What is the best capital markets strategy for an online lending originator? Some companies argue that the balance sheet model is ideal because your business deploys its own money (aka, it has “skin in the game”) and therefore is less likely to originate borderline borrowers. Others argue that the marketplace model is ideal since you can build a lightweight and highly scalable technology company. I believe that the best capital markets strategy is the hybrid model and I recommend that all new startups follow this capital markets blueprint. The hybrid model combines the best of the balance sheet business with the best of the marketplace business. At the end of the day your goal should be to maximize the diversity of your funding sources so when the next liquidity crunch hits you will be somewhat insulated. The hybrid model helps you achieve that goal.

Start with the Balance Sheet Model

Balance Sheet: It is called the balance sheet model because the originator uses its own balance sheet to fund loans. This model has been around for many years, well before technology began influencing the category. These models operated under the name “specialty finance” companies or “non-bank lenders.” Since they apply their own balance sheet, their goal is to lend at a high rate and borrow at a low rate to capture the maximum spread. As a result, the spread drives revenue. OnDeck was the first “fintech” balance sheet lender. They embraced the use of technology to find efficiencies in their lending operations and they re-thought the underwriting process using big data and machine learning algorithms. While a traditional specialty finance company was viewed as a low margin, low growth, low multiple business, Wall Street priced this first fintech balance sheet lender at a much higher multiple. For instance, OnDeck’s current Enterprise Value-Revenues multiple for ‘17 is about 5x whereas American Express trades closer to 2.6x and Ally Financial is more like 1.8x. OnDeck is a good example of a company that started as a balance sheet lender and is transitioning to a hybrid model (more about that later).

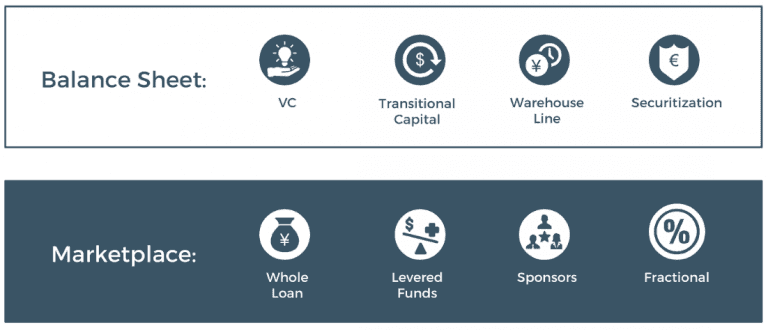

Here is the process for rolling out a balance sheet model:

VC: Have you ever noticed that the VC rounds for online lending startups are some of the largest in all of VC? It is common to see $25, $50, $75, or even $100+ million equity rounds in Series A, B, and C. This is because these businesses have a capital markets strategy that starts by using VC money to fund loans. From the VC’s perspective, this sounds crazy since VCs are expected to take high risk in exchange for a high return. For an early stage company, the VC likely has an IRR return target of about 30%+ and they will never achieve their target if they have to invest in 12% yielding loans unlevered. However, they know that someone needs to lend the first money. They know that if they can get the fly wheel churning there will be new money (aka, Transitional Capital) that follows their money. They also know that their equity can eventually be levered if the company can manufacture new cash into the company. The VCs allow the management teams to use maybe 60% of their VC commitment to fund loans for a year or two but then the company needs to reinvest that VC lending capital in a more traditional way (hire new staff, invest in additional technology, acquire new borrowers, etc). As a result, the VC’s round is almost like two rounds combined into one, the original 40% not used for lending capital that was originally applied as working capital, and the follow-on 60% that is recycled into working capital after its use as lending capital. In order to convince a VC that this is a smart investment, your company better have a transitional capital provider warmed up before the the VC money is committed.

Transitional Capital: The Transitional Capital is the first lending capital provider to the platform. They evaluate the quality of the management team, the quality of the credit and underwriting models, and the early performance of the original loans. They are willing to take early stage lending risk in exchange for unusually high returns, typically high teens or low twenties (this widely varies by lending category). They typically commit $20-$100 million in balance sheet capital to the originator. At LendIt we see many credit hedge funds that focus on this category. Some of the well known players are funds like Victory Park Capital, Atalaya, and Direct Lending Investments. Often times they will participate in the equity or take warrants as part of their deal. They are called transitional capital providers because it is well known that they are high priced providers of balance sheet capital that will be transitioned out to lower cost providers of capital once the originator’s track record firms up. An originator will often cycle through two or three providers of transitional capital to progressively bring their cost of capital down from high teens, to low teens, or high single digits.

Warehouse Lines: The Warehouse line is a huge line of credit that the originator can draw from, often $100-$250 million in size. Theses lines are typically provided by banks (Capital One, Citi, Deutsche Bank, Jefferies, Goldman Sachs, etc) although there are many mega-funds that are out there (Fortress, Ares, Apollo, Waterfall, etc) that also provide these lines. They want to see an originator with an established business model, a proven track record, and a consistent underwriting model. Basically they do not want any surprises. As a result, they are willing to offer their capital at a lower rate of return than the Transitional Capital providers. As the track record lengthens, the warehouse lenders are willing to offer more attractive advance rates and lower costs of capital, which could drop from high single digits to mid single digits.

Securitization: The Securitization market is fickle but when it is working it provides two major benefits. First, it offers a low cost of capital from insurance companies, pension funds, and other larger allocators. The balance sheet originator captures a healthy spread since they continue to fund borrowers at a higher rate of return while they pay a much lower rate to the securitization market. Second, it allows the originator to quickly recycle their capital allowing it to originate more loans with a limited amount of capital. This is key since an originator’s capital markets needs get increasingly difficult to fund as originations reach billions per year (or higher). For instance, an originator could securitize a $250m line of credit four times in one year converting that $250m in capital to $1 billion of originations. The most prolific and sophisticated originator that sponsors its own securitizations is SoFi, which has securitized both student loans and consumer loans and will soon securitize mortgages. Others include Avant, OnDeck, LendingHome, Marlette, Earnest, and Commonbond among others.

Follow with Marketplace Lending Model

Marketplace Lending: It all began with Zopa in the UK in 2005 followed by Prosper and Lending Club in 2006 and 2007 respectively. The idea was to build the eBay of lending, a lightweight online financial market that connects lenders to borrowers. Prosper quickly realized that letting the crowd price the loans was a bad idea so they shifted credit underwriting in house (LC launched with underwriting in house). The revenue model is to take a transactional fee from the borrower and a loan servicing fee from the investor. As compared to a balance sheet lender, marketplaces have lower revenue generated per loan origination since they take a transactional fee instead of funding the loans themselves but they generate much higher margins since their cost is only the cost of the platform and not the cost of capital. The marketplace model is much more like the Nasdaq or the New York Stock Exchange where volume drives revenue.

When Lending Club went public as the first fintech IPO since PayPal in 2001, Wall Street considered Lending Club an Internet company since the company operates a highly scalable tech platform focused on lowering the cost of lender/borrower acquisition as opposed to lowering the cost of capital. The greatest quality of the marketplace model is that it opens up a market to a new category of investors. Whereas the balance sheet model takes capital from a highly concentrated group of large investors, the marketplace democratizes access to a wide selection of investors. Again, think about the Nasdaq, which has a diverse group of buyers including mutual funds, hedge funds, ETFs, wealth advisors, and self directed individual investors. All of a sudden, everyone gets to fund loans instead of just the banks and the specialty finance companies. This goes back to my original point that your goal should be to maximize the diversity of your funding sources, the marketplace opens the door to many new funding sources.

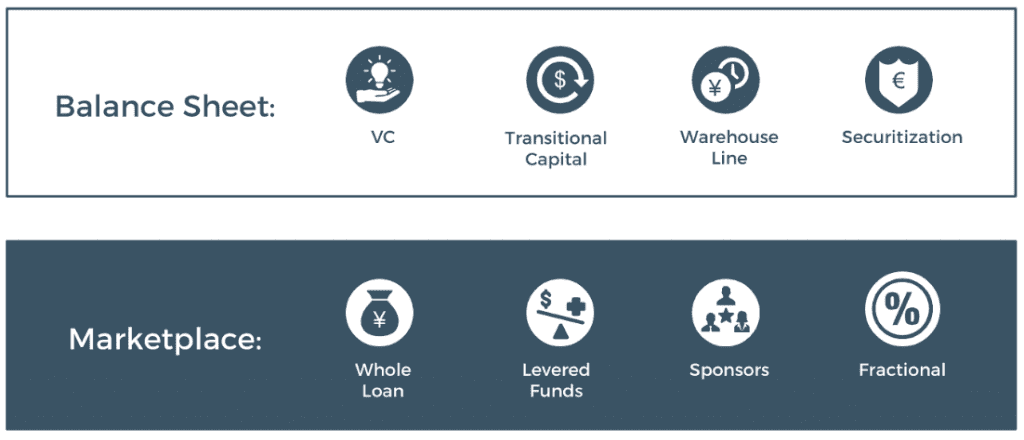

Here is the process for rolling out a marketplace lending model:

Whole Loans: Keep things simple and start by offering whole loans to accredited investors. Your marketing team will be tasked with acquiring new borrowers, your credit and risk team will evaluate each borrower and price approved loans, and your capital markets team can focus on offering whole loans to P2P lending funds, high net worth individuals and family offices. Since this is a hybrid model, I would recommend turning on the marketplace to whole loan buyers once you reach $100 million in balance sheet originations. It is easier to start with the balance sheet model and add the marketplace model once a certain scale is achieved. That way your origination platform will have developed and deployed a system that works for you. Many of the marketplaces are raising their own whole loan index funds that purchase loans off their own platforms.

Levered Funds: In the balance sheet model your capital markets team negotiates for their own warehouse line. In the marketplace model your capital markets team negotiates with the same providers to make their capital available to fund managers that seek leverage for their funds. The capital providers must complete similar due diligence on the marketplace as they would on the balance sheet originators but in addition, they must also evaluate the fund manager. Many of the leading P2P funds managers offer both unlevered and a levered funds including Colchis, Eaglewood, Incline, Echelon, and HCG to name a few.

Sponsors: Some fund managers act as securitization sponsors. The fund manager secures a warehouse line and applies it to a credit facility. Once the facility is filled with loans, the sponsor securitizes the facility into two or three tranches and sells the newly formed securities to insurance companies, pension funds, and large credit funds. The two best known sponsored deals were organized by BlackRock (CCOLT) and Citi (CHAI), which both securitized a portfolio of Prosper loans. Other active sponsors have included Garrison, Insikt, and Blue Elephant. Recently, the marketplaces have decided to take a more active role in this process. Lending Club’s most recent securitization of a Jefferies credit facility was done with Lending Club as the sponsor as opposed to Jefferies. Avant completed a similar deal with KKR and Victory Park. The marketplaces are working toward a new model where the originator files the shelf and acts as the sponsor and then coordinates with several fund managers that offer their credit facilities with standardized terms through the Marketplace Lending shelf. This will be a ground breaking new format when it comes to market.

Fractional: The fractional loan market is designed for smaller investors that cannot achieve proper diversification through the whole loan market (we recommend 400+ loans). This market includes smaller fund managers, high net worth individuals, and family offices as well as wealth managers and self-directed investors Our sister company, NSR Invest, is a robo-lender and advisor in this category. The fractional market is designed for the retail investor universe, which is highly fragmented and difficult to aggregate. However, we strongly recommend that your hybrid strategy include a long term plan to offer fractional loans to the retail investor base.

The behavior of this group of investors is much different than the institutional market because of their long term time horizon and different risk appetite. In many cases, retail capital can serve as counterbalance to institutional capital to stabilize investor inflows and outflows. We believe that online lending is an ideal product for retirement accounts since it offers stable returns, high yields, low correlation to the equity and bond markets, and short duration. We believe that up to 40% of all loan originations could eventually come from retirement accounts through the wealth management channel once the infrastructure is in place.

The Hybrid Model

We are seeing a convergence of the balance sheet and marketplace models. In the balance sheet case the platform is focused on profitability/spread per loan; in the marketplace model the platform is focused on volume but profitability per loan is small. Neither approach seems to be perfect. The balance sheet approach is capital intensive, the marketplace model requires massive volume. The hybrid model helps to solve these problems.

Many of the leading originators are moving towards the hybrid model. Avant has been very vocal about their hybrid strategy and has been a leading example for the industry. LendingHome is another good example. OnDeck has also started rolling out the hybrid model. LendInvest has built a hybrid platform in the UK. As platforms are able to diversify their capital sources the hybrid model is likely to prove to be the most sustainable business model over the long term.

Finally, it is worth noting that the ultimate source of capital are the banks themselves. If you can sell directly to a bank, you can effectively operate with 2.5%-4.0% cost of funds without all the overhead of a securitization program or the need to hold the residual strip. Companies like GreenSky do this well in the consumer category. The auto and mortgage sectors are other categories with originators that actively sell directly to banks. If you have a product that allows you to write loans to a bank’s credit box, and you have the scale and track record, then selling loans directly to a bank will get you a very low cost of capital.