This morning, Lending Club held their Q4 2015 earnings call. Lending Club has been a public company over a year now and this marks their fifth earnings call where we have heard details about their recent performance. This latest quarter may have been their most impressive yet.

Let’s start with the high level financials:

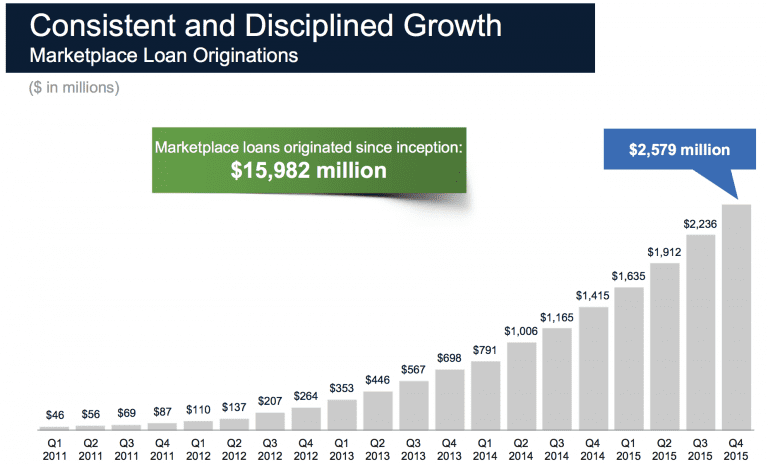

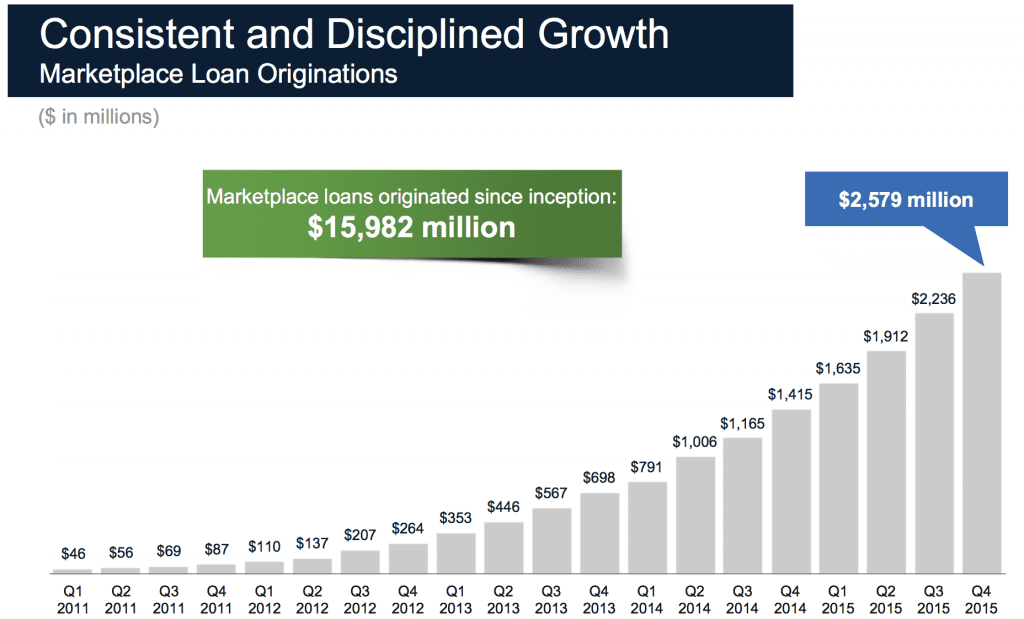

- Q4 total originations were $2.58 billion, up 82% from the same quarter of 2014 bringing their total originations near $16 billion. Lending Club originated $8.4 billion of loans in 2015.

- Revenue was $134.5 million, up from $115.1 from the previous quarter.

- Earnings per share of $0.01 compared to ($0.07) for the same period last year. Adjusted EPS was $0.05 for Q4 2015, compared to $0.01 in the same period last year.

- Adjusted EBITDA was $24.6 million up from $21.2 million in Q3 2015. This resulted of adjusted EBITDA margin of 18.3%

- Sales and marketing expenses as a percent of originations increased to 2.01% in Q4 2015 from 1.87% in Q3 2015.

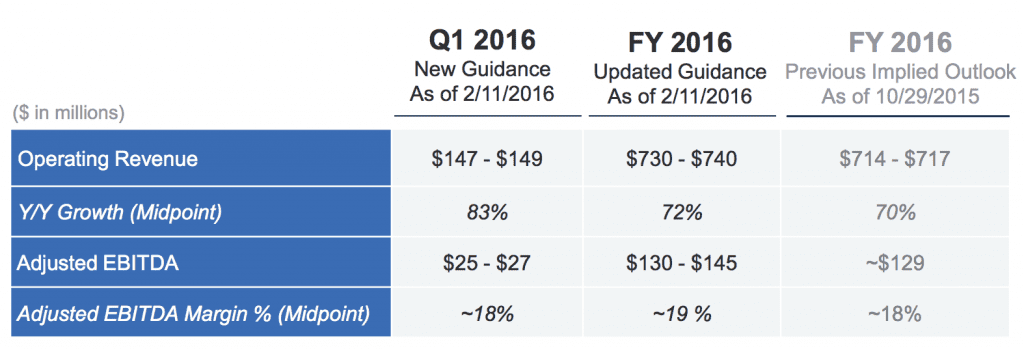

Lending Club adjusted their 2016 outlook higher.

Lending Club made several other announcements and provided some interesting information about the platform. Most importantly, Lending Club announced $150 million share buyback citing tremendous long term potential that is not reflected in Lending Club’s share price. In the press release, Lending Club stated that based on estimates, loans will pay out over $7 billion in principal and interest to investors in 2016. If reinvested, this would provide enough capital to fund over half of originations in 2016. If their projections are correct this means we should see Lending Club surpass $30 billion in total originations by the end of 2016. Lending Club has also continued to grow faster than Prosper, their biggest competitor, in four out of the last five quarters. Lending Club’s growth quarter over quarter was 15% compared to 7% Prosper and they now have 1.4 million customers.

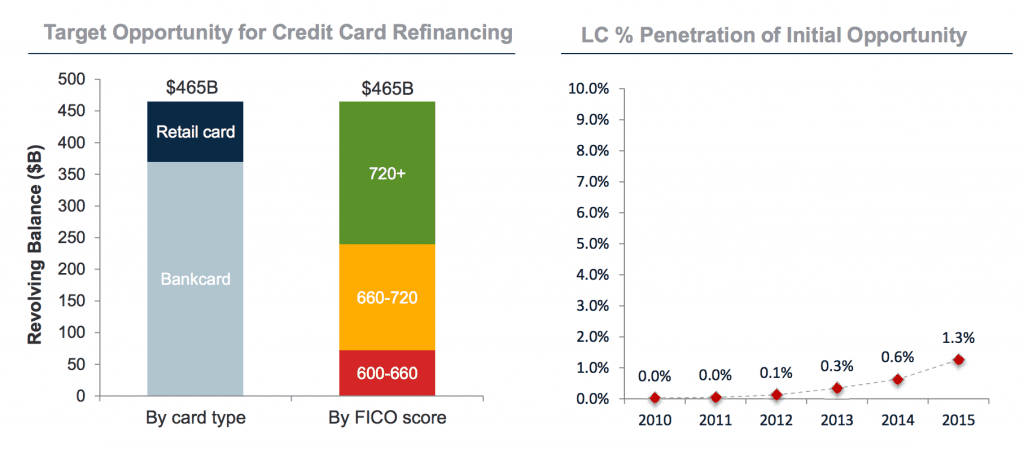

During their presentation, Lending Club noted that they are still very early in market penetration. As shown below, they estimate that the addressable market totals $465 billion based on their underwriting criteria. Current penetration of the market totals just 1.3% which shows the immense opportunity still available for Lending Club and other online lenders providing unsecured credit.

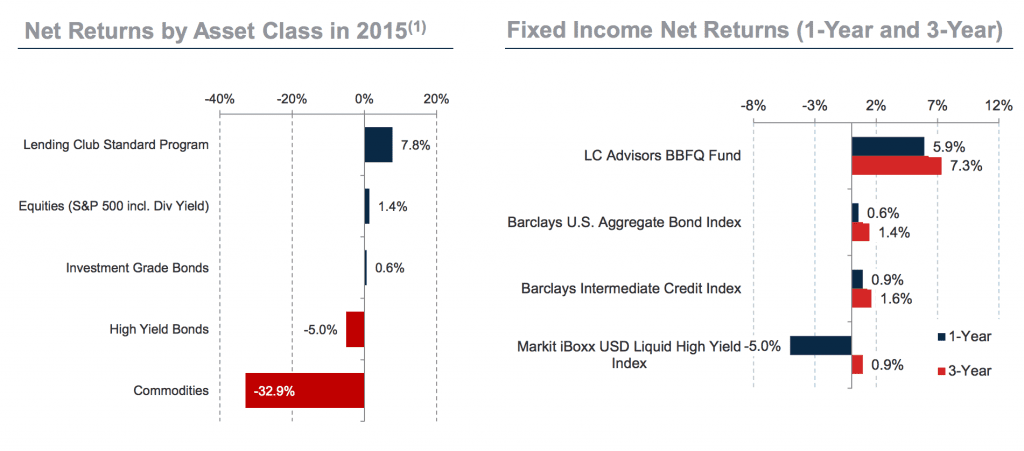

Given the recent volatility and the relatively flat stock market in 2015 overall, Lending Club compared their returns across other asset classes showing average returns for investors just shy of 8% in 2015.

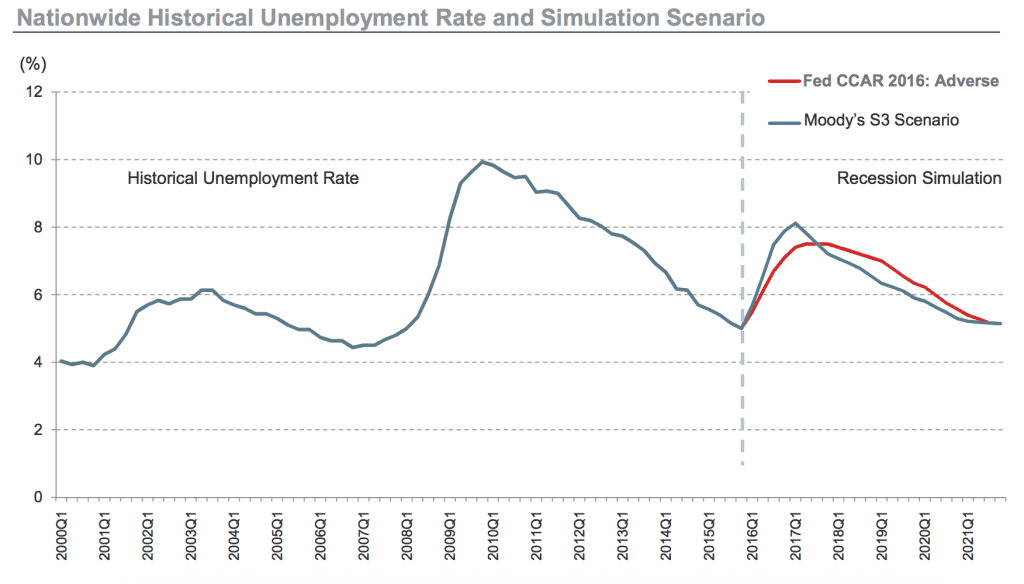

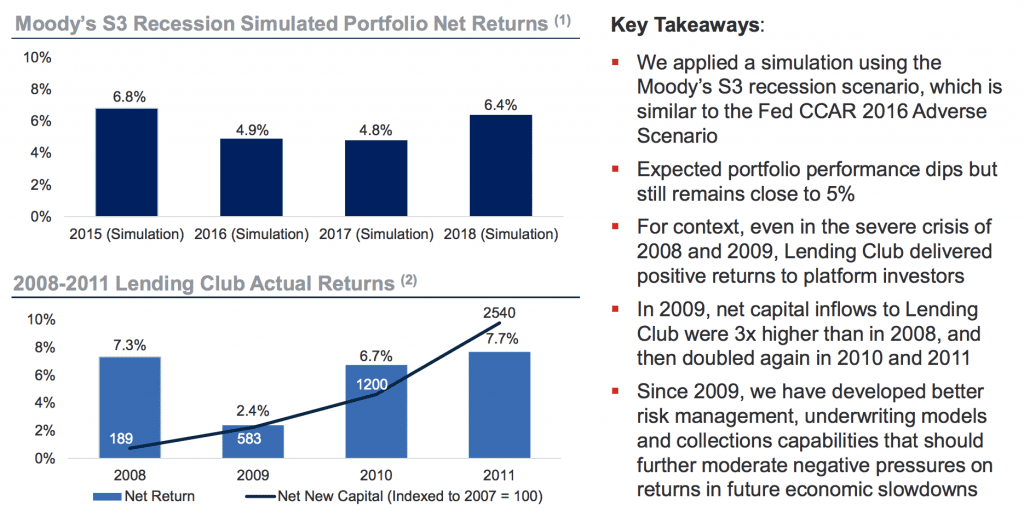

Lending Club also presented analysis on how performance may be affected in a recession. This is a common question among investors in this asset class and it is nice to see Lending Club present some data. Note that this analysis takes many assumptions into consideration including:

- $1,000 invested across the Standard Program platform each month from Jan. ‘12 – Dec. ’18

- unemployment rate peaks at 8% per Moody’s S3 scenario

- recession to hit immediately in Q1 2016

- remaining part of loan life for existing bookings subject to recession performance

- successive rate increases of 100bps in Jul. ‘16 and Jan. ‘17

- portfolio mix of grade and term similar to Q4 2015.

Finally, the call wrapped up with a question and answer section which highlights many of the issues investors are thinking about. Several questions are summarized below:

Q: Related to guidance, are you basing any conservatism in your view based on the health of the economy?

A: We are watching the environment with as much caution as investors. There is no sign of deterioration in demand or credit quality or investors appetite. What we have done is raise yield on the platform quite a bit over the last few months with two interest rate hikes in the last few months. This gives investors additional loss coverage in case of economic slow down. We are confident enough to raise guidance from where we were a few months ago.

Q: Is there any appetite to securitize Lending Club loans?

A: We remain very attached to the marketplace model and believe it is superior. We have no intention, as a matter of business model, to invest our own capital or take balance sheet risk. Sometimes we use our own balance sheet for test programs, but this is a very small amount.

Q: You talked about investor mix and how retail investors are usually more sticky in an economic downturn. Can you talk about your marketing plan to these investors? As the VC money is drying up, can you talk about issues in marketing channels? What about your competitors?

A: We continue to like our retail base and have a healthy mix of institutional and individual. We are dedicating more resources to marketing and the product development team. The retail team is growing faster with more focus on retail coming this year. Retail investors is a core competency and competitive advantage of Lending Club and no other platform has scale in retail distribution. It is a nice differentiator if and when the economy slows down since retail is sticky. Venture capital investments in general and in fintech has reached its peak last year. We anticipate it will continue to slow down this year, providing less capital to smaller players. We may start seeing less competition from smaller platforms. We did not feel much of an impact from competitors last year and don’t anticipate a huge boost due to lower spend of competitors.

Q: Guidance in Q1 implies acceleration given what you’ve already seen. How much is coming from share gains as a result of improving competitive position versus acceleration for demand.

A: We continue to see appetite on both sides and awareness coming on the consumer side. They are more aware of personal loans as an alternative. On investor side, markets are turbulent. Sometimes we see divergent behavior from different pockets of capital, but diversification shows the power of our model. Behaviors differ between insurance companies, pension funds etc. who all have different objectives. We have diversity and breadth of platform participants on both sides.

Q: You mentioned operational and contractual changes you are putting in place with issuing bank partners. Do you foresee any other changes related to your issuing bank partner and are these changes you mention in place? Is it possible you will have to seek state licenses? What about the Midland case?

A: We do not foresee any other changes with our bank partner. The changes mentioned are being made by the end of this quarter. I wouldn’t put too much focus on these changes. Our main message on Madden is we believe we are in a different position than those in that case. The changes were made out of caution. We haven’t seen any change in volume going to loans in Connecticut, New York and Vermont.

As far as state licenses it’s a possibility, but unlikely. We have a large number of state licenses and this is how they started, but what we found is that a bank issuance framework is more efficient and is a better experience for consumers who get all the same terms no matter state of residence.

Q: You mentioned rates in January and that rates will give more of a buffer. What prompted that change?

A: The global environment has changed, there are more concerns about global growth in the economy. We don’t pretend to know more, but in times of uncertainty it’s good to be prudent. Rates are dynamic on the platform so if we see any sign of degradation we will act accordingly. If things improve than interest rates may go down and that is the benefit of the marketplace model – pricing equilibrium.

Q: Did institutional demand effect this?

A: Every interest rate change is informed by what we see on the platform. We have a large number of touch points and discussions. Some investors have different views and some people have more bearish views.

Q: Regarding education and patient financing. is there any overlap with other customers? Can you talk about repeat borrowing? Any update on new product? Is your goal to be a broad based platform?

A: Our goal continues to be to transform the way consumers access credit. We can make it more affordable and our goal is to cover the entire range of credit products including, auto, mortgage, student loans. We want to be helpful in every stage of life. We’ve said previously we are gearing up for a major product launch. This will be the first of a major extension to product suite, but not the last.

Conclusion

Lending Club continues to deliver on their quarterly results as we’ve reported since they became a public company. The market responded favorably to Lending Club’s results and their stock price was up around 5.7% today to close at $6.88 while the broader market as a whole went down. 2016 is going to be an interesting year as they announce a new product in the first half of the year. With the largest borrowing base in the industry there is a lot of potential to cross market new products.

If you’re interested in digging deeper I highly recommend listening to the webcast yourself or going through the presentation yourself for topics not covered here. Those materials can be found on Lending Club’s investor relations website.

Disclosure: Peter Renton, the founder of Lend Academy and Ryan Lichtenwald, the author of this post own shares of Lending Club.