It has been difficult to ignore the media attention surrounding NFTs.

Every week, another company joins in on the NFT frenzy. Even the UK government announced it would be releasing its own this summer.

Goldman Sachs is the latest institution exploring the technology. During the Financial Times Crypto and Digital Assets Summit in April, Goldman’s Global Head of Digital Assets, Matthew McDermott, reportedly said the firm is “exploring NFTs in the context of financial instruments” and considering the “tokenization of real assets.”

For some, perhaps this comes as a bit of a surprise. What exactly does a globally established bank need an NFT for? For others, it’s the logical next step.

Although most mainstream media focuses on the visual NFTs — the Bored Ape Yacht Club (BAYC), the Crypto punks, and Azuki — there is a lot more to the technology that can be applied functionally.

Nonfungibility: what does this mean for financial instruments?

“NFTs are a form of token that’s very flexible. It’s the logical next step for financial instruments,” said Eric Hill, Web3 crypto lawyer, and contributor to Bankless DAO.

“NFTs are non-fungible tokens, which means that they’re unique.”

This “uniqueness” is the driving force behind the usability of NFTs in financial products.

Stored on the blockchain, the unique nature of the technology makes it simple to track and transfer ownership.

“Because there’s an immutable history of the life of the token, there is no problem authenticating whether the token itself is real or fake,” continued Hill.

The blockchain is fundamental to the future usage of NFTs. Providing transparency and security through the network of authenticating nodes offers excellent value for companies.

This, combined with non-fungibility, creates a powerful asset.

Strengthening the infrastructure

A concern for some is the fragility of the infrastructure underlying NFTs. As seen in a recent BAYC NFT drop, gas fee values can be volatile, rising and falling per demand. For large institutions, this may not be an issue.

With private blockchains, companies such as Goldman Sachs could control the volatility of gas fees.

The NFTs would work solely within this private blockchain, retaining the benefits of the technology within a secure, albeit relatively centralized, system.

“The technology, the infrastructure, and the knowledge to build even your private blockchain internally is there, and it is robust,” said Hill. “Gas fees are a known issue, and people are working on solutions.”

“Financial instruments are either going to happen on a private blockchain — Goldman Sachs could make its own private blockchain that you have to plug into. Or if it uses a public blockchain, public blockchains like ethereum, they have layer-two scaling, and the layer twos, it’s just a blockchain that rides on top of the ethereum blockchain.”

“The secondary layer, like Polygon, for example, gets all its security from Ethereum and does batch transactions. It then allows for fast transactions with almost no gas fees. So that’s how the layer twos solve that scaling problem and reduce the gas fees.”

Flexibility to improve efficiency

Within the overarching NFT, all things can be contained, whether in artwork or multiple smart contracts.

“There’s composability to an NFT. Just think of it as a wrapper, like a dim sum,” said Hill. “You can put stuff in it and wrap it up into one thing. Then you can trade this “thing” on a blockchain instantly. Instant settlement anywhere with global permission.”

One of the main benefits of this is efficiency. Hill explained that within a single NFT, access to goods, services, and values could all be contained. In addition, NFTs can be combined with bigger NFTs, eventually creating large financial products.

“That may not sound that different from, for example, an ETF or something of the like. But it’s substantially different because the costs are negligible,” said Hill.

“The ease at which you could do it, you don’t need a really specialized person. You eliminate all these layers.”

“It would make sense if Goldman Sachs was looking into NFTs. Why? Because they could eliminate all sorts of middlemen.”

“These financial products may already exist in the institutional sector, but because there’s bloat and all these intermediaries, it’s not financially viable. So they only do it at scale. The NFT makes the cost exactly the same. If your NFT is worth a billion or 10 bucks, the gas cost is exactly the same.”

Reducing the ‘bloat’ to regain competitive advantage

On a certain level, reducing “middlemen” and workers could pose a significant issue, adding to unemployment rates at a time when they are already high.

“When we talk about something like a financial institution, these are not workers. These are managers and managerial people that become redundant,” explained Hill.

The increase in fintech businesses has significantly influenced traditional financial institutions. Fintechs have been segmenting the value chain and coupling their products with others through selected partnerships, achieving competitive advantages through this horizontal structure.

According to Accenture’s Future of Banking report, through adopting this strategy, businesses have achieved a compound revenue growth of 76% between 2018 and 2020, compared to 44% for those which adopted a more traditional vertical structure.

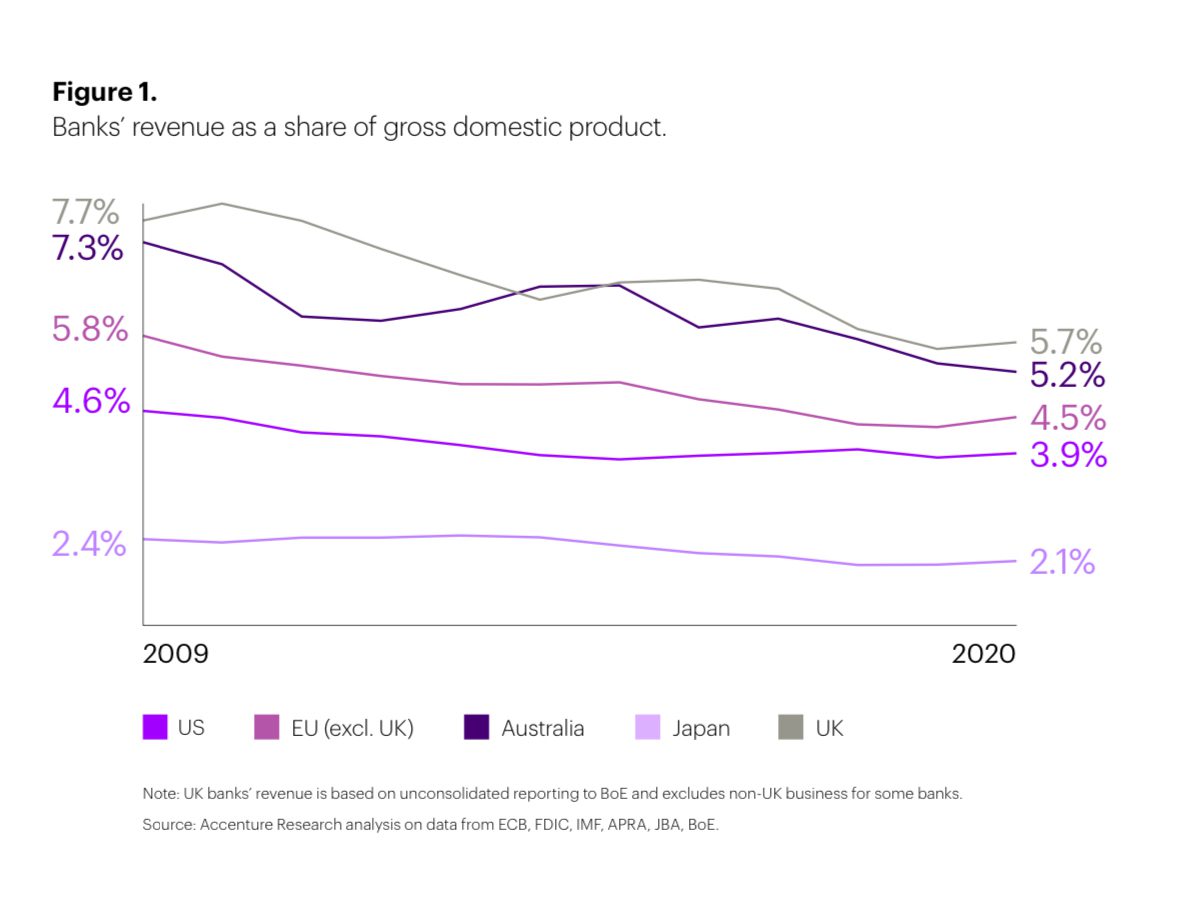

The report also found that over the past decade, the revenue of traditional institutions as a share of GDP has steadily declined. Despite this, converting to a non-linear structure could create growth of almost 4%.

“We have the system whereby we try to automate the workers with robots, those who actually create the value,” commented Hill. “And then we preserve the management that actually adds no value.”

The composability of NFTs could provide a solution to assist in an efficient breakdown and segmentation of the linear structure.

The ability to manage risk and familiarity with regulation remain advantages traditional institutions retain.

According to Accenture, however, there is significant evidence that “bundling the unbundled” could help these larger institutions regain some flexibility and competitive advantage from the smaller, digital-native fintechs.

NFT case study: A fast-moving founders perspective

While traditional institutions grapple with new realities of adding value, crypto natives in the NFT space are taking off.

While the BAYC native coin drop and land sale exemplify the hunger for crypto-native NFT products, NFT startup founder and advisor Sean Kelly said that Fortune 500 brands would start to see NFT and Web3 products as new channels to add value.

“I think all these big IPs, all these big Fortune 500s will have to offer some sort of NFT or Web3 products because it’s just going to be another marketing channel for them,” Kelley said.

In the fast-moving NFT space, Kelly said he went from an NBA top shot investor to founder of a play-to-earn (P2E) NFT line in only a couple of months.

“I got on NBA Top Shot, probably around the peak of April or May [2021], when things were heating up in NFT space. I started seeing the power of community,” Kelly said. “Then a couple of months later, after researching all the top NFT traders, I launched my project called Chibi Dinos that launched in August.”

His premier project, Chibi Dinos, enables customers to buy characters in an expansive world of basketball-playing dinosaurs, with traits, items, and P2E gaming coming soon.

Now, Kelly focuses on an NFT project marketing agency called NFT Gorillas, recently acquired by a firm called Infinite World.

“That sold out in 18 minutes for $2.4 million, and we hired a whole team from there: we have about 22 employees running that company now. And then a month after that, I started NF T marketing agency called NF T guerrillas,” Kelly said.

“Basically, for the six-seven months, I was helping people launch their NFT projects, advising, consulting, and helping on the marketing side. We just did a McLaren drop yesterday.”

What happens when NFT prices drop?

When NFTs move fast, they do not only go up, Kelly said, referencing the volume of BAYC, the most popular project in the space, and the recent slashing in NFT prices. He said prices in NFTs are compared to the valuation of ethereum, but when ethereum or crypto drops, so do NFT prices.

“I don’t know income parison to ethereum, but Bored Apes dropped to $89 M. I think their peak was $160 M, Azuki’s are down to nine million, their peak was $30 M. A lot of the blue chips were cut in half or more, and this was all within two days,” Kelly said. “I haven’t seen this happen yet, but I’m not worried because if you’re just building doesn’t matter what the price of crypto or other NFT projects is.”

He said his original project, Chibi Dinos, has not seen a significant floor price drop, which is the metric he referenced for BAYC.

The bad part of being big: BAYC Otherside land mint

On April 30, BAYC launched a mint sale for 55,000 plots of virtual land, available only to ApeCoin and NFT avatar holders.

The infamous Otherside mint saw ethereum gas prices explode as demand overwhelmed the favorite Web3 L1.

Kelly said the team of the largest NFT project could have planned the mint better, a sign that even with massive volume, there is room for the network to grow.

Related:

“I think they made over $300 million within a couple of hours. But now the floor price is below mint if you include gas because the prices were outrageous, for that mint people were paying one, two, five ethereum to ensure they got one.”

“Anytime you got labs or board apes do a drop, anyone, that mints make a lot of money. But I think they could have handled it better; if they gave people 24 or 48 hours to choose when they could mint. Then it wasn’t like a gas war.”

Another problem with the mint and a growing conflict within Web3: BAYC required a KYC element to gain access, which locket out the most decentralized, anonymous users from the sale.

Know your crypto

An expectation in traditional financial markets, KYC is a hot topic in Web3. Nothing halts money laundering and hacking better than checking IDs at the door. Kelly said with a large valuation, KYC may have been required because Bored Apes were entering the territory of investment securities.

“People had to KYC for that to be eligible to mint. It was the first time an NF T project did that. I guess we’re getting into securities territory with this Metaverse landscape,” he said.

“I didn’t fill it out just because I feel like, in the NFT space, people like having the option of being anonymous and not doxxing themselves. Many people didn’t fill it out because they wanted to keep their identities private.”

When every transaction is traceable on a public blockchain, one of the draws for crypto has become a deterrent for centralized trad adoption.

If Goldman Sachs launches an NFT project, they get user data through KYC, and many Web3 users see that as an insult to the entire ecosystem. Traditional finance and brands could use crypto wallets as the new email list, but Kelly said with even more data on financials and memberships.

“These brands, it’s important to them because collecting wallet addresses is going to be like collecting an email, and it’s going to be more valuable because it records how much money is in that account,” he said.

“Big firms like Coinbase, when they launched their NFT platform collected, however many wallets they did, and directly increased the valuation of their company, for sure.”

Kelly said that for the public, centralized fintechs like Coinbase, Robinhood, and other consumer-facing investing apps pivoting toward Web3, NFT sales may not be the goal. Even if NFT platforms fail to draw real volume, the value-added is in the transactional data: lists of customers’ entire web financials.

“Even if their new NFT platform didn’t do that well, they still have all this data, So I think it’s important for these companies to start collecting.”

While prices act volatile and firms collect databases of Web3 names, Kelly said he remains unworried: the industry is building infrastructure even as prices drop.

“Because we’re building the infrastructure for all these web two brands to enter the metaverse Web3 space, we’re not too worried,” Kelly said.