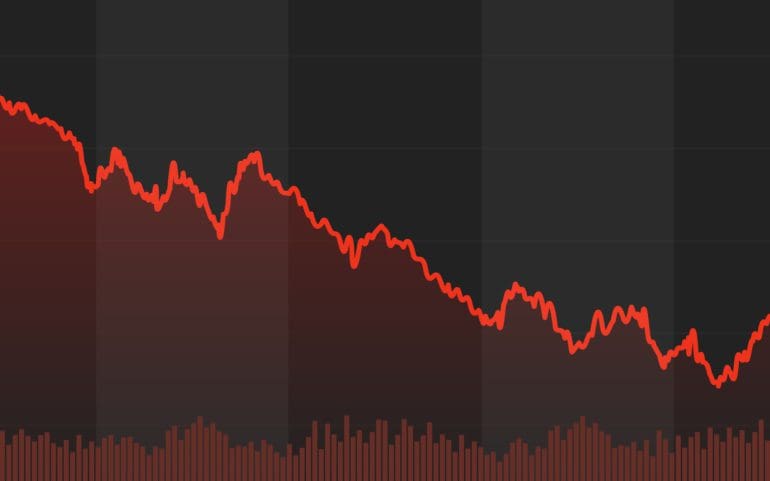

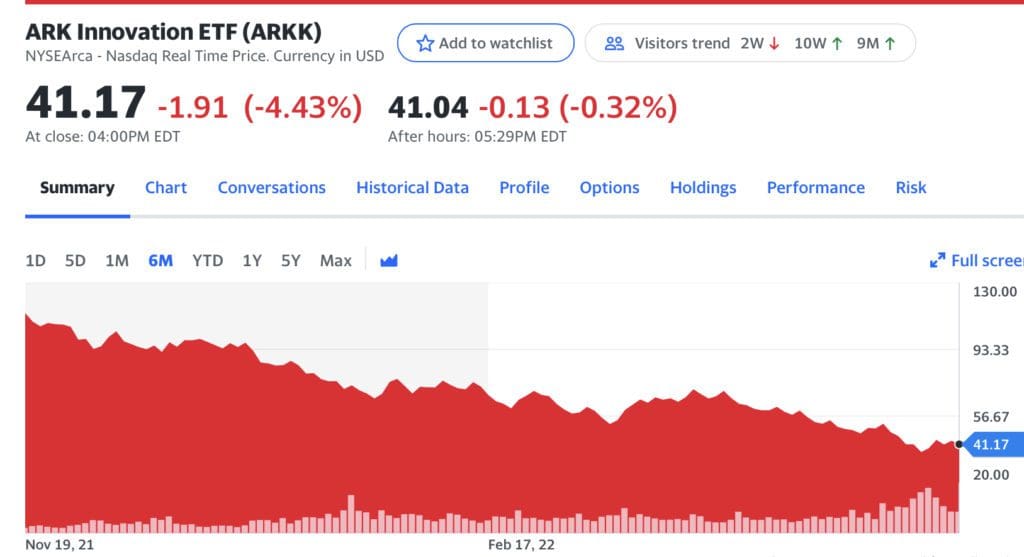

If Cathie Wood’s ARK Innovation ETF is an indicator of anything, tech stocks and fintechs are seeing a six-month downtrend.

One quarter into 2022 and earnings from top fintech public companies are not pretty: where revenue was light, prices crashed, and even where revenue showed up, prices crashed.

Here is a roundup list of public companies in the dog house.

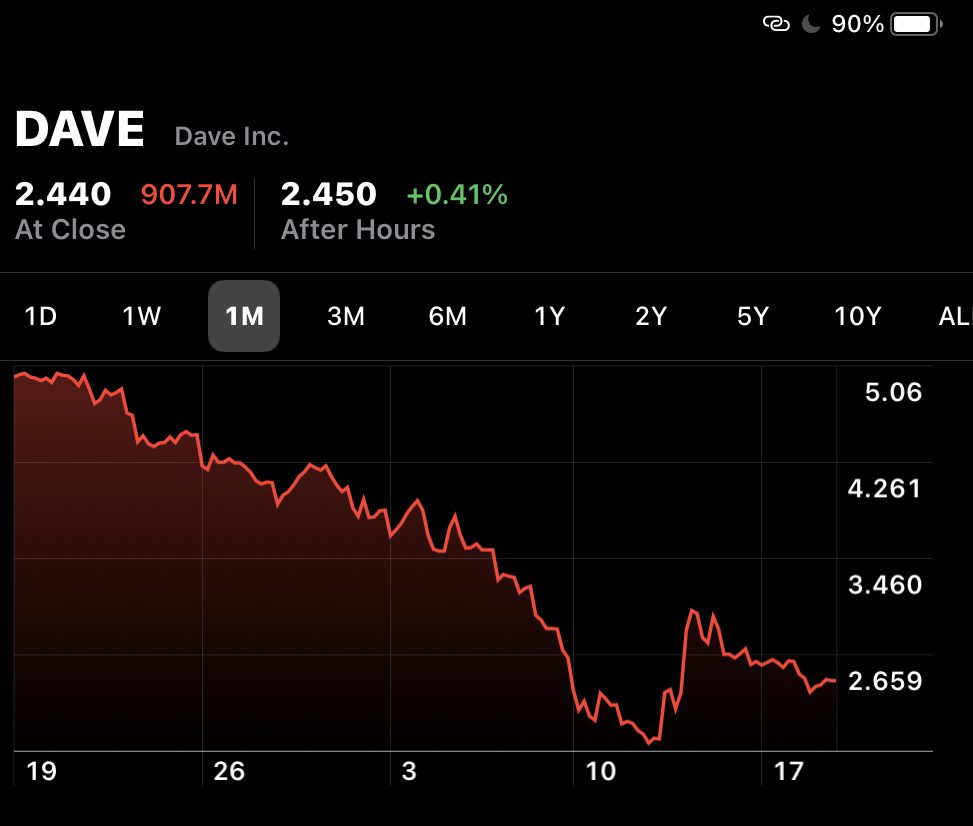

Dave

The challenger banking app Dave took an absolute hammering. It posted Q1 results of 24% growth of 300,000 new members to a total of 6.4 million, but a net loss of $34.8 million.

The stock leveled nearly 70% in the past few months, and the firm posting a nonprofitable quarter did little to stem the tide. Neobanking challengers face heavy capitulation for massive funding rounds and hype but little in terms of profit outside of breaking even or increasing user bases.

CFO Kyle Beilman said during the earnings call that hiring and paying up fixed-cost investments were taken care of in the first quarter, so it should be smooth sailing through the rest of the year.

“With that backdrop, Q1 2022 adjusted EBITDA was approximately -$18.3 million, with a GAAP net loss of approximately $34.8 million, including several one-time non-cash and leaseback-related transaction expenses,” Beilman said.

CEO Jason Wilk told LendIt that it was a time of consolidation and capitulation as markets reacted to competition in the space.

“The markets are re-calibrating, and companies with high growth, great technology, and real unit economics that will lead to profitability over time will be rewarded,” Wilk said. We believe Dave is one of those companies.”

Upstart

Posting triple-digit revenue growth did nothing to stop the flood.

Upstart lost 90% since this summer and on May 9 reported $310.14 million in revenue, up 156% from Q1 2021.

They originated $4.5 billion in loans in three months but cut their full-year 2022 expectations down by $200 million to $1.25 billion. Their stock dropped 56% overnight.

The team on the earnings call pointed out that inflation and prolonged pandemic market stress hit their target users of AI credit scoring and underwriting loans.

CEO David Girouard said Powell’s rate adjustments directly hurt their bottom line.

“In addition to increasing rates for approved borrowers, this also has the effect of lowering approval rates for applicants on the margin,” he said.

CFO Sanjay Datta pointed to general uncertainty when announcing the lowering of year revenue expectations.

“Given the general macro uncertainties and the emerging prospect of a recession later this year, we have deemed it prudent to reflect a higher degree of conservatism in our forward expectations,” Datt said.

SoFi

Tuesday afternoon, SoFi Technologies stock dropped more than 18%, and the stock’s trading halted after Bloomberg released the firm’s Q1 earnings early.

SoFi disappointed the market even after lowering its posted result expectations in April. The firm is down 70% in value this year.

Later in the day, SoFi released its earnings across the business wire, showing a net revenue of $330 million, up 69% year over year, but below the expected revenue of about $340 million. CEO Anthony Noto said the strong results during volatile markets demonstrated the stability his team has built at SoFi.

“Our strategy of building a full suite of differentiated products and services has created a uniquely diversified business that can endure and outperforms across market cycles,” Noto said. “Because of the depth and breadth of our offerings, we were able to make swift and critical adjustments in priorities and spend as conditions evolved quickly, to capitalize on growth opportunities and exceed our performance targets.”

Noto said that the lending, technology platform, and financial services drove a record first-quarter adjusted net revenue of $322 million and adjusted EBITDA of nearly $9 million.

Oportun earnings

The consumer credit firm showed strong results but still felt a stock plunge, falling on similar forces that hit Upstart: when inflation grows and rates go up, the fear that consumers borrow less raises regardless of reality.

Oportun showed originations up 139% and total revenue growth of 59% year-over-year. They even raised full-year ’22 guidance, to no avail of a falling stock that has already seen a 47% drop this year.

CEO Raul Vazquez said he was pleased with the quarter’s results, and on pace for an ambitions 2022, adding 200,000 new members in one quarter to a total of 1.7 million members.

“Accordingly, we are raising our full-year 2022 revenue guidance to a range of $910 million to $930 million, and our Adjusted EPS guidance to a range of $2.45 to $2.56,” he said during the earnings call.

How goes the market, so goes earnings reaction

But in the face of overall tech market forces that drop the stock, he said his team has to focus on what they can control and block out the market noise.

During a TD Ameritrade call on May 10, Vazquez broke down the financial services and fintech markets to highlight which areas are soft and remain recession-proof. He zeroed in on the employment market as a leading indicator of which companies will continue to grow fastest over the rest of the year.

“We are focused on what we can control, especially at times like these. We are executing well across all parts of our business, as evidenced by the Q1 results we shared today and the fact that we raised guidance for the full year,” he told LendIt. “Our multiple growth vectors, including Digit, are helping us take share and drive growth, which we believe will be recognized and rewarded by investors over time.”

Related:

Coinbase

Buried in Coinbase’s first-quarter earnings report, where the largest U.S. crypto exchange reported a 19% drop in monthly users and a $430M quarterly loss, is an update on the risks to the millions of Coinbase users.

The stock naturally sank as trends that would harm even the most traditional-looking fintech company doubled down to wail on a crypto one.

No extra users flocked online despite an expensive rollout on an NFT platform. The new disclosure, a big discussion point in the alternative banking industry, said that if Coinbase goes bankrupt, users might lose all crypto in their accounts to pay creditors.

Bankruptcy means not your coins

Coinbase stated that if it ever declared bankruptcy, “the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings.”

Coinbase users would become “general unsecured creditors,” meaning they have no right to claim any specific property from the exchange in proceedings. Their funds would become inaccessible.

The image of a NY-based crypto trust that would safeguard crypto assets like a bank safeguards FDIC-insured funds was gone, despite a typical Twitter thread from the firm’s founder Brian Armstrong. He took the opportunity to blame the SEC for a new staff order that requires crypto firms to hold user-bought assets on the books and advises crypto custody holders to keep reserves to safeguard user funds.

As Klaros group’s Jonah Krane and Patrick Haggerty advised LendIt, the legal precedent of a crypto firm going under does not exist.

The SEC is signaling to crypto firms that they may have a responsibility to protect users’ funds if it all goes to zero.