According to the Ellen MacArthur Foundation, the circular economy could become a 900 billion euro opportunity.

With a focus on reusing, recycling, and reselling activities, business models could be created to form an economy with significant savings potential. Individual customers could benefit from up to 30,000 euros a year in household benefits and savings, which could be an antidote to the worsening cost of living crisis.

This, along with net-zero targets, may be the reasoning behind the EU’s focus on promoting regenerative systems, and fintech could play a significant role.

At Innovate Finance’s Fintech for Good Forum in London yesterday, Mandy Lamb, Visa’s Managing Director in the UK and Ireland, spoke about how fintech could drive the economy’s transition from linear to circular and how collaboration is critical.

“We need radical transformation,” she said. “Individuals, communities, businesses, and governments really need to rethink, innovate, and scale opportunities to create a regenerative future.”

EU and UK back circular economy development

The EU and the UK have announced initiatives to support the creation of a circular economy.

Earlier this year, the European Commission announced proposals for strengthening regulation on goods sold within the EU, making them more sustainable and easier to repair.

These announcements follow the trajectory of the EU Green Deal, which has included a Circular Economy Action Plan.

The document outlining the plan reads, “Innovative models based on a closer relationship with customers, mass customization, the sharing, and collaborative economy, and powered by digital technologies, such as the internet of things, big data, blockchain, and artificial intelligence, will not only accelerate circularity but also the dematerialization of our economy and make Europe less dependent on primary materials.”

It indicates that increased digitization of the European community could help drive this growth, innovation, increased company data disclosure, and customer-centricity.

Circular potential for broken economy

Despite 87% of UK consumers reportedly being unaware of what the circular economy is, it has been found that the 4,117 companies working within the UK circular economy sector have made over £28 billion in revenue.

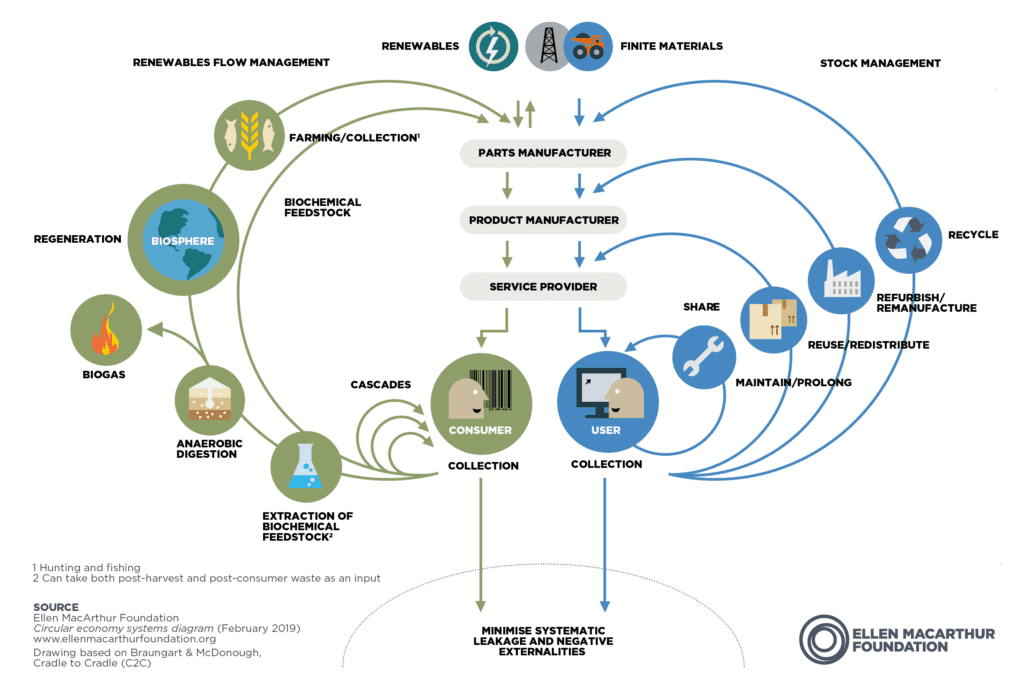

The UN found that in the current linear economy, global consumption will outweigh the resources of three Earths by 2050. A circular economy model, which currently only makes up 8.6% of UK economic activity, focuses on reusing and recycling resources, maximizing their potential, and repurposing waste.

According to Lamb, the circular economy can be made up of six main activities:

- Repair

- Refill

- Recycle

- Rental

- Resell

- Redistribute

- Return

Finance has a large part to play in creating this change.

Fintech well positioned to support shift

Aside from investment flows with the potential to supercharge the sector, companies facilitating the safe reselling and renting goods are starting to show momentum.

P2P payment options and sharing economy insurtech for companies like Airbnb and Uber are just two examples of fintech supporting the transition.

In addition, awareness is set to play a significant role. Carbon tracking software linked to the bank accounts of consumers has seen substantial growth in the past few years. It could contribute to individuals changing spending behavior to align with their carbon footprint reduction goals.

For Visa, ReCommerce provides a significant opportunity to engage consumers in circular economy activities, meet customers where they already are, and encourage growth in the sector.

“Re Commerce has to be built on an equitable model that is open to all and accessible to all,” said Lamb, explaining that Visa felt this could be achieved through collaboration with fintechs.

She said Visa had found that over 50% of customers engage in circular economy activities online via marketplaces. The main points of engagement were through resale and rental.

“We believe that a key incentive to try and drive consumers to change to adopting more of those six bars is through things like security, availability, speed, and reward.”

Fintech’s focus on customers, digital presence, and innovation agility could make them well-positioned to support the growing sector.

“It’s critical that these re-commerce behaviors are linked to both personal motivation from the consumer perspective and commercial opportunities in the SME space without adding substantial incremental costs in the equation.”