[Editor’s note: Deepak Lalit is the Managing Director of LendIt Advisors, which is a new business line within LendIt Fintech that launched in 2017. LendIt Advisors has access to deep relationships across the entire Marketplace Lending ecosystem, and its objective is to connect Loan Originators with sources of Capital. Deepak has over 10 years of experience in Financial Services, with a specialty in Alternative Lending. Deepak has previously qualified as a Chartered Accountant (CA) and a CFA Charter holder.]

It is no doubt that Fintech has been THE buzzword of the last five years. While it may be hard to agree on the exact definition – there is a strong consensus that we are living in a time where technology is accelerating the pace at which traditional financial norms are being disrupted. The companies which master how to leverage their technology are creating huge opportunities for revenue growth in seemingly shorter and shorter periods of time. This makes the fintech sector very interesting from the point of view of an Equity Investor.

In this article, we briefly look at the broad performance of the publicly listed Fintech Companies, and discuss the investment opportunities that are available to US investors, and why we should all be paying attention.

How have the stock prices fared?

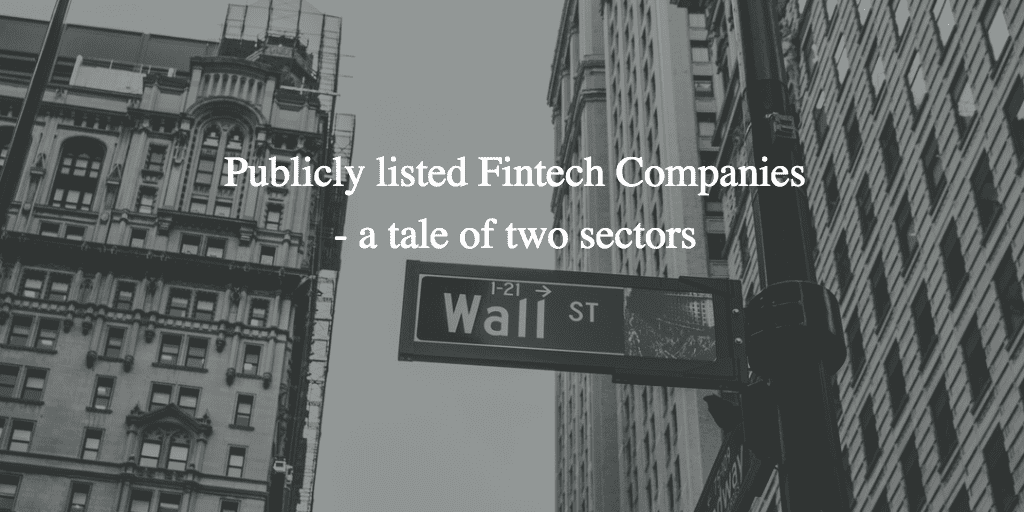

To understand the broad performance of the sector – the KBW Nasdaq Financial Technology Index (KFTX) is a good place to start. It is an equal weighted index of 50 companies ranging from the more recent IPO’s such as Square (SQ) and LendingClub (LC) to some of the more established players like VISA (V) and PayPal (PYPL). The criteria for inclusion into the index is where the distribution of a company’s financial products and services is exclusively through electronic means and their revenue mix is predominantly fee-based.

Since inception in June 2016, the index has returned 46%, outperforming the broad market S&P 500 by a whopping 24%, and even the tech-heavy NASDAQ by a meaningful 9%.

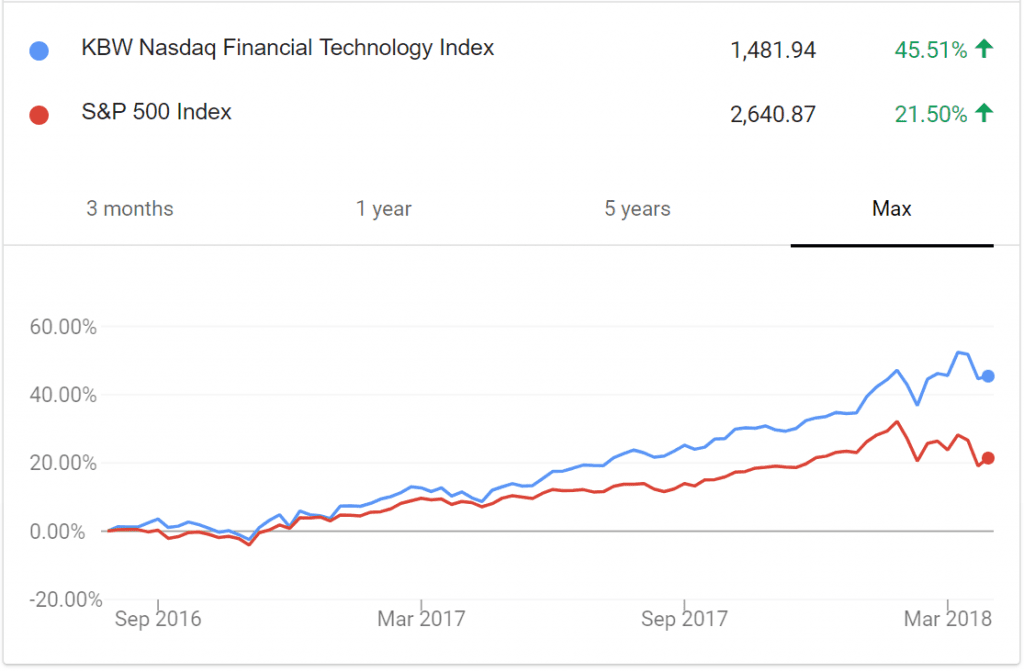

Digging into the Index constituents reveals two very different pictures. The strong returns have been anything but broad based. Certain Fintech verticals, e.g. Payments and Data Providers have done exceptionally well (with Square, Finserv and Envestnet amongst the winners), whereas the Lending sector has been plagued by the challenges surrounding their cost of capital and the volumes have not scaled in line with expectations.The worst performers in the sector have been two of the biggest names in Marketplace Lending (LC, ONDK)

Public Companies featured at LendIt

LendIt Fintech will be held next week in San Francisco. For three days (April 9-11), several prominent fintech companies (including many constituents of the fintech index discussed above) will take to the stage and the exhibition floors to network, learn and share knowledge about the latest trends in this rapidly changing landscape. Here is a list of the Companies that will be in attendance.

Other Industry trends

One of the more noticeable trends of the last few years has been a spate of listings from Asian (primarily Chinese) Fintech companies in the US. 2017 saw several established Chinese players such as Hexindai (HX), China Rapid Finance (XRF), Qudian (QD) list in the US improving access for US-based Investors. All of the companies featured below will be in attendance at LendIt Fintech Conference 2018.

Why Investors and Equity Analysts should be interested?

Several Public (and private companies), use LendIt as a platform to make key announcements, which often have implications for the entire Industry. Several of the more established Financial Services businesses (Banks, Insurers and Asset Managers) are paying closer attention that ever, and will be in attendance at LendIt in record numbers.

For Investors and Equity Analysts – LendIt Fintech is a great opportunity to get a sense of where the industry is headed and the key players that will stand out and be the winners of the next five years.

Complimentary tickets for Equity Analysts

LendIt Fintech, offers complimentary tickets for Equity Analysts to attend the Conference. We will have several analysts from Bulge Bracket, Boutique I-banks and smaller Independent Trading and Research shops in attendance. If you would like to request a free pass, please email deepak@lendit.com to see if you qualify.