Lending Club held it’s Q2 2015 earnings call today and expenses continue to be on the minds of many investors. The stock has had a steady decline since last quarter. As I reported in the last earnings release, LC closed previously at $17.58. It has since fallen to close today at 13.84. Below are some of the highlights from their earnings release as well as a review of the questions that were asked during the question and answer session.

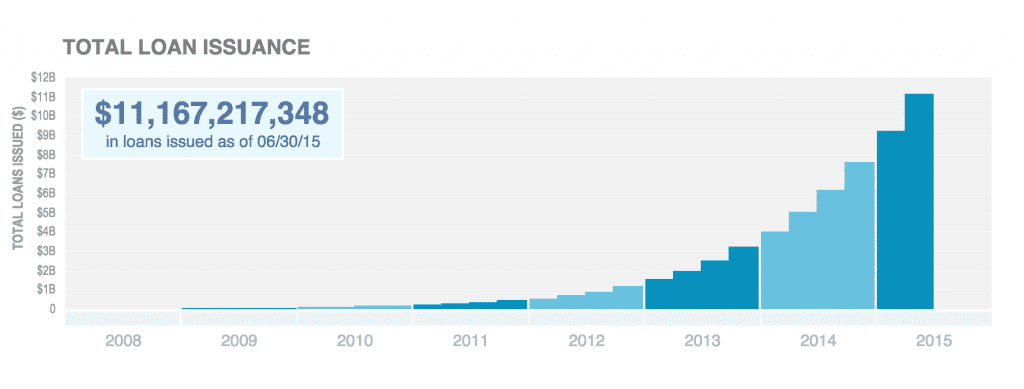

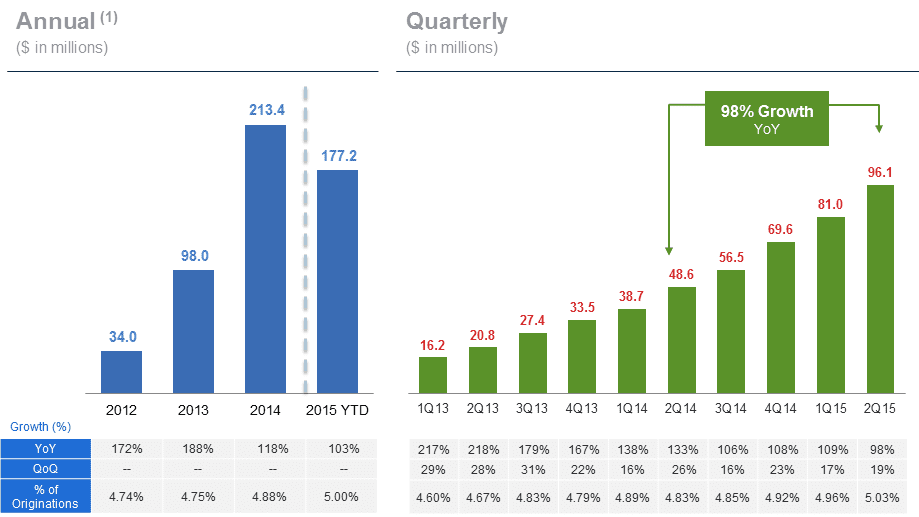

Loss per share came in at ($0.01) for the second quarter of 2015. This is compared to EPS of ($0.16) in the same period last year. Revenue growth remains strong with $96.1 million for 2015, up from $48.6 million in the same period last year. This is an increase of 98% year-over-year. Lending Club has a strong balance sheet with cash, cash equivalents and securities available for sale totaling $888 million, with no outstanding debt.

Growth doesn’t seem to be an issue for Lending Club with $1.9 billion in originations for the quarter. This is up from $1.6 billion last quarter. This is a 90% increase from Q2 2014 originations and Lending Club has officially passed $10 billion mark with $11.2 billion in total originations.

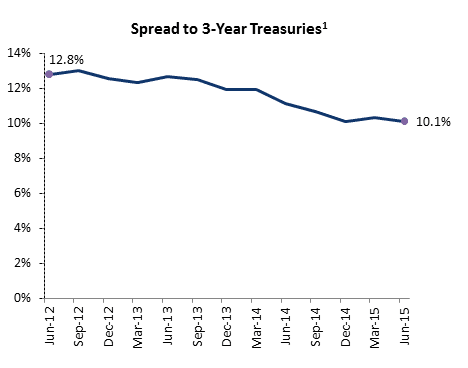

As I have written about in the past, borrower acquisition has been an issue for marketplace lenders. Recently, Lending Club lowered interest rates across most loan grades. As part of the presentation, Lending Club noted that risk premiums required by investors declined 270 bps over the last 3 years due to investor confidence. This includes an average interest rate decrease on 36-month loans from 13.2% in June 2012 to 11.2% in June 2015 (200 bps) and the 3-year treasury yield increase of 70 bps over the same period. Interestingly, Renaud stated in the question and answer session that they don’t have any constraints on the borrower or investor side.

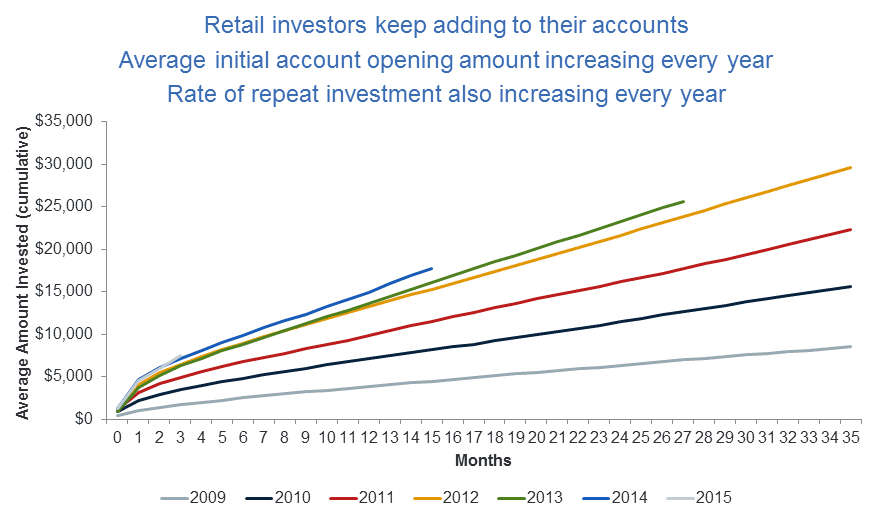

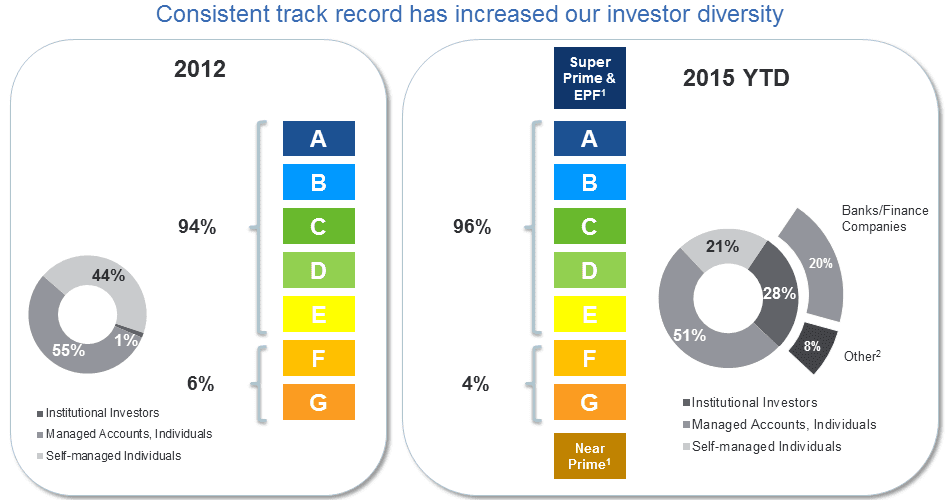

Lending Club highlighted several recent business developments in their press release. They have opened to investors in five states (total of 33) and increased borrower states by two. Lending Club loans are now available in 47 states. In addition, they touted 100,000 active individual investors who have invested over $1 billion on the Lending Club platform in Q2.This will continue to provide a stable source of capital according to Renaud Laplanche. This accounts for slightly more than half of the total loans originated. As of Q2 2015, 30% of investors are institutional, 20% are self-managed, individuals and 50% are managed accounts, individuals. As part of their presentation, they highlighted retail investors continuing add to their accounts as depicted below.

Lending Club also provided additional information of the shift of investors over time.

They also launched an alliance with Ingram Micro, the world’s largest wholesale technology distribution company. Lending Club will be the the exclusive provider of unsecured lines of credit and term loans up to $300,000. According to the release, this could account for tens of thousands of new borrowers. They also partnered with Zulily, a specialty online retailer that’s topped a billion a year in sales. The continued focus on partnerships comes as no surprise as Lending Club continues to seek new borrowers.

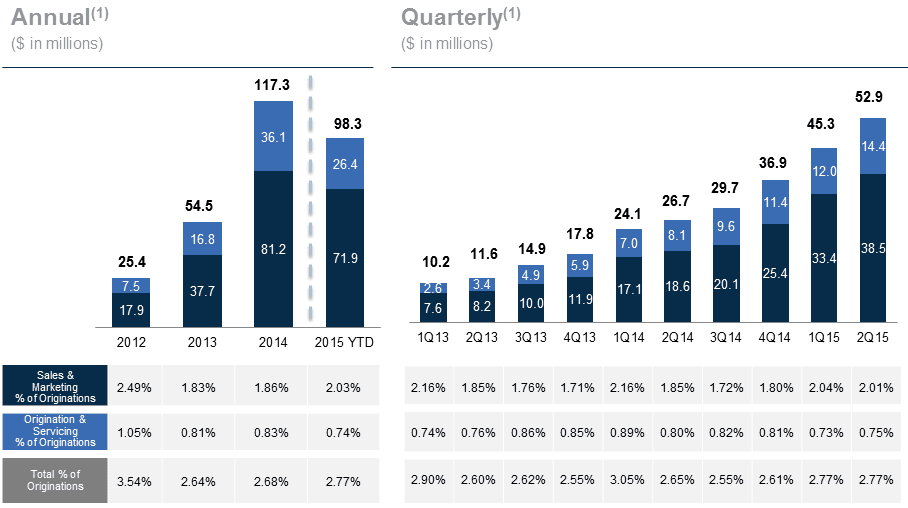

One of the biggest areas that investors focus on are Lending Club’s expenses as a percent of originations, specifically when it comes to sales and marketing. We saw a decrease from 2.04% to 2.01% this quarter, although Lending Club also mentioned some additional expenses being included in this. Regardless, a decrease is a welcome change and it will be interesting to see how this progresses.

Renaud mentioned in the call that they are starting to see some benefits of the network effect, resulting in lower borrower acquisition costs. As I’ve reported on in the past, Lending Club continues to state that they are investing in the business. They’ve seen solid growth in both their education and patient financing product lines.

Third quarter 2015 operating revenues are projected to be in the range of $106 million to $108 million. Lending Club has also adjusted fiscal year 2015 total revenues to be in the range of $405 million to $409 million, up from $385 million to $392 million previously.

Below is a summary of the question and answer session that were highlighted in the call.

Q: In the presentation there was a slide about the potential to unlock value from 1 million borrowers that have taken a loan. Can you talk about the degree that you are limited by only having one product. Can you talk about new products?

A: As noted in the presentation, 14% of borrowers have come back to take a second loan. This figure is driven down by the rate of growth that LC is seeing. 80% of the 1 million borrower base has come along in the last 2 years. We have a nice repeat customer rate, but with the young age of these loans there is still a of future value to unlock. As Lending Club’s product line gets broader and we release other products, that will only increase ability to cross-sell and monetize that base.

Q: Can you speak about the Madden vs Midland funding case?

A: Lending Club has seen the case and believes there are two things that may apply. First, is the federal preemption and the other is the choice of law provision. Lending Club only needs one of these and are currently relying on their choice of provisions. In this case it is being challenged by the banks. If this gets challenged, Lending Club could think of a different issuance framework. If need be, they will switch to a series of state licenses. As noted in the presentation, approximately 12.5% of the consumer loan volume originated through the platform would exceed state rate limits. If need be, this would need to be revised in certain states.

Q: Can you talk about the large negative operating cash flow?

A: Lending Club has close to $900 million in cash. They moved half of that (around $400 million) to a securities profile in order to earn a better return. If you’re just looking at the cash-flow, it is a result of investments they made.

Q: Can you speak more about marketing efficiency including offline vs. offline, channel partners etc. and which are driving efficiency?

A: Lending Club is experiencing tailwinds coming from the brand gaining in awareness and credibility. This is helping in driving conversion rates. We are receiving positive reviews and have high customer satisfaction. The partnerships tend to be more efficient than direct marketing in some cases. For example, the bank alliance partnership with small community banks, which is offering co-branded loans with the banks is working well. These banks, for instance, had the borrower as a mortgage customer, but don’t offer a personal loan product. Customers are more responsive to a co-branded offer of the local bank. It is still early, but we are seeing 2x-3x better marketing efficiency than the rest of the business.

Q: Operating revenue has grown significantly from 2013. Are there any trends we can draw this? What would cause it to reverse?

A: We’ve seen it gradually increasing from collection fees and passing that through to investors. On the investor side, we charge retail investors 1%, but as we bring on high net worth and institutions we bring them on at marginally higher rates. Harder to predict permanently, but we do expect some marginally increases in servicing fees.

Q: Can you talk about the flexibility across marketing channels?

A: We continue to move the budget to other channels that are more efficient as we benefit of diversification across marketing channels. When we begin to scale back efforts with some channels we usually get a call from the CEO or partner to offer better pricing terms. From this perspective, we benefit from having a leading position and are able to favorably negotiate terms.

Q: Give us a sense of the level of interest as you’ve seen more growth in SMB and you expand in closer verticals. Has this given you any more interest in other categories of getting in faster? Any plan of accelerating the timeline of going international?

A: We are pleased with all new initiatives and they have reinforced the conviction that we should continue to grow product offerings and fulfill the mission of transforming the entire banking industry as well as make credit more affordable. Over time, we look to fulfill all the needs of customers. We have been releasing 1-2 new products year and are planning to launch another product in the next few months before the end of the year. Lending Club is also planning to enter a new category in the first half of next year. This category is a new use-case and will utilize different channels. International expansion is a long term opportunity, but we have so many opportunities domestically that we’ll continue to focus on that in short term.

It is nice to see Lending Club continue to raise future guidance and it seems the market is reacting favorably to this. The stock is up around 5% in after-hours trading. The origination growth remains solid and I believe we are still in the early days of many of these partnerships coming to fruition. It will be interesting to see what new category Lending Club enters next year. Perhaps we will see a Lending Club auto loan?