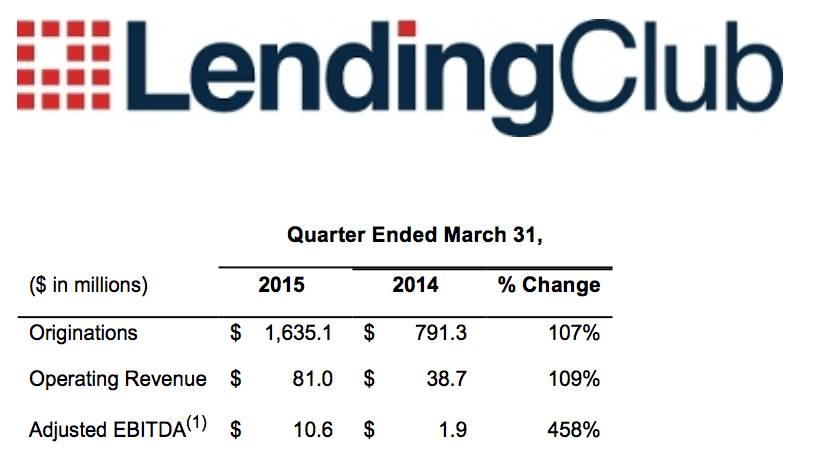

Today Lending Club announced their first quarter earnings for 2015. The big focus on Lending Club has been rising expenses which was addressed in the call. Sales and marketing expenses as a total of originations have decreased from 2.16% to 2.04% year over year due to channel efficiency. In Q1 2015, they crossed the $1.5 billion mark in originations with over $1.6 billion for the quarter. This is an increase of 107% year-over-year with last year coming in at $791 million for the same time period. Total loan originations are sitting at $9.2 billion, which means we will see them cross the $10 billion mark next quarter.

Before their first earnings call for Q4 2014, the stock traded at $23.65. It has since fallen and closed today at $17.58. At the time of writing, it is up around 5% in after hours trading at $18.48. The stock still trades above it’s original IPO price of $15 per share.

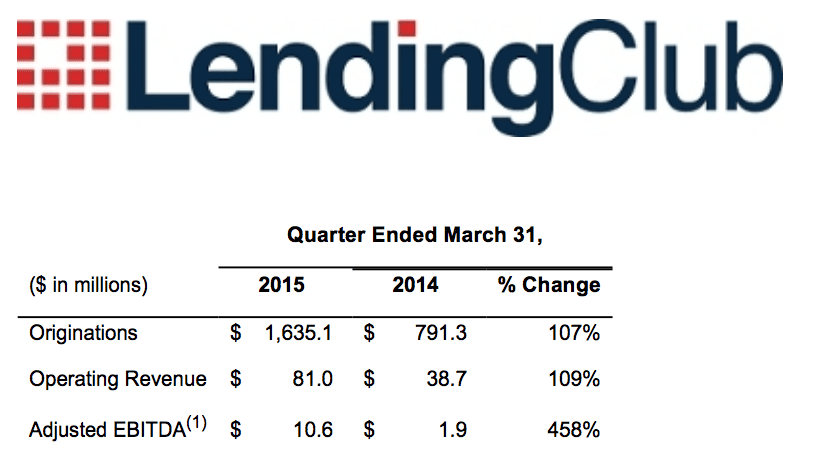

Q1 earnings were an adjusted $0.02 per share, up from $0.01 from Q4 2014. Revenues rose 109.3% year-over-year to $81 million versus the $75.68 million consensus. Guidance for Q2 was revised to $90-92 million and fiscal year 2015 total was revised to $385-$392 million (previously $370-$380). Adjusted EBITDA was $10.6 million for Q1 2015, compared to $1.9 million in the same period last year. They also revised adjusted EBITDA to $40-46 million, up from $33-$42 million.

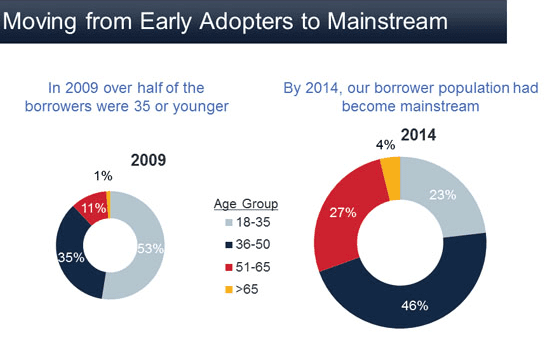

Lending Club shed some light during the call on the changing demographics over time. In 2009, over half of the borrowers were 35 or younger. By 2014, over 75% of borrowers are over the age of 35. This clearly shows the transition from the younger generation of borrowers willing to get an online loan to online lending becoming much more mainstream. It’s clear that we have come a long way.

The question and answer session brought up many topics that were highlighted in the call. Below is a summary of the question and answer session.

Q: When you look at SMB efforts, what have you learned in terms of demand and profile of borrowers? What is the APR, spread, and cost of origination compared to personal unsecured loans?

A: Lending Club continues to learn a lot about this market as they launched about a year ago. At the time they thought there were two things to focus on: customer acquisition and underwriting. They believe no one has really cracked the code on those items. The strategy has been to go after the market with partnerships. By partnering with large companies, they believe they can acquire customers at a lower cost, utilizing existing brand loyalty and an existing trusted relationship. This is evidenced with the Google and Sams Club partnerships. Partnerships also help with underwriting in the sense that many borrowers have thin credit files and the credit data isn’t as predictive as it is with personal loans. When you enhance the data with financial/transactional data and the history coming from partners, it puts them in a better position to assesses risk and thus generate a better yield for investors. The yield is similar to the personal loan product with yields in the double digits. They are currently not breaking out SMB specifically as part of their originations and earnings.

Q: With the Home Advisor partnership, is this still the standard product? How does the Citi partnership work and is it similar to other distribution channels?

A. The Home Advisor product is the same old loan product. This program was launched late last year as the AA super prime product going up to 50k with interest rates starting at 3.99%. Renaud stressed that this is a competitive rate compared to a HELOC. The Lending Club loan is also much simpler and faster than the HELOC. The Citi partnership is not a big dollar amount, but it is the first time a top 5 bank is relying on a marketplace to originate loans. It is a program that is dedicated to low and moderate income consumers. They can reach consumers in using a national origination platform in areas where banks don’t have a branch footprint, so the banks can benefit from the online. This will offer affordable credit to this population.

Q: At LendIt, there was a lot of focus on the increase in customer acquisition channel and inefficiencies. How are you bucking the trend?

A: In general, they have seen a number of small origination platforms, many of them in different countries or niches that Lending Club is not. They’ve seen over the course of many years that they have grown faster and extended their lead from Prosper (the second largest marketplace). In the last two quarters, they grew faster in percentage terms even in being in a higher base. Renaud mentioned a FTPartners article showing that Prosper spending 300 bps of origination on marketing compared to 200 in Lending Club’s case. He believes brand, credibility, efficiency of marketing channels, operating efficiency, and interest rate advantage along with a broader investor base are all factors that lead to better cost efficiency. Investors have built enough confidence that they have a pricing advantage due to investors willing to accept less yield.

Q: Followup question on initiatives to build the brand and to acquire more efficiently. What have you done over the last 5-6 months to move towards that goal?

A: Number one is having a great service and great product. They released the net promoter score of 78% which is extremely high. It is a good proxy for customer satisfaction and willingness to talk about Lending Club and for borrowers to refer their friends. Over time, they build more brand awareness through multiple channels including new channels such as direct response radio and tv. It’s very early so they don’t have a read on the success of these efforts. The tv test will launch in the next few weeks. As Lending Club continues to offer more useful products and cover more use cases, this will lead to an increase of brand awareness.

Q: How is SMB healthcare and education going to impact the model on a sustainable basis? What will be there impact on sales and marketing?

A: Both products are roughly equivalent to their core product. They are not breaking it out at this point because they are very similar. With regard to acquisition and investments, those have a bit higher cost. Lending Club is focused on long term efficiency on the the contribution margin. Related to the core product, there is a lot of runway with the current products/channels at similar cost. The market size is not a limiting factor anytime soon. They see $900 billion in credit card receivables outstanding with around 390 billion meeting their credit policy. Current average rates at credit cards is at 17% and a 3 year Lending Club loan was 12% in the last quarter.

It is clear that Lending Club had a successful quarter as they revised their outlooks higher. I believe there are also several partnerships that we still won’t see the effects of until later this year. More partnerships continue to be a theme for Lending Club as they look to expand their borrower reach. You can view more information about Lending Club’s earnings on their Investor Relations site.