MAJORITY, a Florida-based neobank and mobile app for migrants in the U.S., announced a $37.5-million Series B funding round.

The round is a combined $30 million in equity and $7 million in debt.

Valar Ventures led the equity round alongside participating investor Heartcore Capital.

A “leading U.S.-based based commercial bank” led the debt round, the firm said, without other details. Nine months after the firm’s series A, the round brings the total funding to $83.5 million.

CEO and Founder Magnus Larsson said MAJORITY is a company of immigrants aiming to serve the nearly 50 million immigrants in America.

“Given the country’s current financial standing, we are thrilled to provide tailored resources that meet the unique needs of migrants and ease the burden of transitioning to a new country,” Larsson said. “Our mission, as a company of immigrants for immigrants, has always been to provide migrant communities with the resources they need.”

Serving the underserved

Larsson said funds would help refine the firm’s services for underserved communities. MAJORITY advertises it saves its users an average of $15/month, sometimes up to $30/month, with cashback rewards, discounted services, and a lack of predatory overdraft or service fees.

Since its last funding round, the firm also opened three new locations in Florida — in Miami, Hialeah, and Orlando — and a new location in Houston, Tex., to provide hands-on service and resources to migrants in those cities.

This expansion of MAJORITY’s service comes despite the current uncertainty in the fintech market, proving the demand for MAJORITY’s life-changing resources. This year, MAJORITY has seen monthly transaction volume among its migrant user-base increase four-fold. Overall, MAJORITY’s revenue has increased five times in the past year.

Member dedication

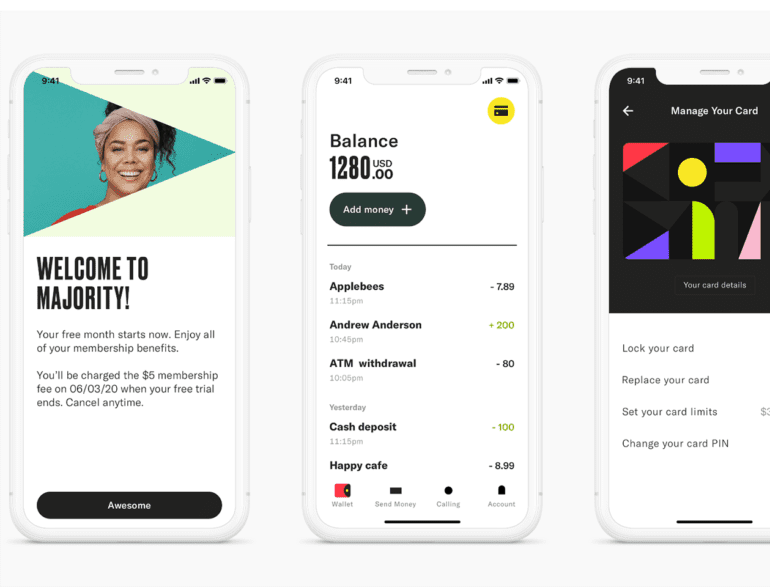

The neobank offers a $5.99 per month membership that grants immigrant-focused services like free cross-border payments, international calling, and standard banking services like a bank account, debit card, and community discounts. FDIC Member Sutton Bank issues the Visa debit card.

Earlier this year, MAJORITY announced that users could register without a social security number or U.S. documentation. Customers only need an international government-issued ID and some proof of US residence. The firm said the lack of ID makes their financial services even more accessible for immigrants.

James Fitzgerald, the founding partner at Valar Ventures, said Majority is unique in its dedication.

“MAJORITY is unique in the way it provides members with a service dedicated to their ultimate success,” Fitzgerald said. “They are pioneering a new and improved way for the banking industry to meet and support the needs of their users, all while championing an incredibly underserved community in the U.S.”

This year, the firm also released a Migrant Handbook on navigating living in the US, with advice on enrolling kids in school and tips on employment, health insurance, and housing.