The most anticipated fintech IPO in the UK is finally going to happen. Yesterday, small business lender Funding Circle filed papers with the London Stock Exchange to go public in a deal expected to raise £300 million and value the peer to peer lender at more than £1.5 billion.

This is big news for the fintech community not just in the Europe but for the US as well. Funding Circle has had a US operation since 2013 and has loaned more than $1 billion here. Overall, Funding Circle has said it has loaned more than £5 billion (around $6.5 billion) in the four countries where it operates: UK, US, Germany and The Netherlands. Clearly, the US is the largest of these markets and it is highly likely that the US will eventually be Funding Circle’s largest market.

According to this piece in Forbes, Funding Circle is now the biggest small business lender by volume in the UK. And while they are expanding the overall market there in conversations I have had with CEO Samir Desai over the years he has made it clear that he intends to make Funding Circle a global brand. So, their international business will become ever more important as time goes on.

Funding Circle is expanding their footprint in the US. Last month I attended the official opening for their new office in Denver, Colorado (I am based in Denver). Their US headquarters are in San Francisco so Denver will be their second US office. The modern office space in downtown Denver has room for about 200 people although at the time of their launch they had around 40 people on staff there. So, clearly they have big expansion plans for the US.

Almost lost in the flurry of news around the IPO was the significant investment commitment that Funding Circle’s US business received. The asset management arm of the Bank of New York Mellon, called Alcentra, has agreed to invest $1 billion in loans originated by Funding Circle’s US business over “the next few years”.

The Funding Circle Regulatory Filing

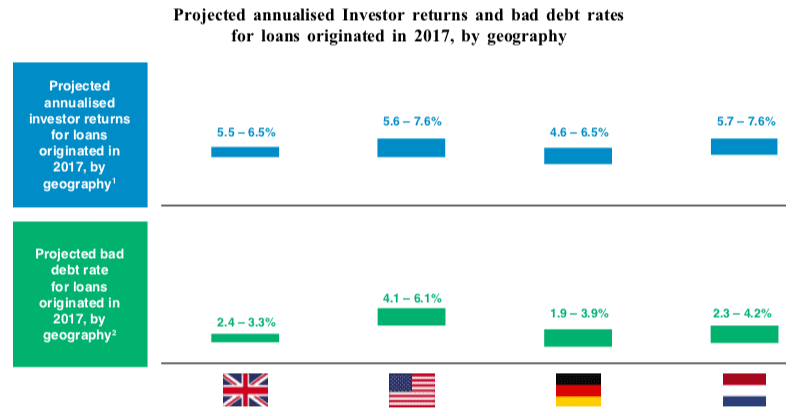

We have learned from the IPO registration document many interesting tidbits about Funding Circle that until now had remained private. First, and perhaps most importantly, we have some new detail on Funding Circle’s loan performance. See the graphic below that shows projected returns and projected bad debt rates on loans originated in 2017.

There is also a breakdown by year of investor returns for loans originated in the UK – it has ranged pretty consistently between 5% and 7% each year. They also describe the breakdown of their loan book by industry, by geography and by risk band.

We also learned that prominent venture capital firm Index Ventures, which incidentally posted this interesting piece about Funding Circle on their blog yesterday, is the largest shareholder at 20%. Other active fintech VCs Accel with 9.1% and Union Square Ventures with 7.3%, are major shareholders. Samir owns 7.7% and his fellow co-founders, James Meekings and Andrew Mullinger own 4.4% and 4.2% respectively.

They provided the investor breakdown for the first half of 2018 and, not surprisingly, institutional direct lending is the biggest category at 51%, retail investors account for 31%, Funding Circle’s publicly traded fund (FCIF) is at 13% and public bodies/supranationals at 5%.

Funding Circle breaks down the total addressable market by country. They claim that the US has a an addressable market of $305 billion in small business loans with potential annual originations at $125 billion.

A Big New Supporter

Several news sources mentioned Danish billionaire Anders Povlsen will be supporting the IPO. He has committed to a 10% stake in the company so long as the valuation does not exceed £1.65 billion according to the FT.

The £300 million issuance of new shares along with existing investors intention to sell £100 – £150 million worth of shares would make Funding Circle the sixth largest IPO in London this year. It will also be the first significant IPO for the burgeoning fintech sector in the UK.

My Take

Funding Circle has been planning this IPO for years. They have watched fellow fintech lenders, LendingClub and OnDeck struggle in the US so they are clearly aware of the risks involved with being a public company. They are the first of their peers to list in the UK and no doubt others like Zopa, LendInvest and Ratesetter will be watching the events very closely.

I think Funding Circle will do well. In conversations I have had there is clearly a lot of excitement in the UK about their listing. Many large investors in the UK have a mandate to invest in British companies. That and the fact that they have a large commitment from a Danish billionaire should provide a floor for their offering price.

The big unknown is profitability. Both LendingClub and OnDeck are still struggling to be profitable almost five years after their listings. Their stock prices have suffered because of this. Investors may be fine with top line growth in the short term but eventually they want to see a solidly profitable business. I think Funding Circle can be a profitable business eventually and that is why I am bullish on their success as a public company. It is certainly going to be fascinating to watch.