvarez from Affirm, Richard Neiman from Lending Club, Kevin Lewis from Avant, and Mike Whalen from Goodwin.

Prediction: We Are Just Getting Started

Dear online lending companies, in case you didn’t hear us the first time, your teams will be very busy in 2017 as we are about to see a wave of banks seeking partnerships. Get your deal teams ready. Thanks for listening, now go out there and strike some deals! Your friends at LendIt & Lend Academy.