FT Partners announced the release of their Q1 2022 Fintech insights report, finding a record year in the making for financing in fintech.

The company is globally renowned for its expertise in the fintech sector. They have associations with many fintechs and unicorns worldwide and regularly advise on large transactions.

During the first quarter of 2022, FT Partners advised on multiple million-dollar financing rounds for the likes of Bolt, BlackRock, and Cross River.

The company provides one of the most in-depth looks at the fintech industry through its vast database of companies and transactions. The report is split into three sections; Financing, M&A, and IPOs.

In a general overview of the first quarter, it was found that the fintech industry had already surpassed the total value of past years, making it the most active period to date. In financing, over 1,000 transactions were made at $37 billion, while in M&A, the total dollar volume was lower than in the previous two quarters.

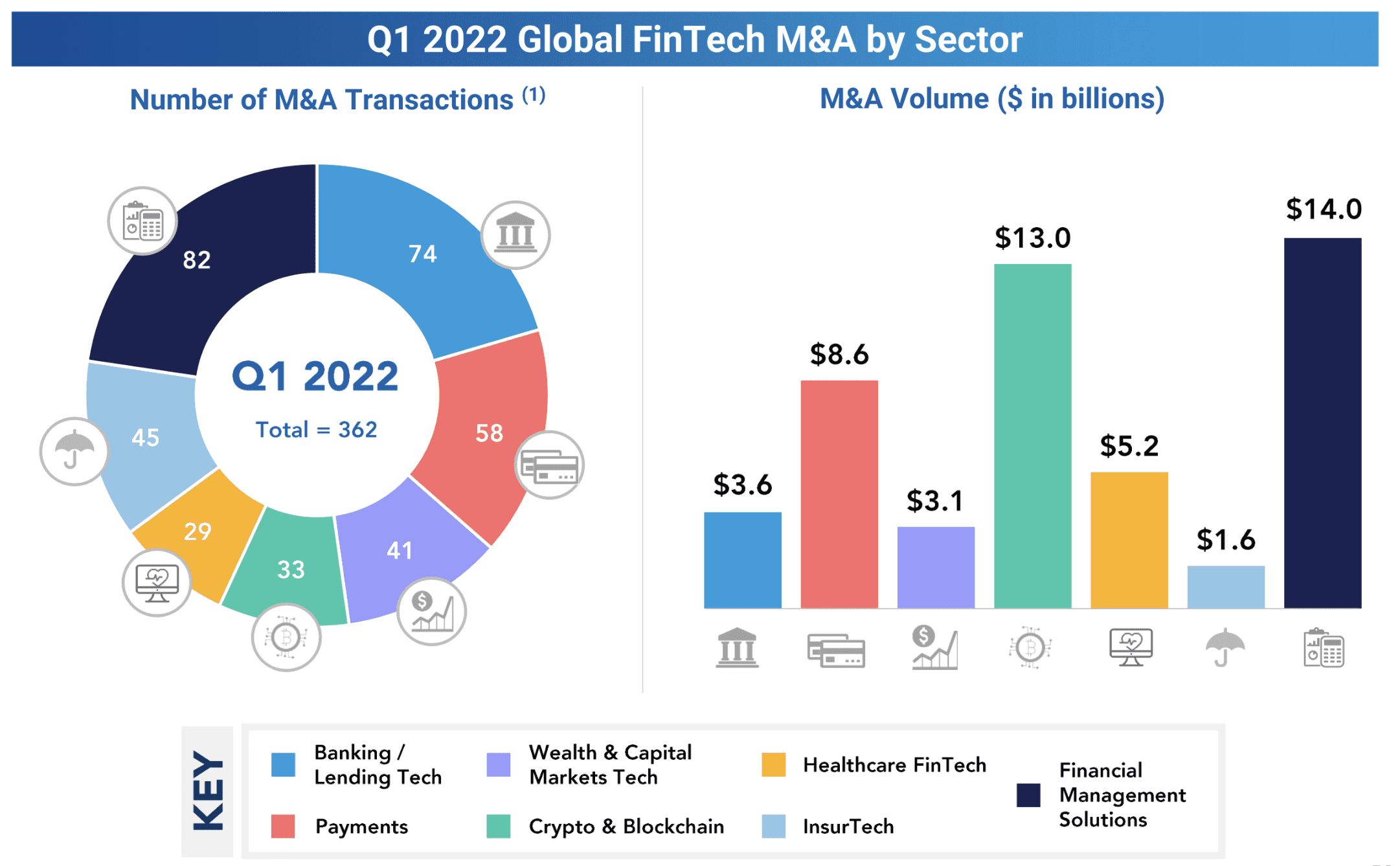

However, the quarterly deal count was higher than the two-year average, at 362 transactions compared to the average of 321.

First Quarter financing insights

The report found that for financing, it had been the most active quarter ever for fintech. The total value of this quarter has surpassed the annual value transacted every year until 2018.

With a significant focus on the crypto and blockchain sectors, this trend continued the record year for the industry in 2021. The first quarter alone has seen an acceleration with over 280 deals, bringing the total volume of the sector to $8.8 billion, just under banking and insurtech.

In addition to this, 40 companies globally reached unicorn status. Two of these stood out from the crypto sector. Yuga Labs and FTX US both reached unicorn status after only the first round of funding. Five other companies also achieved Decacorn status (valued at over $10 billion).

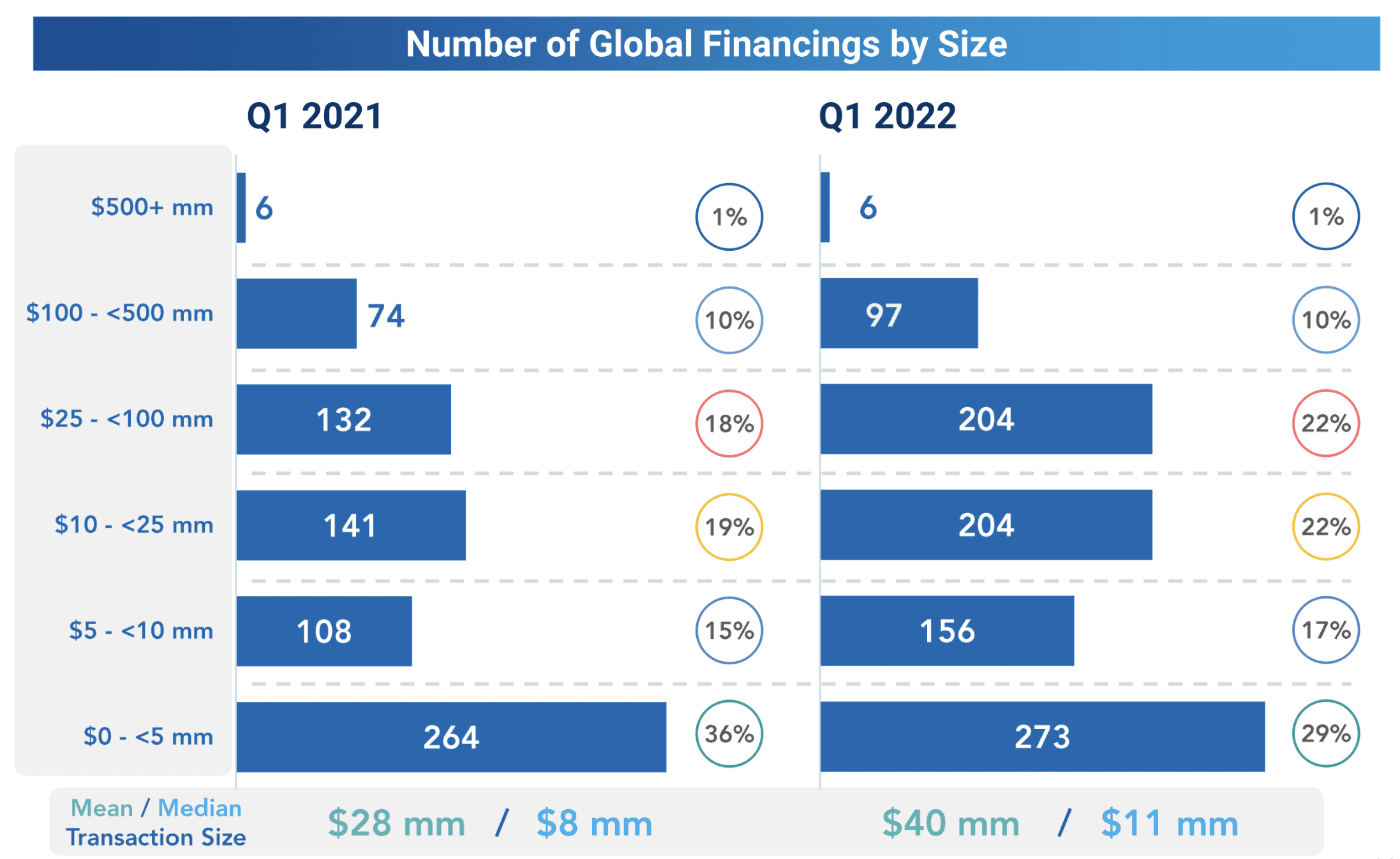

Looking at the same quarter of 2021, the report also shows growth.

In all transaction sizes under $500 million, there has been a significant increase in the number of global financings, and for financings over $500 million, the amount has remained the same. The mean value of this quarter is $40 million, compared to last year at the same time, which saw transactions with a mean value of $28 million.

Financing activity was primarily in the North American region, followed by Europe. North American activity makes up 51% of total global volume at a value of $18,886mm and 512 deals. The next largest region, Europe, saw 28% of total volume with 251 deals at a total value of $10,422mm. The rest of the world combined saw 328 deals with a total value of $8,057 million.

All regions saw record activity during 2021 and seem to be following a similar pattern in Q1. The most significant was in Europe, which has already achieved a third of the volume raised in 2021 within just one quarter.

Within fintech, the most active sector for transactions was crypto and blockchain, followed by banking and lending.

However, in terms of value, the banking sector came out front, with a total transaction value of $1 billion more than crypto. Other sectors which saw much activity were payments, wealth and capital markets tech, and financial management solutions.

M&A saw significant reduction in Q1

In the first quarter, 91% of fintech acquisitions were conducted by strategic buyers. However, they only represented 37% of the total dollar volume.

Thoma Bravo led the fintech sector in M&A during the first quarter of 2022. Their $11 billion acquisition of Anaplan was the only M&A valued at over $10 billion. The second largest was Circle’s revised SPAC merger, valued at $9 billion, and the next, R1 RCM’s acquisition of Cloudmed at $4.1 billion.

Generally, the sector saw a fall in deals over $1 billion by 6% to 13 transactions, compared to the first quarter of 2021, which saw 20. Despite this, there was growth in the number of deals between $100 million and $500 million.

During the first quarter, the global value of M&A was $49.1 billion, with a mean transaction value of $745 million. A significant reduction from the previous year.

Most of these M&A deals were seen in North America; however, it was at a lower percentile than 2021, at 55%.

It was here two of the top three M&A deals were conducted. In Europe, the largest deal was conducted in France and was valued at $2,604 million; the Apollo acquisition of Worldline.

Of these deals, the most activity was seen in financial management solutions, which saw 82 transactions. Despite this, seven new M&A deals were announced, five of which were in the crypto space.

The report also highlighted that there had been a record number of SPAC mergers in the past two years, with 36 in 2021 at a total value of $138,912 million. The largest SPAC in Q1 came from Japan in the Crypto sector. Thunder Bridge Capital Partners IV’s SPAC of Coindesk was announced in late March and had a value of $1,250 million.

Although there was a rise in SPAC activity during 2021, six deals have since been canceled. This includes the VPC Impact Acquisition Holdings II and FinAccel SPAC, announced at the beginning of 2021 with a proposed value of $2,019 million.

North America saw zero IPOs in Q1

Despite seeing many IPOs in 2021, North America saw none during the first quarter of 2022. The same can be seen in the rest of the world.

In 2021 the median age of the companies at the time of IPO dropped from 14 in 2020 to 11 years of establishment, mirroring the general average since 2005. The median age is slightly higher for PE and Non-VC or PE-backed companies at 14 years. Since 2005 VC backed companies make up 47% of IPOs and have an average age of 10.3 years.

Banking sector companies made up the majority of IPOs both in North America and abroad in 2021. Companies in the payments sector also made up a significant number within Europe, while in North America, the second-largest industry for IPOs was financial management solutions.

Continued insights into financing and M&A

Although FT Partners have released the official insight report, the company publishes regular reports weekly and monthly.

Every week they release a summary of global fintech activity with historical comparisons. Monthly reports are more in-depth, featuring an international outlook and a focus on Europe, featuring historical and country comparisons.

In addition, the company has conducted research on specific trends and sectors. The most recent is focused on The Blockchain Economy, Women in Fintech 2022, The Race to the Super App, and Buy Now Pay Later.

Research from the firm continues to inform industry professionals and is featured in many media reports on the fintech sector.