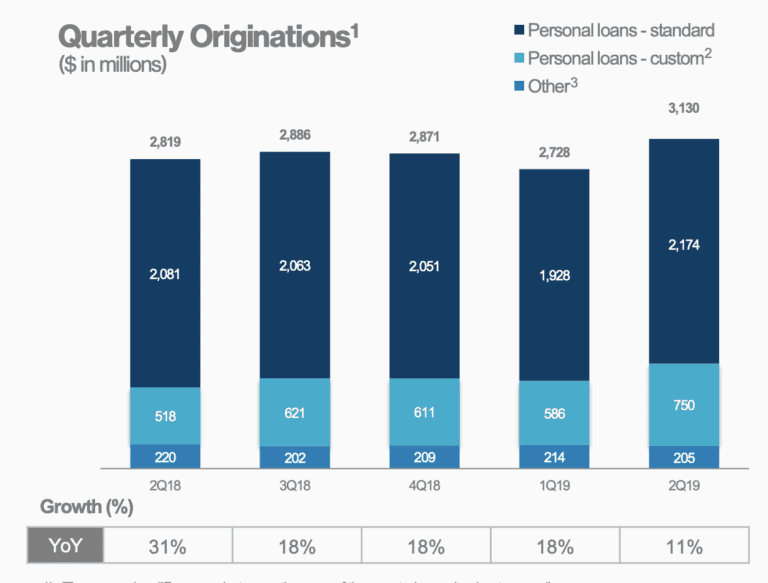

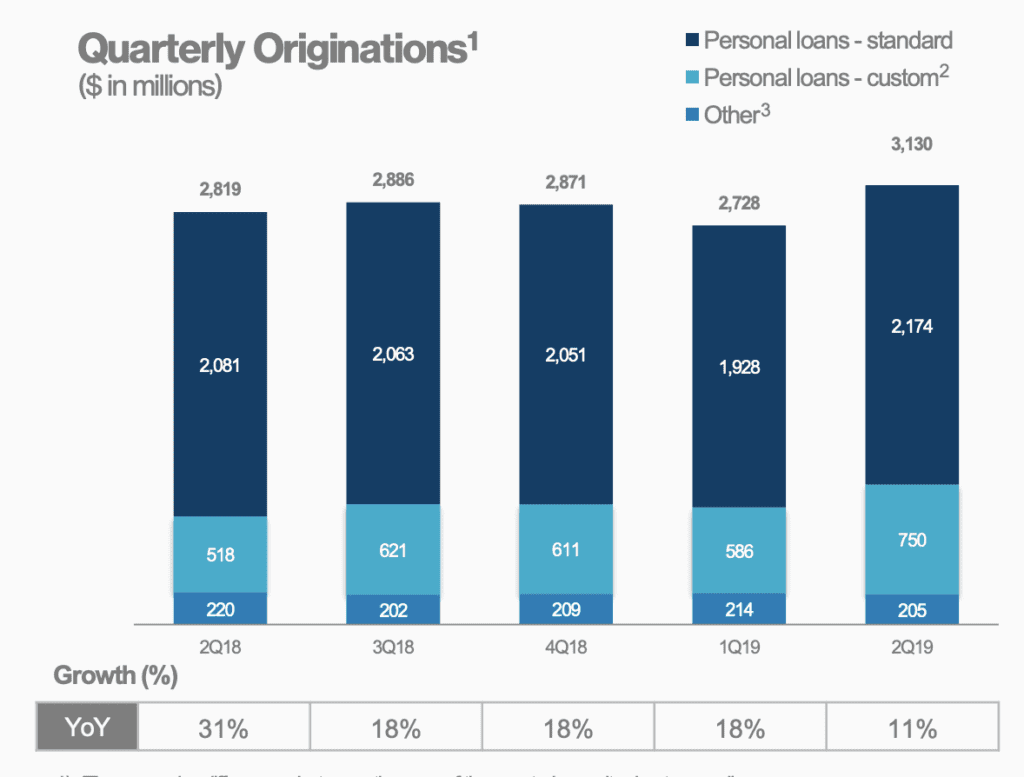

Today LendingClub reported their Q2 2019 earnings. Highlights include record loan originations of $3.1 billion, up 11% from the prior year period and record net revenue of $190.8 million, up 8% year over year. The company reported a GAAP Consolidated net loss of $(10.6) million compared to $(60.9) million in Q2 2018.

LendingClub attributed data driven improvements in leading to improved conversions with 72% of customers going from application to approval in 24 hours. In the same period last year this number was just 46%.

As we’ve seen recently, LendingClub continues to push their structured programs. 35% of loans purchased in Q2 2019 were through LendingClub’s structured program channels, notably their certificate program which was expanded upon recently with levered certificates.

One of the biggest changes for the quarter is the addition of the Select Plus Platform. It is no secret that LendingClub has morphed over time into a platform that tilts heavily towards prime consumers. LendingClub has removed E, F & G grade loans from the platform for investors. However, they are now working with sophisticated investors who will purchase loans outside of LendingClub’s current underwriting criteria, though CEO Scott Sanborn noted that that the average FICO of borrowers served in this channel is little changed from LendingClub’s own mix. The difference with this program is strictly serving investors who might have a different view on credit or specific segments. It is still early days for the program as they are live with just one partner, though it moves LendingClub in the direction of being able to serve more borrowers without additional marketing cost.

A topic that has been coming up more often is the potential of a national bank charter. Last week we learned that small business lender OnDeck was pursuing a charter and LendingClub is doing the same. According to CEO Scott Sanborn they are past the exploratory phase and are now in the business planning phase, having carefully considered the benefits. LendingClub will continue to offer the marketplace model or verbiage they’ve recently been using, a “visitor to member, product to platform” approach. We could see a broader mix of products for consumers, with the ability for LendingClub to better serve their partners. Another significant benefit is a new source of funding and greater resiliency of the platform.

This is a significant undertaking so it will probably be some time before this effort comes to fruition. It was mentioned in the question and answer section of the call that LendingClub would potentially hold off on any potential share buybacks due to ensuring they have the funds to capitalize the bank. It’s important to note that with LendingClub currently originating 10% of all unsecured loans, the opportunity to drive revenue growth with additional products is quite significant.

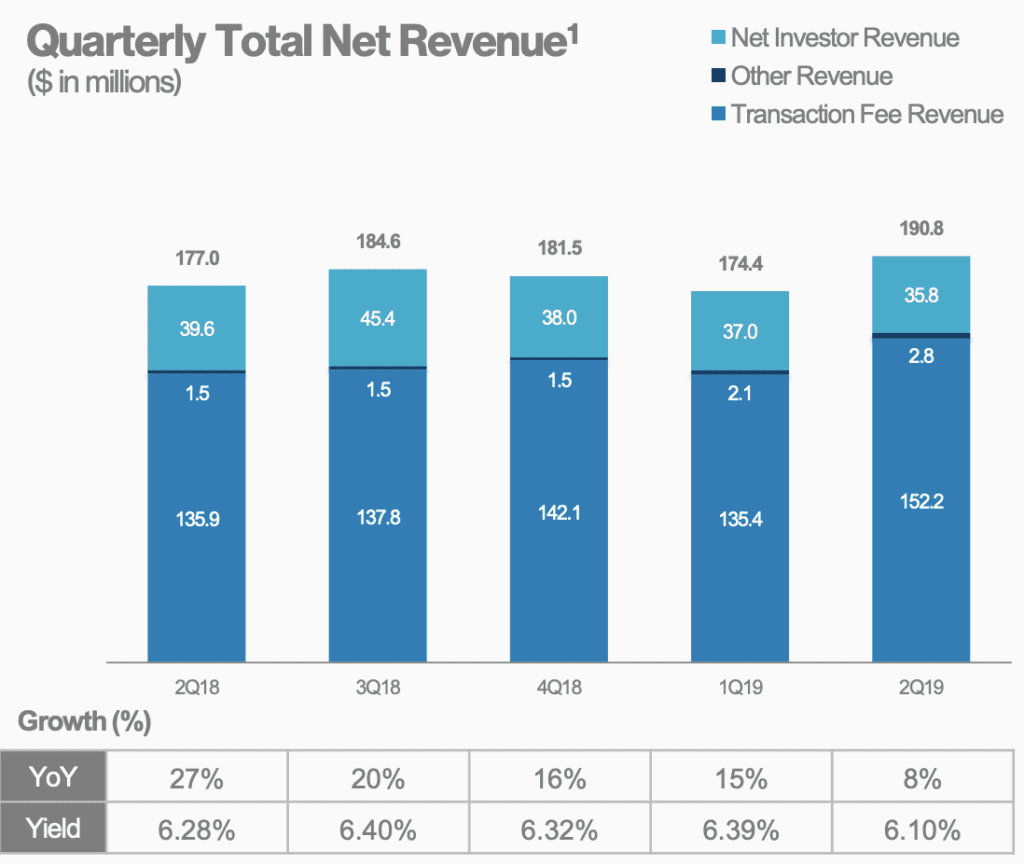

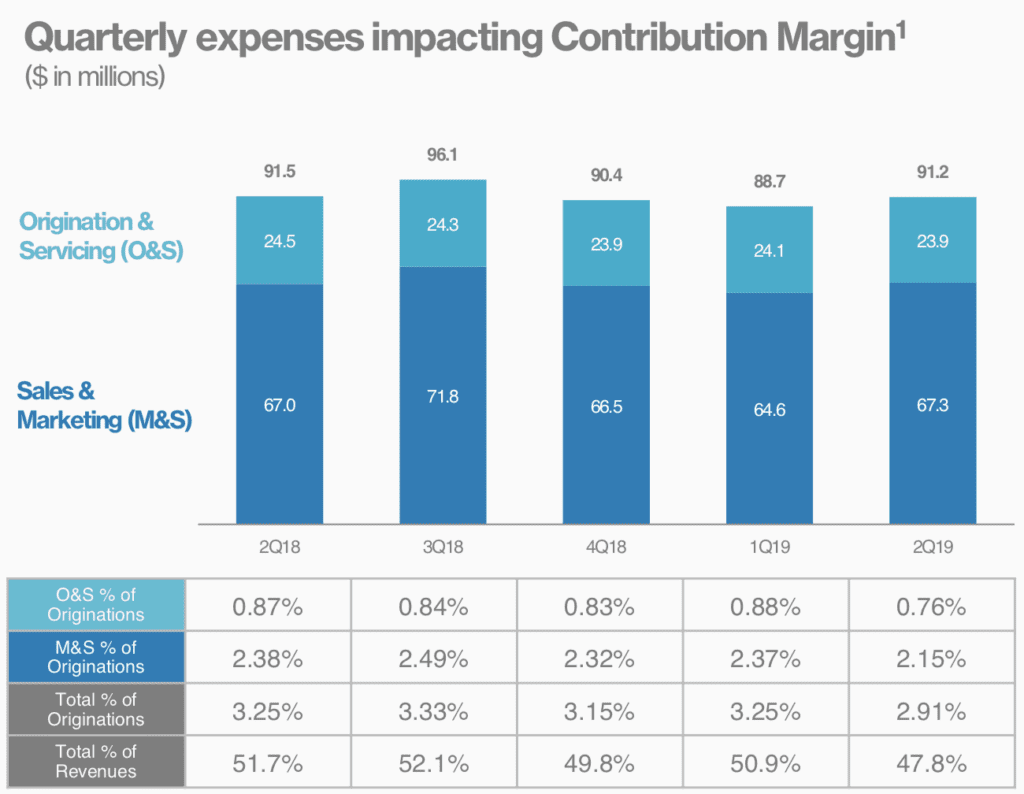

On the simplification front, LendingClub now has 309 employees at their new office in the Salt Lake City area which will continue to expand to the capacity of 550 throughout the rest of the year. LendingClub is also outsourcing over 450 operations and technology support employees in order to cut further in costs. What these initiatives and others translate to is LendingClub delivering on the promise of driving originations while still keeping costs in check. The chart below shares the trend of expenses over time as it relates to originations.

Other highlights for the quarter include LendingClub’s first Moody’s rated securitization, the levered certificates as previously mentioned and the partnership with Funding Circle and Opportunity Fund.

GreenSky Q2 2019 Earnings

In their earnings release today GreenSky suspended giving financial guidance and the most surprising news was that the company was exploring a possible sale. GreenSky went public 15 months ago and their price after today’s earnings is well below their opening share price. The public markets in the US simply haven’t been good for fintech companies. David Zalik, GreenSky Chairman and CEO included this statement in the press release:

Notwithstanding the Company’s solid operating results, in light of the complexity of the Company’s operating model, we do not believe that the Company’s current market value is reflective of the Company’s strong record of cash flow generation and intrinsic value. Accordingly, GreenSky’s Board of Directors, working together with its senior management team and legal and financial advisors, has commenced a process to explore, review and evaluate a range of potential strategic alternatives focused on maximizing stockholder value. In connection with this review, GreenSky has retained FTP Securities LLC (“FT Partners”) and J.P. Morgan Securities LLC as its financial advisors, and Cravath, Swaine & Moore LLP and Troutman Sanders LLP as its legal advisors.

The news sparked Christopher Donat, an analyst Sandler O’Neill to speculate that Square or Goldman Sachs could be potential buyers according to this article in American Banker. GreenSky is different from most companies in the fintech space in that it partners with contractors, health care providers and merchants to offer financing at the point of sale. It is a more capital light business model than other companies in the space though some have shared concerns over relying heavily on bank funding as Regions Financial recently decided to end their relationship. However, GreenSky currently has aggregate funding commitments of $11.9 billion, of which $4.0 billion were unused as of June 30, 2019.

Other financial highlights include transaction volume increasing 20% to $1.6 billion from the prior year period with second quarter revenue growing 31% over the prior year to $138.7 million. The company spent $146 million to repurchase shares over the last eight months and currently has $209 million of unrestricted cash on hand as of the end of Q2.

Conclusion

As an outsider it has been interesting to watch the public fintech companies, both LendingClub back in 2014 as well as more recently GreenSky. LendingClub seems to finally have their vision for the future of the company and there are some potentially very interesting initiatives coming down the tracks. Looking back I think many people would have expected the company to innovate at a much faster pace. For GreenSky it’s unfortunate that the public markets haven’t been receptive. Zalik and the team at GreenSky truly took an innovative approach at the outset and built one of the few fintech companies that is profitable today. It will be interesting to see what happens from here.