Today, a research effort was announced in the UK called the Cambridge Digital Asset Project (CDAP.)

The CDAP is a joint effort between the Cambridge Center for Alternative Finance (CCAF) and 16 private sector tradfi leaders to develop open-source data to inform public decision-making for the environment, tech infrastructure, and crypto. Contributors include the IMF, BIS, and more.

“The growing adoption of digital assets increasingly blurs the lines between roles, responsibilities, and applicable rules, stretching the boundaries of long-term institutional arrangements,” Bryan Zhang, Executive Director, CCAF, said. “The Cambridge Digital Assets Programme that we are launching today aims to meet the resulting need for greater clarity by providing data-driven insights through collaborative research involving public and private sector stakeholders.”

Established in 2015 at one of the leading business schools globally, the CCAF has published 40 industry reports and surveyed more than 5,000 fintech firms in over 185 countries. They said they are on call when more than 120 regulatory authorities and central banks worldwide need help with fintech regulation and regulatory innovation research.

The new endeavor is a two-year-long project to build empirical data, tools, and insights necessary to facilitate an evidence-based public dialogue about the opportunities and risks presented by the growing digital asset ecosystem.

Cambridge CDAP’s institutional collaborators:

Accenture, Bank for International Settlements Innovation Hub, British International Investment, Dubai International Financial Centre, EY, Fidelity, UK Foreign, Commonwealth & Development Office, Goldman Sachs, Inter-American Development Bank, International Monetary Fund, Invesco, London Stock Exchange Group, Mastercard, MSCI, Visa, and the World Bank.

“As the digital assets ecosystem grows, so too does the need for data and insights that inform thoughtful dialogue about the associated opportunities and risks,” Chris Tyrer, Head of Fidelity Digital Assets in Europe, said. “Collaborative research and analysis that result from programs like the Cambridge Digital Assets Programme are important to furthering understanding and clarity on key topics that affect this nascent asset class.”

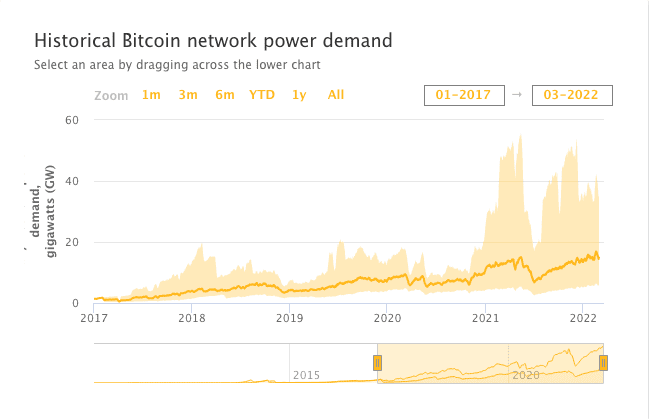

CCAF published tools like the Cambridge Bitcoin Electricity Consumption Index and research reports like the Global Cryptoasset Benchmarking Study series.

“Industry collaboration and public-private partnerships will be vital in bringing the benefits of digital currencies to life in a sustainable, inclusive, and secure way,” Terry Angelos, SVP and Global Head of Fintech at Visa, said. “We’re excited to participate in rigorous academic forums like the Cambridge Digital Assets Programme to explore opportunities that scale and integrate digital assets responsibly.”

Program focused on ‘Three Workstreams’

The research agenda for the program will be centered around three workstreams covering distinct but related thematic areas, Cambridge said:

- The importance of digital assets and their associated services is important for environmental, social, and governance (ESG).

- Distributed Financial Market Infrastructure, including the evolving constellation of networks, platforms, applications, and services.

- Emergent money systems – the “asset” side of the ecosystem comprising crypto assets, stablecoins, CBDCs, as well as enterprise and consumer tokens.

“We have spent a lot of time developing a consistent framework that consolidates our efforts in the digital assets space and ensuring that we have the right collaborations in place to deliver insight and clarity,” Michel Rauchs, Digital Assets Lead at the CCAF, said. “We believe that this program will provide decision-makers with the objective analysis and empirical evidence that they need to navigate the digital assets maze.”