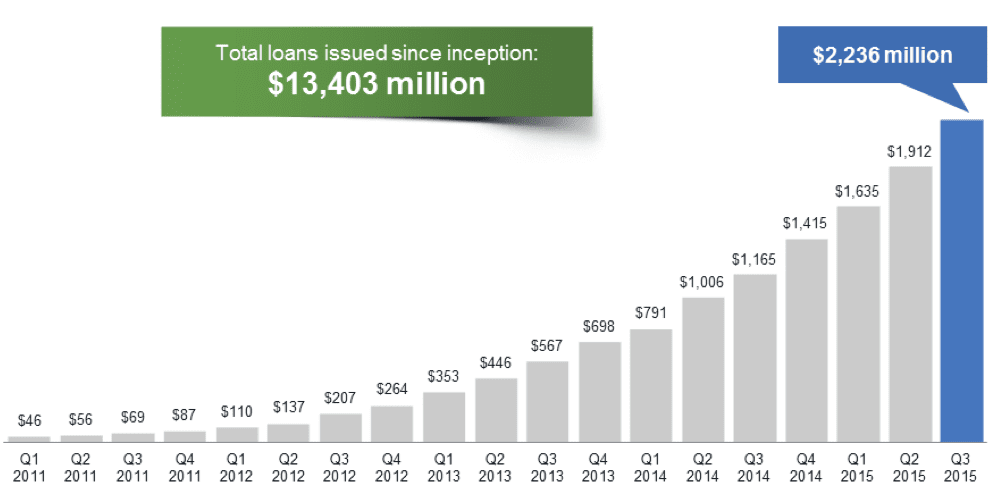

Yesterday, Lending Club released their financial results for the third quarter. They continue to show rapid growth in originations as well as revenue and this quarter they also showed a solid profit. Their total loan originations for the quarter was just over $2.2 billion up from $1.9 billion last quarter.

I listened in on their earnings call where CEO Renaud Laplanche gave some prepared remarks as well as CFO Carrie Dolan. Here are some of the financial highlights:

- Originations: $2.24 billion across 180,520 loans for an average loan size of $12,384.

- Revenue – $115.1 million, up from $56.5 million in Q3 2014.

- Adjusted EBITDA – $21.2 million resulting in an 18.4% profit margin.

- Cash and equivalents: $918 million

Renaud said in his opening remarks, “This quarter was our best quarter so far”. Clearly Lending Club had a great quarter anyway you slice the numbers. There is no sign of this consistent 100% year over year growth slowing down even as we get into much larger numbers.

As always in these calls there were some interesting nuggets of new information. Here is a random assortment of some of the highlights:

- Lending Club measured brand awareness for the first time and it came out at 3% of their target population.

- Q3 had lower customer acquisition costs driving total sales and marketing costs down to 192 bps of originations.

- Tested direct response radio and TV and will be expanding this test campaign.

- Added nine new investor states in Q3 for a total of 39 states open to retail investors.

- 87% of the capital invested in loans year to date have been by investors with accounts open at least six months.

- Lending Club will introduce a new consumer lending product in the first half of next year.

- The Madden ruling has had no impact on investor interest in loans issued by NY, CT and VT.

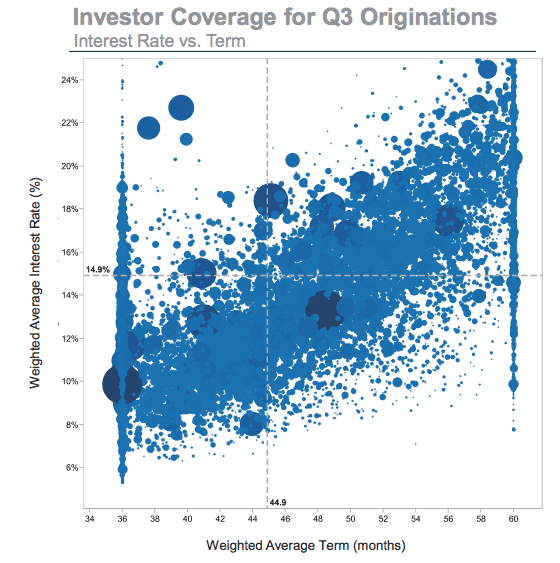

One of the fascinating slides in the deck was the one that showed the graphic below. Basically, this show every investor account, with the size of the blue circle signifying the size of the account, graphed by weighted average interest rate and loan term. It shows that while there are many investors who choose only 36-month loans and some only 60-month loans the vast majority have a mix. And the longer the loan term the higher the average interest rate.

One of the best parts of these earnings calls is the Q&A that follows the formal presentations. Here is a summary of some of these:

Q: Borrower rates have come down around 100 bps – what is behind this trend?

A: This is the result of the network effect where we continue to attract more and more investors and then as we continue to build our track record, we are able to lower the returns we offer to investors and we essentially pass on this benefit to the borrowers in the form of lower interest rates.

Q: Could you give us a sense of what it is that’s allowing you to be able to achieve lower customer acquisition costs when most others in the space are seeing the opposite?

A: I think that’s a lot of the network effects in play. A lot of the investments we made early on in products, quality of underwriting and servicing, compliance, back office. Also, with lower interest rates it increases the number of borrowers taking our offer, which increases our conversion, which decreases acquisition cost.

Q: Some of the smaller platforms have noted that they’ve seen an increase in instances of first payment defaults. Can you talk about what you guys are experiencing in this area and what you’re doing to prevent fraudulent attempts?

A: We have not seen an increase in fraud attempts or in successful fraud. We are not surprised that newer players would see such an increase in that. Fraudsters would typically go to the path of least resistance and certainly smaller or newer platforms wouldn’t have had the opportunity to build some of the fraud detection and prevention mechanisms we put in place over the last eight years.

Q: Santander today announced they were exiting the consumer loan business and was wondering what impact that has on your relationship and just more broadly if you can speak to the relevance or lack thereof of any individual lender on the platform?

A: Santander has been a great partner and we’re very grateful for the relationship we’ve had with them over the years. This year specifically they were a single-digit percentage of originations. They stopped investing at some point over the summer and we were able to replace them with other investors essentially overnight. So that really speaks to the resiliency of the platform and the power of the marketplace model, the diversity of our investor base and so our ability to manage the flow of both supply and demand.

Q: Renaud, in the prepared remarks I think you said something along the lines of modifying some of the relationships with the banks to – distance yourself from Madden. So curious if you could provide may be a little bit more color on that statement and then sort of the implications for Lending Club going forward.

A: So with respect to Madden we continue to see no impact from our investor base and actually some new data shows that investors are continuing to fund loans made to residents of the three states covered by the Madden decision (NY, CT, VT) and institutional investment in those states has actually increased contrary to rumors we have heard in the market.

So that shows that investors, particularly the most sophisticated investors, really are aligned with us in terms of our interpretation of the different facts of the Madden case compared to our situation and so we believe that no change is necessary. That being said to your point as a matter of extra caution we decided to make a few changes to our relationship with our issuing bank to make sure they could withstand a Madden type of case. We are not going into more details at this stage about what the specific measures are.

Q: I am trying to understand the relationship between the originations that you report in any given period, and the amount of whole loans sold reported in the period and kind of the relationship there. It looks like that if I’ve read the numbers right your whole loan sales seem to have grown at a faster rate sequentially than origination. So just trying to understand that interplay a little and how it ultimately impacts revenue in the quarter?

A: During the quarter the originations include essentially all types of funding behind it. In the press release there is a little bit of detail of how each is funded whether it be from note certificates or whole loan sales. And the method at which somebody finances it is really going to be more a preference of the investor and the investor type. Banks prefer to buy the whole loans, for example, as opposed to hold the security.

And so the mix of whole loan sales versus our certificate or note funding is going to be really a function of the mix and appetite of the investors behind there. So when we look at revenue, we are looking just total revenue as a percent of originations, which is essentially funded by all three methods.

Q: There have been some announcements over the last several quarters that more traditional financial services firms are getting interested or planned to enter the online lending marketplace. Just would like to hear your take is that changing the competitive dynamics all in your view, is that something that you are watching closely?

A: Yes, we are obviously watching our market very closely. We are not particularly worried about traditional institutions competing with us. Most of the announcements you have seen already focused on different use cases, different market segments than what we focus on. At the end of the day we have 6,500 banks in the country, it’s a very big market and so there are many different target segments and room for a very large number of players to be successful. In areas where there is a overlap and where we compete, we believe our very low cost of operations, high-efficiency, great reputation and very diverse investor base that again can only be built over a long period of time and track record where there is also no shortcuts, all these factors really continue to give us increasing competitive advantage.

When the earnings report was announced all of the statistics on Lending Club’s website were updated at the same time. The historical data has already been updated on NSR Platform so you are welcome to do your own independent analysis of the third quarter data. Here is one cool fact that has gone unmentioned: Lending Club passed 1 million in total loans issued last quarter.

Finally, if you want to spend more time studying this earnings call you can go to this page on Lending Club’s site and download the slide presentation, the audio of the call as well as the prepared remarks.