When Luna, Celsius, and other DeFi firms caught fire and burned to the ground in the spring of ’22, the question on the industry’s minds: what would have saved us?

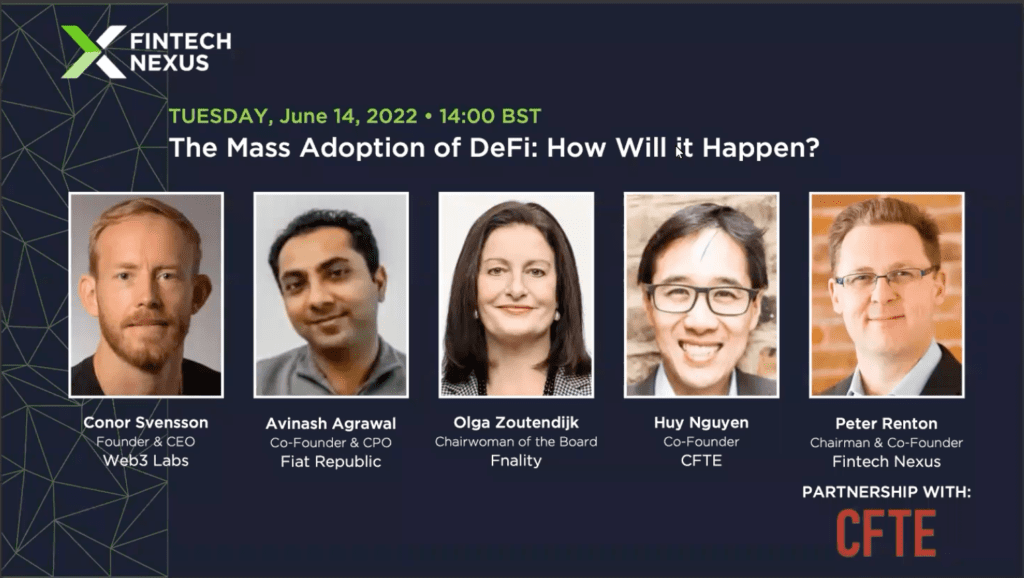

A smattering of fintech crypto execs joined the Fintech Nexus Webinar series to find out. The stacked panel featured Fiat Republic CPO Avinash Agrawal; Conor Svensson, Founder and CEO of Web3 Labs; Huy Nguyen Trieu, Co-founder of the Center for Finance, Technology and Entrepreneurship (CFTE); Olga Zoutendijk, Chairwoman of Fnality International; and moderator Peter Renton, Co-Founder & Chairman of Fintech Nexus.

So after the clean-up crew passes through, how can decentralized finance go from a fringe product for the crypto crowd to a valuable tool for the masses?

What is DeFi?

Trieu, the co-founder of the CFTE, said he came from a background in banking as an MD at Citi with a mentor and educator background at organizations like MIT. He said the objective of the CFTE was to help organizations and people gain the right skills they need for the world of finance, driven by tech. They offer courses on stablecoins, blockchain tech, and they also develop in-house research.

He began by defining DeFi, which he called a way to create a financial system based on distributed ledgers. To describe the different areas of DeFi, Trieu broke down the crypto ecosystem into four levels.

“DeFi uses crypto or stablecoins but doesn’t use fiat currencies: it uses distributed ledger rails. If we take that definition, I think we can look at the architecture across four levels,” Trieu said.

“The first is the technology itself, is distributed ledgers. On top of that, let’s call that the asset classes: those are cryptocurrencies, tokens, stablecoins. On top of those, let’s call it ‘simple finance, payments, and exchange.’ And on top of that, you can do more complex finance, like lending, insurance, and staking.”

He said the sum of those parts, “all of that is DeFi,” when the elements come together.

“Once you have built on top of all of these different asset classes, simple transactions, and more complex finance, then hopefully it becomes decentralized finance,” Trieu said.

Why should bankers care about DeFi?

Olga Zoutendijk went from traditional finance right to crypto and DeFi when she became the chairwoman for Fnality, a UK-based blockchain and distributed ledger tech research firm. She said that financial experts need to pay attention because the overall DeFi world makes the movement of currency easier. She said Fnality aims to build DeFi market infrastructure to enable real-time payments with near-instant settlement through central bank-backed digital assets.

“I became more formally involved in the DeFi space earlier this year when I started chairing Fnality International,” she said. “We are really at the forefront of what’s happening.”

Zoutendijk said she saw three key reasons banks and bankers should care about DeFi. The first dimension is to reduce counterparty credit risk and optimize liquidity management, using Defi to reduce counterpart credit risk.

“Just think of all the liquidity trapped in the current T+2 settlement process for equities, fixed income, and foreign exchange,” she said.

The second reason, Zoutendijk said, is that banks can lower administrative cost reductions on a scale the industry has not seen for decades. In-house admin tasks will execute at a fraction of the cost on-chain in the future, she said.

‘Banking relies on massive back-office operations’

“From cross-currency swaps to syndicated loans or fixed income banking, Wholesale Banking businesses rely on massive back-office operations,” Zoutendijk said. “These people are doing reconciliation and all administrative tasks involving manual processes, which are error-prone, costly, and time-consuming. Now, all those tasks can be automatically executed on-chain in the future.”

The third reason: she said banks need to get ready for digital assets; customers will want more exposure.

“Their customers want to buy, trade, hold cryptocurrencies, and they want to be able to invest in crypto through money market, or mutual type funds. I think they will increasingly want to do this through a trusted provider, especially given recent events like Terra Luna and Celsius,” she said. “If you look at private banks and wealth managers, having digital assets capabilities will be critical in attracting the next generation of wealth. Banks could and should become major stable coin issuers.”

Lessons from Traditional Finance

Agrawal introduced himself as the co-founder and Chief Product Officer (CPO) at Fiat Republic, which helps crypto firms integrate Fiat payment methods into their platforms through a single API.

“Instead of having to go to multiple banks or payment processors to enable each different currency, they can connect to a single API and manage all of their inflows through us,” he said.

So, how do DeFi platforms reach consumers as banks and fintech do? Agrawal said they need to be super approachable; UI comes first. Traditional finance did not take this seriously or keep pace with modern tech, which is why fintechs came along and out-competed them with consumer-friendly products.

“We must ensure that the DeFi world is optimizing for user experience, right from the get-go. in traditional finance, banks and traditional financial institutions historically never put the user first; they never thought about that user experience,” he said. “It’s only in the last 10-15 years that fintech has come along. They’re trying to disrupt primarily the user experience because they were all building a better user experience on top of the existing financial system.”

Focus on UX

Now, DeFi comes along as brand new tech, and platforms should focus on excellent user experience from the get-go, he said.

“Many fintechs started building a better user experience on top of the ecosystem. Trust and confidence for mass adoption come from that. You want to ensure DeFi gets it right from the beginning.”

When markets begin to fail, and for example, Celsius crashes and consumers lose their funds behind a down withdrawal system, Agrawal said consumers want some protection too.

“Ultimately, the retail user, your average retail user, wants some sort of protection to get comfortable using new financial products,” Agrawal said.

What needs to change for Defi adoption

Svensson, Founder and CEO of Web3 Labs, found his way to DeFi after working through traditional finance and spending time at UBS and Deutsche Bank. He founded Web3 Labs, a software as a service firm that builds applications for asset custody and exchanges for giants like Microsoft, J.P. Morgan, and ConsenSys.

He said anyone who has transacted with the space through in-browser wallets will appreciate how complex the space is now and how much it needs to grow. For example, firms that are succeeding now in what he called the web2.5 space are providing web2 infrastructure to onboard people into Web3. As soon as users want to move on to Web3, they face a barrier, he said.

“The most common example of this is with any centralized exchanges, they provide the nice user experiences for their users to make the whole crypto end-user experience simpler,” Svensson said. “As soon as people want to move crypto off the platform, then all of a sudden, they have to figure out all the details, which is what makes it so hard.”

He said dealing with hexadecimal addresses, or crypto private and public keys to wallets, is a major issue. “No one other than a programmer should have to think in terms of hexadecimal.” He said the chance of consumers correctly typing these 30-digit account numbers is zero.

Hexidecimal has to go

“With bank account numbers, you enter like a bank account number when you’re paying someone, it’s a manageable number of digits. There are solutions, such as ethereum naming service, where you have a wallet named “something dot eth.”

As opposed to natural adoption by crypto sleuths, Svensson believes when consumers are forced to adopt, it becomes a much smoother experience.

That being just an example, he said even knowing finance institutions have trouble interacting with Metamask wallets and signing transactions, “it’s just a nonstarter.”

“It would be nice to see some of the fundamental user experience issues addressed closer to adopting the technology,” he said. “For example, Web3 native wallets without seed phrases, but instead a username and password or a longer-term centralized identity. We need to see these types of things, but we’re not there yet.”