In the aftermath of FTX’s chaotic demise, other centralized crypto exchanges scrambled to prove their credibility. Binance’s founder and CEO, Changpeng Zhao, has indicated Proof-of-Reserves (PoR) could restore faith in crypto.

Trust in the crypto sector is at an all-time low. According to Alternative’s Crypto Fear and Greed Index, the market is in a period of extreme fear. While this has been the case for some time, confidence was experiencing an uptick just before FTX’s fraud came to light. Now, sentiment has dropped, with indications it could crash even further.

Some entities have already taken matters into their own hands, with Santander UK announcing a block on all payments to crypto exchanges.

While experts predict the effects of FTX’s betrayal could be seen for years to come, centralized exchanges hope to improve matters by publishing PoR. However, not everyone in the crypto community is convinced.

What is PoR?

The mechanisms that the hope of many is hanging on are relatively new to the mainstream audience.

True DeFi holds transparency paramount, and many decentralized exchanges have public ledgers updated in real time. Despite functioning within the DeFi sector, the same is not true of centralized exchanges.

“We have a very interesting situation,” said Daniel Keller, Co-Founder of Flux. “Essentially, blockchain was born to be completely transparent ledgers, yet we have people continuing to obfuscate this process.”

The PoRs are exchanges’ answer to improving transparency.

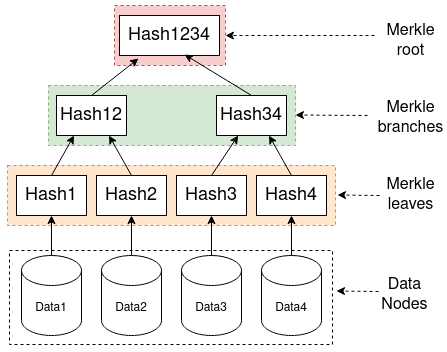

Essentially the PoRs prove that an exchange has enough liquidity to process all customers’ withdrawals. By implementing a “Merkle tree,” users can track funds and verify the exchange’s reserves.

Usually, PoR proposals require the involvement of a third party to verify that the on-chain funds match the funds claimed by the exchange.

The cryptocurrency community isn’t convinced

Despite much noise in the media, many of the PoRs published to date are incomplete, and the exchange has presented most. This has led to some continued wariness of the announcements.

“Currently, there is much skepticism around the proof of reserves, as they are currently presented,” said Keller. “There have been several transactions between exchanges with very little clarity around why. My guess is it’s post-contagion from FTX. Even Genesis, one of the most trusted exchanges, suffered from this.”

Binance has been particularly vocal about producing their PoR. Zhao tweeted an announcement promising to publish a PoR on the same day as pledging to help FTX, calling other exchanges to do the same. A few exchanges, such as Kraken and BitMEX, already had the policy.

On producing their primary “snapshot” PoR, it was made clear Binances data was incomplete, and full PoR was in the works. Ethereum founder Vitalik Buterin has also told Zhao that he will be working on a new protocol which Binance will be the first to try. The original PoR protocol has existed for years using the Merkle Tree method.

Zhao has, however, commented that it “is probably not as good as a Merkle Tree, but at least we can say: ‘Look, this is how much funds we have,’ and anything people do to increase transparency is good.”

RELATED: What is Binance going to do next?

In DeFi entities, a public ledger removes the need for a PoR, and all transactions are available for viewing on the blockchain in real time.

“Having a formal process in place where people could see the reserves held on exchange is essential,” continues Keller. “If we are truly all about decentralization and transparency, allowing users to trust centralized, blockchain entities much like exchanges, we need to be better practitioners of business practices and allow people to see on the blockchain, on an explorer, exactly what is held by the exchange.”

Is it really an issue of reserves?

Putting the hype about PoR to one side, one could ask, are reserves even the real issue, or is it just one part of the puzzle?

FTX had a liquidity issue, but another significant factor was the extent of its liabilities, compounded by the use of its native token as collateral.

“In the case of FTX, we saw that FTX had $9 billion in liabilities and only $900 million in liquid assets,” said Yves Longchamp, Head of Research at SEBA Bank. “It was clear that FTX was lending out users’ funds to Alameda Research to funnel it into early-stage investments, which were later deposited back into FTX exchange.”

“This way, FTX had 9 billion in illiquid assets which could not be sold immediately to cover user withdrawals. This led to panic among users, and FTX had to halt withdrawals altogether.”

Coingecko has compiled all the PoRs as they have been published. Currently, none show liability data. The use of native tokens to form part of holdings is widespread, and many perceive their usage to be necessary in some cases.

While Binance’s PoR showed $69 billion in reserves, 40% of holdings are in their native tokens. The company has not yet published liability data. However, Zhao assured on Twitter that Binance “has no liabilities.”