SoFi is the first bank to begin ‘Pay in 4’ within the Mastercard Instalments program that began in mid-December.

The company said this partnership is only available for eligible members and will slowly roll out to select members.

How do permitted members know if they have early access?

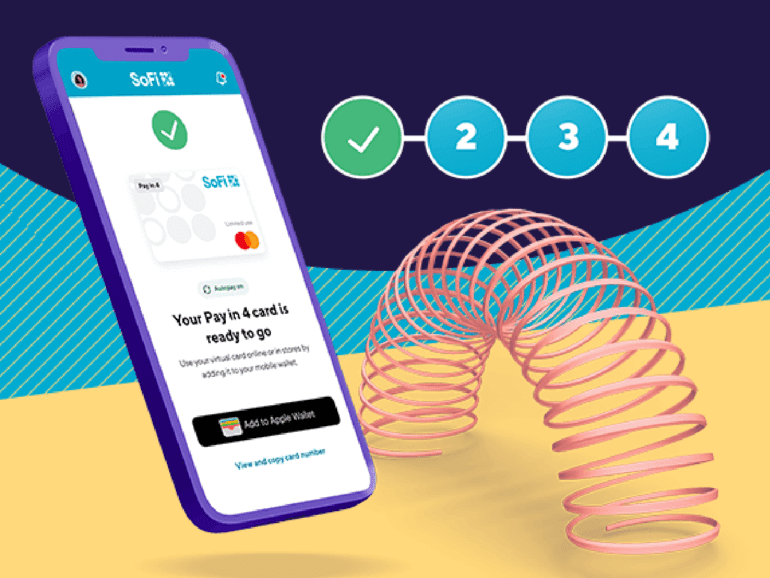

If you are eligible for ‘Pay in 4,’ you must maintain a direct deposit to a SoFi Checking & Saving account and pass a soft credit check which doesn’t affect your credit score. When logging in, eligible members will see an offer to ‘Pay in 4’ within the bank section online or tab-in app and then go through the activation process.

This new choice will map out an additional way to pay when it comes to larger purchases and provides a way to stretch out the payments interest-free.

SoFi members who use ‘Pay in 4’ have the security and flexibility when making purchases across the country and option online and-in store at checkout. Members who may use this latest feature should know it comes with Mastercard Zero Liability protection to protect against fraudulent transactions.

How does ‘Pay in 4’ work?

‘Pay in 4’ will allow members to chop their purchase payment of $50-$500 into four payments without interest for only thirty days. The $50-$500 is for purchases on a one-time use digital Mastercard. It can be added to your digital wallet. The amount members are eligible for is based on their monthly deposits and credit.

Once you have been approved and have made a purchase, your first payment is due and is pulled from your SoFi account, then every two weeks, your remaining amount is due.

For any reason, if a member doesn’t make the payments, SoFi can eventually withdraw funds from a member’s account if payments have not been made after reminders. To qualify for another ‘Pay in 4’ payment arrangement, you must pay off the current one in full. This program is for those that are financially stable.

Related:

Where can I use my one-time use digital Mastercard?

‘Pay in 4’ can be used for purchases at any major and small retailer anywhere Mastercard is accepted. However, it cannot be used on daily purchases and activities such as filling up the tank at gas stations, buying groceries, or eating at restaurants and bars.

SoFi’s goal is to help promote and want members to manage their money in a way that best suits them and to stay on track.

One way is members will be prompted to set up Autopay directly from their SoFi checking account. They want to encourage and practice healthy spending, not carry on with a circle of debt, and manage their money responsibly, especially during the holidays and current inflation.