In one of the most significant events in the evolution of the crypto world, ethereum conducted its merge in September 2022.

In its wake, speculation of skyrocketing value has been forgotten, and a divide in the community gaped open. On one side — the PoW purists believe the merge to be a destruction of the blockchain’s decentralized democracy. On the other — the ethereum die-hards feel this is just the next step in the blockchain’s evolution.

What is clear is that the media hype around the event does not match the sentiment of many developers. Many have kept the “so what?” stance throughout, maintaining that the merge was just one of many upgrades that ethereum will be rolling out over the next few years.

Are you feeling that balloon of excitement and intrigue slowly deflating? Never fear — the opinions and scandals of the wider community are more than enough to keep any reader entertained.

RELATED: PoW vs. PoS and why you should care

Benefit is primarily ecological

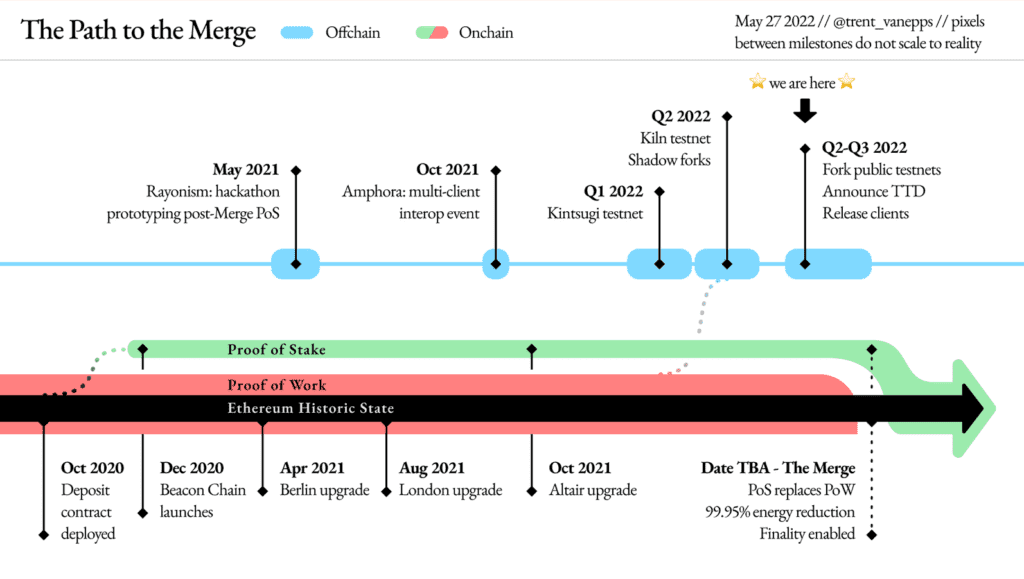

The primary benefit of the shift from Proof of Work to Proof of Stake was the reduction in emissions. According to the Ethereum Foundation, the merge resulted in a 99.99% reduction in energy consumption.

In a world increasingly concerned about the ecological impact, this is significant and has caused many to see the merge in a positive light.

Before the merge, ethereum’s emissions made up an estimated 0.2% of global energy consumption. A damning study by the ECB compared the blockchain’s carbon footprint to that of small countries, hinting at a possible future ban on PoW.

Since the merge, for ethereum, this is no longer an issue, but it does bring into question bitcoin’s next steps.

As the world’s first and largest blockchain, bitcoin contributes significantly to global energy consumption. Continuing with a PoW consensus mechanism, experts estimate that it could contribute as much as 0.6% to global consumption.

What does Vitalik think?

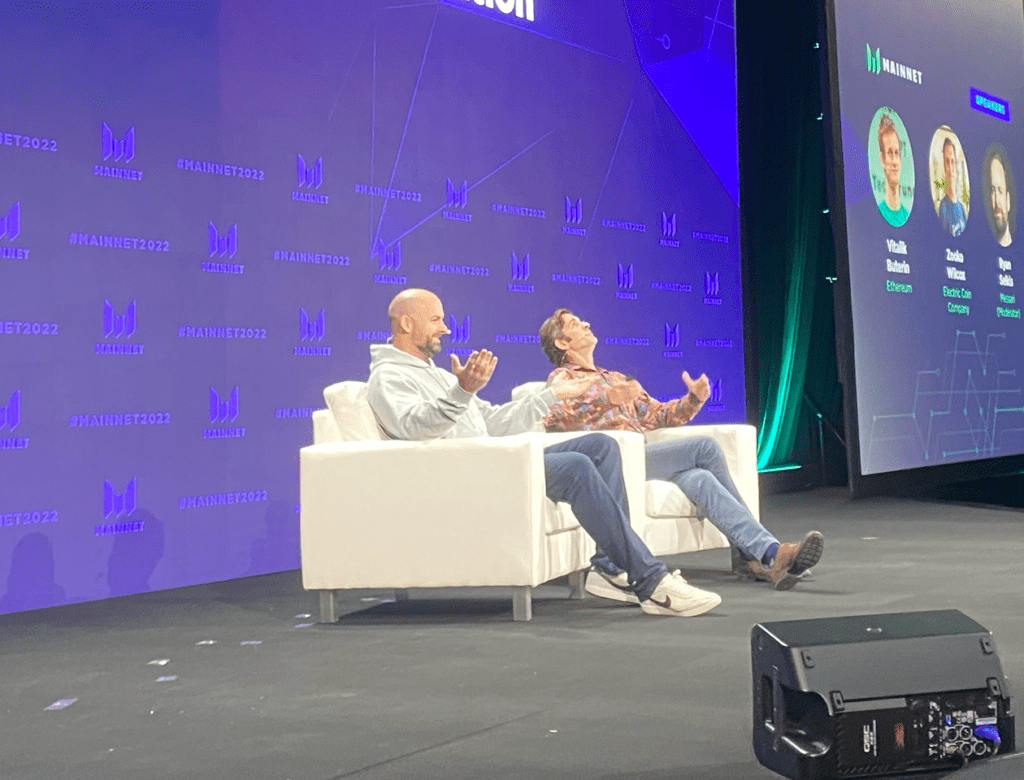

Shortly after the merge, ethereum founder Vitalik Beuterin joined the Messari Mainnet mainstage via Zoom to discuss the most significant crypto software update. He likened the upgrade to a great work of conservationism and said nothing went wrong.

“I mean, like that apocryphal quote from some Chinese leader about the French Revolution, ‘it’s still too early to tell,'” Buterin said. “The transition seems to have gone fine; the transition turned out a lot more smoothly than everyone expected.”

Z Cash co-founder Zooko Wilcox-O’Hearn agreed the upgrade was more like the historical shift from HTTP to HTTPS for most websites. The upgrade was necessary for system health, but in the end, successfully boring. Z-Cash, a well-known privacy-focused proof of work chain, has long claimed it would shift to proof of stake if only eth did it first.

When the multitude of eth client teams ran their test net merges in a demo for the past year, there was always a snag, Buterin said.

“Every one of the tests before merge had at least some kind of bug or snag that caused at least a few percent of the nodes to drop offline for a while, and the last one didn’t finalize for an hour,” Buterin said. “But the main network just went through completely smoothly.”

Wilcox-O’Hearn said it was clear there were no problems just yet, but his attitude on stage then was still, if it is not broke, don’t fix it. He explained that there was hesitation in the ethereum community and crypto at large over the classic decentralized vs. centralized question.

After all, staking meant validation by a bunch of coin holders that could check block updates with their copies of the chain history, as opposed to electricity hoarders checking validity by burning computing power.

So, will others feel the pressure to change?

“I think that bitcoin is unlikely to change its protocol,” said Yves Longchamp, Head of Research at SEBA Bank. “I think there is no willingness to adjust into Proof of Stake.”

“You have two ways to see it. First is where the energy comes from. And the second one is what this energy is used for. The energy is not just wasted; it’s used to provide security to the system. And bitcoin is by far the most secure crypto in the world.”

“The cost of hacking is proportional to the energy used. The more energy you spend, the more costly it is to attack. That’s the USP of bitcoin — something outside the financial system, peer-to-peer censorship-resistant, and kind of unattackable.”

“I think it’s not in the view of bitcoin to to to change this protocol and to become energy efficient.”

That being said, multiple organizations have been formed to address the issue of bitcoin’s energy consumption. The Crypto Climate Accord is focused on the decarbonization of blockchain, with over 200 entities banded together to reach zero net emissions.

Longchamp explained that due to this decarbonization concern, 57% of the energy used to power bitcoin is renewable.

“Most GPU miners and crypto miners are aware of the energy costs, aware of the impact on the environment, and they look for clean, cheap, renewable energy,” said Daniel Keller, Co-Founder of Flux.

However, some say the switch to renewable energy is not enough.

Energy consumption aside, there is still the issue of e-waste

Despite an increase in renewable energy usage, there continues to be a rising problem of electronic waste. Due to the amount of processing needed to mine, discarded hardware has short lifecycles and could end up in an ever-growing pile of toxic chemicals and heavy metals.

Scientists estimated in May 2021 that bitcoin e-waste could amount to as much as 30.7 metric kilotons per year. This is predicted to grow by 70% between 2016-2050 but is likely to be even more as the price of bitcoin increases (there is, at last, an upside to the crash of the crypto winter).

A study conducted by Alex de Vries, Founder of the Digiconomist, and Christian Stoll at the end of 2021 stated, “At peak bitcoin price levels seen early in 2021, the annual amount of e-waste may grow beyond 64.4 metric kilotons in the midterm, which highlights the dynamic trend if the bitcoin price rises further.”

RELATED: Bitcoin’s toxic e-waste problem

Heavy-duty hardware gives miners a competitive edge in the Proof of Work Consensus system. Computers conduct millions of “hashes” to solve puzzles and gain rewards in a global race. It is this which provides the security to the network.

As the value rises, so too does the intensity of the mining and the need to have robust and efficient hardware with it.

In comparison, the Proof of Stake system implemented by ethereum now holds no gains from a more robust software, and the main focus is a constant connection to the blockchain.

“In crypto staking, making sure your validator node is up is critical,” said Hugh Brooks, Director of Security Operations at CertiK. “The network can economically punish you for failing to adhere to its rules.”

The ethereum foundation state that, unlike mining, there is no advantage to having more powerful equipment. Therefore, standard computers or low-power devices like the Raspberry Pi can be used to stake.

Sometimes staking is not enough

Some devs in the ecosystem have already working on proof-of-stake blockchains for years. Dean Tribble, CEO at Agoric Systems, builds crypto as a service in JavaScript on the Cosmos proof of stake blockchain, and when asked about his plans to offer the same capability for devs on eth, he said, “That’s that new proof of stake chain, right?”

To him, it’s as if eth finally joined the rest of them on the right side of the timeline. He wants to help developers build blockchain with JavaScript because of the inherent security risks in Solidity and crypto today. He said the merge is excellent for the planet but changes none of the risks.

“Eth has spent $9 billion battle testing a few critical economic institutions in a decentralized fashion,” he said. “They will continue to be valuable; they inspire many projects. But to me, it’s still not the place to innovate because of the security risk. But, it’s the place where there are lots of assets are; a place where people understand what’s going on.”

Tribble said that in his experience building contracts across fintechs, Microsoft, and more as a dev, the problems in eth are not going away no matter what chain upgrades the team can perform.

Not enough for Solana

For the Solana blockchain, a competitor, the ethereum switch to staking is still insufficient. The team widely circulated a press release the week of the merge that pointed fingers at the steady stream of electricity eth would still consume. They said that even including hardware waste, the Solana Chain produced less than 1% of ethereum, even post-merge.

Comparatively, Solana used 3,290 joules of energy in September, compared to eth’s post-merge estimation of 144,036 J. At least the numbers are lower than ethereum pre-merge, with an estimated 720,180,000 J of energy consumption in September.

Solana estimated a single transaction cost 508 J, less than half of a single google search, while a post-merge eth transaction cost somehow the exact number as all of September, at 144,036 J.

In 2022, users still can’t expect Solana to run year-round. The Solana foundation began tracking the carbon footprint of its blockchain in 2021.

Yields of green

One interesting take on the future of eth and its market is yield farming and the opportunity for more stable financial transitions. Will the eth update make eth cheaper, less expensive gas, and more “stable” overall? The jury is still out, and even Buterin said the update was never designed for that.

Manuel Rensink, head of DeFi at Seccurrency, said that more stable rates from real staking could change everything for DeFi. Securrency is a blockchain infrastructure company based in Dubai and Washington, D.C. They tokenize tangible real-world assets, he said, and help customers get interoperable access to different blockchains and compliance.

“That makes the FBI just not very useful for most people, and also for many commercial institutions,” Rensink said. “If your rate today is 10%, That might be great, but you’re volatile, and the next day it’s 2%. How can you make any savings or product out of that.”

Fixed yield could “10,000-times DeFi,” he said, and attempts have been made to that focus. Though in the past, he said schemes like Terra Luna offered “fixed yield” but collapsed due to poor and low collateral.

“With proof of stake, ethereum, because of the size, I think this is our first chance to offer text fields FTM 2.0,” he said. “It’s here; I don’t think it will change significantly over time, it will persist over the long term, and it’s liquid.”

The liquidity part is essential: Terra Luna collapsed because it ran out of enough free funds to keep the protocol moving. Rensink said staking is not technically a yield but a reward for validation.

Real cryptocurrency financial products

Ripple’s head of DeFi Trading, Boris Alergant, agreed that such a large proof of stake blockchain might enable genuine products for the first time, but it’s unclear. Ripple has its DeFi market-making capabilities.

In his experience, he said the new staking reward rate of 4%-6% could be considered the “no-risk” rate of return on funds in a lending situation.

“You’re staking reward is four to 6%,” Alergant said. “One could say the staking rate is the risk-free rate, the minimum rate, and anything above that, that’s your risk rate. You can calculate Sharpe ratios and risk-adjusted returns, and that’s how folks will look at calculations hypothetically.”

Regarding stability, nothing beats stablecoins, argues Stable Corp president and CEO Alex McDougall. Of course, a stablecoin is only as good as the backing it’s printed on. Stablecorp attests their Canadian Stable Coin VCAD is fully backed with assets held by Versa Bank.

While trying to launch cross-chain and cross-border capability for their products, McDougall said that proof of stake might have more stability or less because it has different risks.

“Everything in crypto is an experiment, and proof of stake has its own challenges,” McDougall said. “There are different risks inherent in a proof of work algorithm around network security and, theoretically, you may not have as much decentralization and a proof of stake model.”

He said the team would have to monitor and work out bugs, especially when bug hunting means billions of dollars. Even when a system works perfectly, the written protocol is flawed enough for a significant mover of capital to siphon up funds, Flash Boys style. Ethereum’s success so far has been that no one has found any holes in the system, he said.

“Especially with all kinds of the turmoil and chaos in the industry recently. Cryptocurrency people are the best at arbitrage: most DeFi attacks are not malicious hacks. They’re just power arbitrage,” McDougall said. “Basically exploiting rules that weren’t written properly. There were some examples of people posting transactions on both chains, But for nobody to find holes on it is impressive.”

One of the reasons they are exploring multiple blockchains is because of the risks that each harbor, he said. The Stablecorp team recently launched an on-chain cross-border exchange rail with Circle.

Decentralization concerns ‘a thorny issue’

The cornerstone of crypto is its decentralization, which has been questioned for ethereum since the merge.

For some, the merge did not affect the blockchain’s decentralization, but others believe the shift to PoS is proof of and will cause centralization.

“Centralization is a thorny issue,” said Brooks. “Decentralization is a core tenet of the crypto space, yet many of the incentives have aligned so that mining and validating power is concentrated in a handful of pools and specialized entities. I’m sure Satoshi didn’t picture ASIC mining hardware when he first created bitcoin — the idea was that people’s home computers could run the network.”

Many believe ethereum’s shift to PoS to has handed the controlling power to those with the most amount invested in the coin.

Staking requires a certain amount of currency to be stored to validate a node, and rewards are distributed at random to validators. The more currency stored, i.e., “staked,” the more nodes are validated. This could then equate to the probability of receiving staking rewards as higher for those who validate more nodes.

Using this logic, those more invested in the currency have more currency to play with and, therefore, will validate more nodes.

Validating can be related to centralization because validators approve transactions. If validators are concentrated in a particular jurisdiction or within a company, transactions can be affected by location-specific sanctions or personal interests. This would then mean the control of the network is not distributed evenly and is, therefore, not decentralized.

Much of the staking on the ethereum blockchain is done via centralized online entities. Coinbase, Kraken, and Binance are leading platforms, holding 30.25% of the network’s nodes. Liquid staking protocol, Lido, is the single largest holder, with 31% of nodes.

However, one look at the distribution map of bitcoin miners makes the logic behind the argument that PoW trumps PoS for decentralization dubious. What was once set up as a system of home computers grew into an industry of mining companies in a handful of countries.

https://ccaf.io/cbeci/mining_map

The questions remain

On stage at Mainnet, Wilcox-O’Hearn asked Buterin similar questions about decentralization. The founder and face of the second most popular chain were in the room; could he answer what was on everyone’s minds?

Could the separate consensus change how “centralized” the mechanism was? Is contributing to one of the top 10 staking pools, run by Coinbase, Kraken, Binance, and other unknown names, any different than contributing to one of the top 10 mining pools that ran most of eth supply?

Buterin, playing his part as a careful tech wizard, said it is too close to call and that the greater community might not know for years.

“It’ll take years, and maybe more than a decade, before we know exactly how all of the details play out,” Buterin said. “How decentralized — the staking distribution — how practical will it look for regular people to run nodes once all of the technological upgrades that we’ve still promised, that we haven’t delivered come to fruition: All of those little details.”

Despite the pre-merge fanfare and warnings by media outlets, crypto talking heads on YouTube, and Telegram groups, nothing has changed regarding price action. There was not a renewed 2021 Bullrun, but no failure to produce new blocks that sent the price back to 2014, either.

In the end, the two founders agreed it was simply a win for decentralized tech upgrades: hundreds of developers, working without any significant corporation, completed a cool goal. A climate cooling goal at that, as Buterin said, a decade-long energy use problem is gone with a snap.

“I think the ethereum community is celebrating,” Buterin said. “And it really does feel like a sky that has been cloudy for almost a decade is finally cleared.”

SEC shows a renewed interest

SEC Chairman Gary Gensler has also reacted to ethereum’s merge. The shift to PoS has caused the SEC to question ethereum’s differentiation from a security.

In the lawsuit against Ian Balina, the SEC accuses Balina of allegedly offering unregulated securities in an investing pool he organized. Due to the validation of transactions happening primarily in the U.S., the SEC believes it has grounds for categorizing eth-based tokens as securities.

One glance at a global map of ethereum’s staking node distribution shows that a large majority of nodes are clustered in the U.S. According to Etherscan, they account for 47.89% of all the nodes on the network. This is close to a 51% majority which could cause issues for the network usually avoided by decentralization. However, the same could be said for the distribution of bitcoin miners.

On hearing the news, Twitter users took to their keyboards to refute the claim.

Unsurprising for some

The news of the SEC’s renewed interest in ethereum is unsurprising for some in the crypto space.

“Ethereum did like a double doozy,” said Keller. “It did an ICO which was purely, clearly an unregulated security, then they went to PoW, and they got a pass because they were decentralized, because of the miners. Now they’re back to PoS, which in the eyes of the SEC, could make them a security.”

However, some believe the SEC’s concerns to be inconsequential.

“The idea is that the shift to Proof of Stake will lower the barriers that prevent most people from becoming network validators,” said Brooks. “Instead of investing in costly hardware, you only really need to invest in the network’s currency: eth.”

“While a few staking pools currently dominate the share of validators, the hope is that this will change as more independent nodes come online.”

Only time will tell if this hope is to become a reality.

The SEC is ‘Coo-coo for Cocoa Puffs’

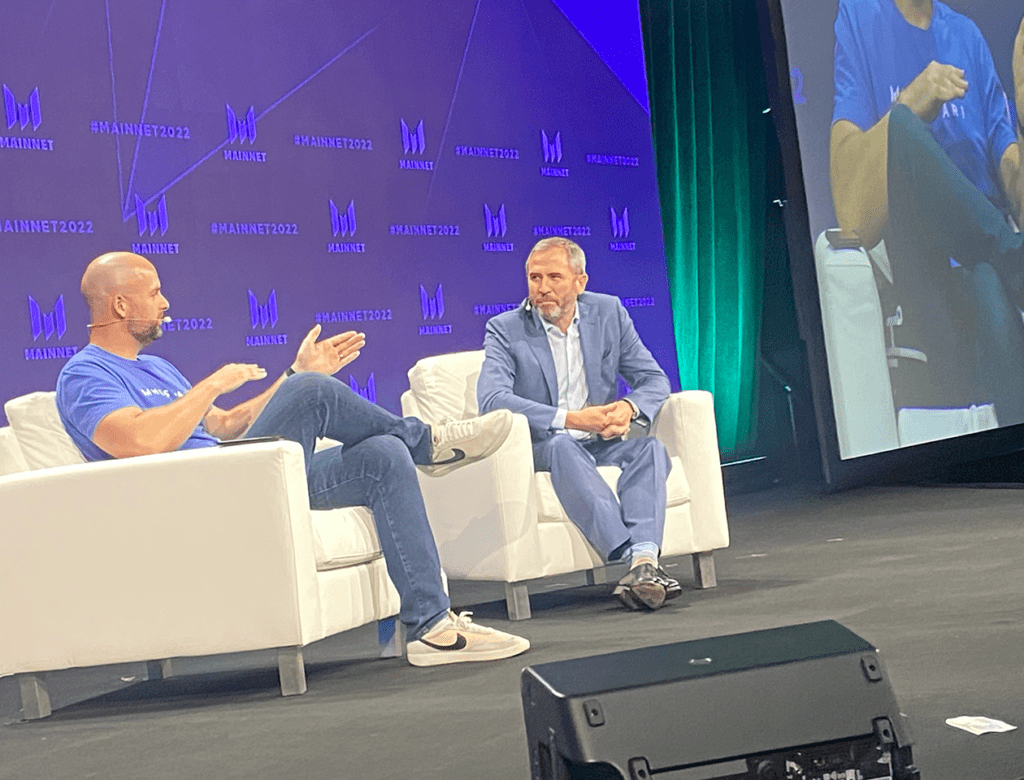

Ripple CEO Brad Garlinghouse said in public comments in the Lower East side of Manhattan on Sept. 21, 2022, that the renewed interest of the SEC in ethereum made no sense and was another example of their misshapen leadership.

The SEC gave ethereum a clear pass in comparison to Ripple. As moderator Ryan Selkis from Messari pointed out, many consider the “Hinman Test” a placeholder for the eth security argument.

In 2018, William Hinman, director of SEC’s Division of Corporation Finance, gave a speech at Yahoo Finance All Markets Summit. As Garlinghouse explained, that speech made the SEC position clear that they would enforce securities sales based on centralization for the time.

“The Hinman Test, just so everyone is on the same page: Hinman said that decentralization is a measure of whether or not something is a security,” Garlinghouse said. “That’s not what the law says. They did an ICO.”

Though Garlinhouse said eth performed an ICO, Hinman said that reselling a security asset always counts as selling a security, even if it is an ICO. However, in the case of an organization that is no longer “centralized” reselling assets, he said “yes,” they could be out of the purview of security laws.

But as Garlinghouse and Selkis pointed out, the SEC now believed PoS turned eth into a governable asset. Both speakers thought PoS does not necessarily make a coin less decentralized.

“That’s the coo-coo for Cocoa Puffs for me,” Garlinghouse said. “How in the world can they say it when they went from proof of work to proof of stake? It went to being security.”

What’s next?

In closing out the Zoom call with Buterin, Wilcox-O’Hearn asked the ultimate question: now what?

Though his tweets would say otherwise, he made no claims for the shift of ZCash to proof of stake. Instead, he seemed more interested in what ethereum’s subsequent problems would be.

“Now that things have gone smoothly with the merge or at least the kind of the first phase of the merge and it was a successful transition to proof of stake, what will you be working on?” he asked.

Scaleability, Buterin said in short. After the environmental change went well without scars, the next major problem for what he believes could be the future of the internet of value is speed.

“I think the ethereum core research and dev community and cell I now run is tilted pretty squarely towards solving the scalability challenge,” Buterin said. “When we’ve talked in the past, when asked if I can summarize the ethereum roadmap in two things, the answer has always been proof of stake, and sharding and proof of stake is finally here.”

Sharding, splitting different regions of the world into processing groups to speed up the process, is the next goal, Buterin said. As he concluded, he poked fun at Z Cash for switching over to Proof of Stake.

“I hope the Z Cash switches over; I am also very hopeful that dogecoin will move over to proof of stake at some point, especially now that there is a clear roadmap for how something like that can be done.”