In his first public comments since the FTX exchange declared bankruptcy, Sam Bankman-Fried claimed ignorance on many topics while answering questions via video call to the New York Times Dealbook Summit.

Appearing over Zoom from the safety of the Bahamas, Bankman-Fried blamed Alameda Research and their general lack of controls.

Despite his attorney’s best wishes for him to hide in a dark hole, Bankman-Fried said he wanted to help as much as he could. Andrew Ross Sorkin of the New York Times and CNBC ran him through a gauntlet, including a personal letter from a consumer investor that lost $2 million in the exchange while Bankman-Fried and team bet on “S***coins.”

“The subject line is ‘SBF stole $2 million from me,” Sorkin said. “It says, ‘Andrew. Can you please ask SBF why he decided to steal my life savings? And the $10 billion more from customers to give to his hedge fund Alameda. Can you ask him why his hedge fund was leveraging long? All of these s***coins?’ I’m going to keep it polite for the kids.”

‘His hands are tied’

He said he was locked out of the U.S. platform and did not have access to data in general, but believed the U.S. platform was solvent. He said that if withdrawals were opened today, everyone could be made whole.

“I’ll start by saying just to make a distinction. Look at the U.S. platform, the U.S. regulated platform with American users, to my knowledge, that’s fully solvent, that’s fully funded,” Bankman-Fried claimed. “I believe that withdrawals could be opened today, and everyone could be made whole from that, that none of these problems plague the U.S. platform.”

He said he explored the chaos alongside the general public as he learned about the devastation a crypto winter market could rend when his exchange collapsed overnight. He said the U.S. exchange likely took controls away from the international FTX to safeguard funds, and he could no longer see into it. He also said the Bahamian government took control of funds from FTX alongside unknown internal actors.

“I was cut off from systems. Our U.S. team tried to seize assets from our exchange for ‘safekeeping.’ The Bahamian regulators also took some assets into ‘safekeeping,’ And there have also been some improper access of assets on the exchange.”

A bad month for some

Drawing laughs from the crowd in the packed Lincoln Center theater overlooking Central Park South, Bankman-Fried said, “I had a bad month.”

As Sorkin delved deep into the connection between Alameda Research, the market-making trading firm founded and run by leadership living in the same Bahamas penthouse, Bankman-Fried said he had little knowledge of the exposure and inner workings of the partner firm. Alameda provided 40% of FTX’s liquidity and levered consumer funds through a backdoor accounting trick Bankman-Fried acknowledged.

Sorkin asked about the recorded staff call, in which 28-year-old Caroline Ellyson, acting CEO, informed staff that she, the CTO, and Bankman-Fried knew about an “$8 billion accounting mistake.”

Bankman-Fried avoided using staff names and said he had no idea how overexposed Alameda was to multiple cryptocurrency crashes this past year. He even said he had no idea Alameda was so closely connected to FTX. It appeared the opposite in past interviews, text leaks, and tweets.

“And yet, it seems like Alameda people were living in the same penthouse where you may very well be right now,” Sorkin said.

Bankman-Fried said he had been living with staff members but based exposure calculations on FTX’s volume and otherwise stayed clear of direct oversight because there was a conflict of interest involved. He said, up until even two months ago, that he was optimistic about the future of FTX.

Right next door, but had no idea

“A lot of these are things I’ve learned over the last month as I was sort of frantically digging into this on Nov 6, 7, 8,” Bankman-Fried said. “That’s a pretty big mistake; that’s a pretty big oversight that I wasn’t aware of. I was scared and nervous because of the conflict of interest about being too involved.”

He said he did not knowledgeably co-mingle client funds or defraud clients. When asked about his lawyers, Bankman-Fried said he would rather talk and try to help than keep his head down. He also said Alameda was so connected to FTX partly because FTX had no corporate bank accounts in the early years of 2018-19, and they needed somewhere to wire customer funds.

He said he was not cautious enough from a downside perspective, as multiple coins and hedged bets collapsed this year.

Sorkin asked how Alameda invested $1.15 billion in Genesis while Bankman-Fried served on the board, and he apparently did not know. Bankman-Fried did not directly answer.

Sorkin asked about the rumors of drug use at the FTX empire through tweets and Tumbler posts and scrutinized office photos.

“It sounds like this is a bunch of smart kids on Adderall having a sleepover party,” he said.

Bankman-Fried said none of the staff drank that much, parties were usually boardgame focused, but the team would take medication if prescribed.

“I have been prescribed various things at various times to help focus and concentration,” he said.

Some things were meant to stay private

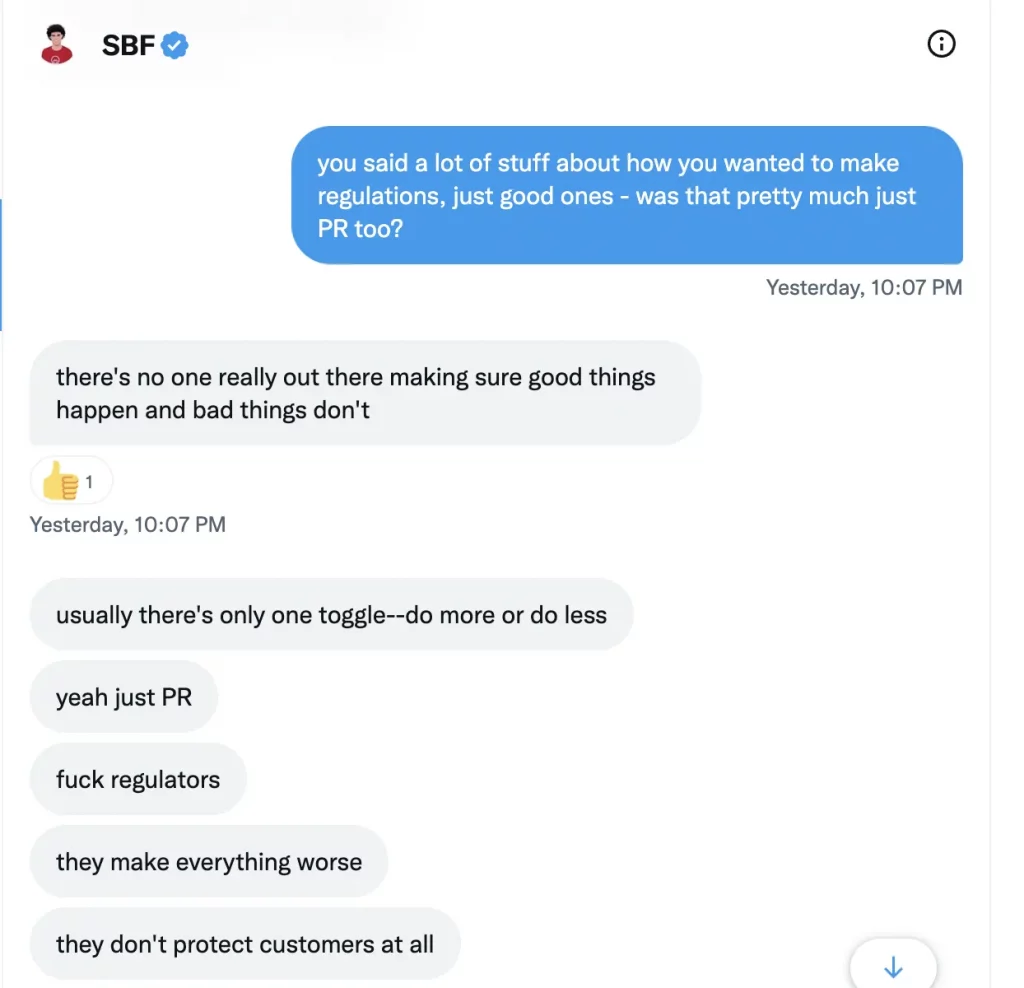

Sorkin asked about the Vox leak of a private conversation between Bankman-Fried and a reporter, in which he said several condemning hot takes.

“I was frustrated that it is not meant to be a public interview,” he said. He said there were “bullsh**t” things companies had to do to get appropriately regulated, to get bank accounts that he wished he did not have to do.

“Did none of the VCs ask you about your risk management systems?” Sorkin asked.

“I don’t think they bear responsibility. What they’re thinking about is the upside,” Bankman-Fried said.

When Sorkin asked if any VC firms or otherwise tried to ramp up FTX’s compliance, Bankman Fried said they were already spending large amounts of money on regulatory compliance and licenses. They, however, did not focus enough on keeping track of customer money, he said.

“I mean, look, I screwed up, like, I was CEO. I was the CEO of FTX. And, I mean, I’d say this, again and again, that means I had a responsibility, that I was responsible, ultimately,” Bankman-Fried said. “We messed up big.”