One by one, traditional banks are starting to see the advantages of working with fintechs. Lloyds is no exception. Last week the high street bank announced the launch of its “Innovation Sandbox” developed in partnership with NayaOne.

NayaOne’s solution

NayaOne has seen the benefits of the intersection between fintech and incumbents for some time. Founded in 2018 the company has created an innovation infrastructure aimed at speeding up the integration of new technologies.

Providing banks with a single point of access they facilitate the visibility of hundreds of fintechs and datasets through their Digital Sandbox and Fintech-as-a-Service solutions.

NayaOne onboards fintechs into their marketplace, which incumbents can then use to choose the technologies they are interested in working with. The company also provides synthetic datasets, allowing banks to test products within the Sandbox.

“Banks can now just pick the tech and datasets off the shelf, then use the sandbox and bring them in,” said Karan Jain, CEO of NayaOne.

“From a bank perspective, they’re able to take the product or the capability to market a lot sooner.”

Instead of taking several months or even years to carry out the selection process of new technologies and the development of new products, financial institutions can conduct multiple proofs of concept within a matter of weeks.

The advantage of working with fintechs

“Fintechs have shifted the competitive landscape in the sector, offering opportunities for established players to innovate their products and services and their operations,” stated Lloyds in their release announcing the news of their partnership with NayaOne.

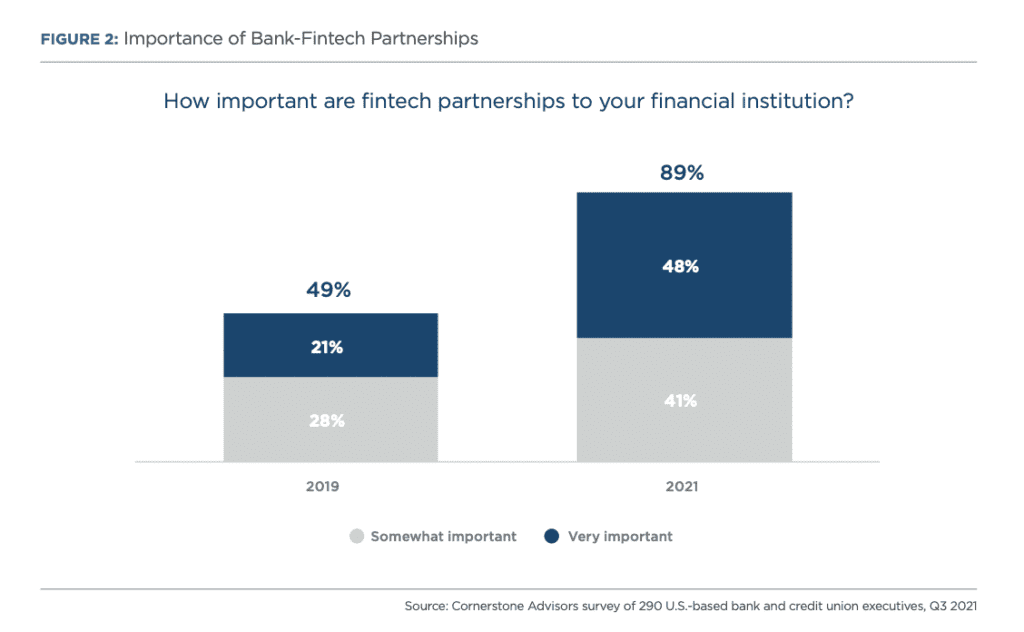

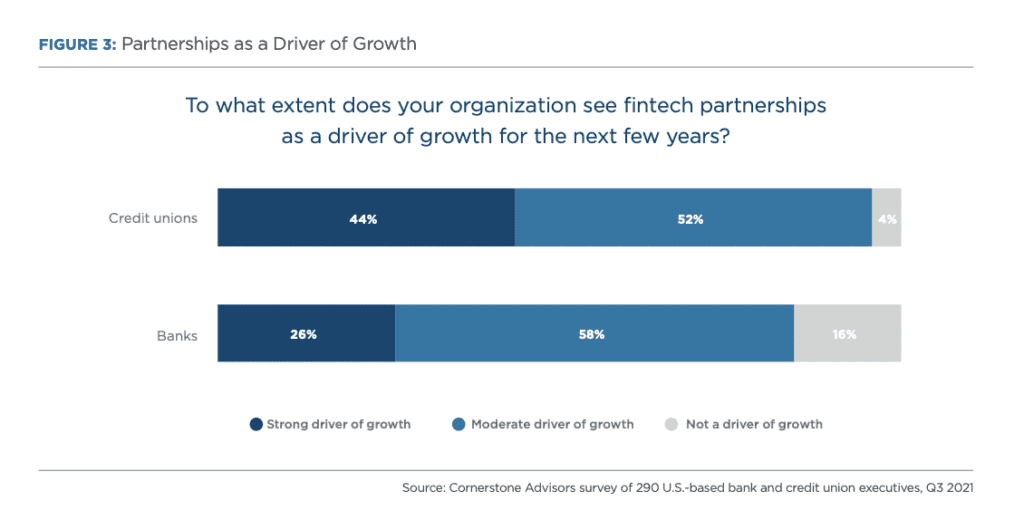

They aren’t the only ones who believe this. According to a report by Cornerstone Advisors, nearly two-thirds of banks and credit unions have entered into at least one fintech partnership. Of those who haven’t, 37% expect to in 2022. The vast majority of them believe these partnerships to be a driver of growth.

Fintechs have changed the shape of financial services. As they become further integrated into consumers’ daily life, digital innovation is becoming the norm.

Despite deep pockets, innovation in the traditional finance giants can be slow and laced with bureaucracy. Fintechs, which are usually built on specific expertise in a particular field, can speed ahead, gaining a competitive advantage and responding quickly to developments in technology.

The marrying of the two can bring incumbents further forward in their digitalization. Streamlining the collaborative process of the two sectors could make all the difference to banks’ competitive advantage.

NayaOne’s partnership with Lloyds

“The launch of the Innovation Sandbox has improved our ability to experiment and learn with Fintechs at pace,” said Vic Weigler, chief technology officer at Lloyds Banking Group.

“We are working to maximize the value of the Sandbox and increase the velocity of technology-led innovation in supporting our growth strategy. Strengthening the UK’s financial ecosystem is part of how we help Britain prosper.”

The Innovation Sandbox adds to Lloyds growth strategy, facilitating collaboration with fintechs and improving the digital solutions it offers its customers. Already experiments have been conducted using the Sandbox, allowing technology-led innovation to be quickly developed with selected fintechs.

“We are extremely proud to be working with Lloyds Banking Group on their Innovation Sandbox,” said Karan Jain, CEO of NayaOne. “It is clear this will enable the bank’s growth strategy through technology-led innovation, strengthen the UK financial ecosystem, and deliver on the Fintech Delivery Pledge.”

RELATED: