On Jan. 30, 2023, SoFi delivered results that surpassed expectations despite challenging conditions.

“We finished a remarkable year with another quarter of record financial results, and continued strength in member and product adds, as well as cross-buy momentum,” said Anthony Noto, CEO of SoFi Technologies, Inc.

The company reported a 51% year-over-year (YOY) increase in new members and a 53% increase in new products.

Leaning heavily on product diversity, the fintech has weathered the storm created by higher inflation, which has been putting pressure on its original product for student loan refinancing.

The Q4 student loan volume was down 50% on pre-pandemic averages. However, driven primarily by continued demand for personal loans, the company’s overall lending segment showed minimal growth.

In the fourth quarter of 2022, personal loan originations were up nearly 50% YOY. Full-year personal loan originations were up 81% from 2021.

Deposit growth has analysts excited

While the financial services sector of SoFi has historically been an area of significant loss, the losses shown in this year’s earnings are said to be the lowest yet.

Deposits were a focus for analysts on the earnings call. The year started with the company receiving less than $1 billion of deposits, which has since grown to over $7 billion.

In the first quarter of 2022, SoFi received a bank charter, leading them to set up a new Checking and Savings solution. Noto said this has been significant in driving growth.

“That trend reflects the strategy that we’ve employed behind the bank to offer a very high-interest rate on checking, over 2%, and a high-interest rate on savings at 3.75%,” he said.

He also noted the functionality of the app has appealed to consumers.

“The combination of that plus the focus we’ve had on driving high-quality direct deposits have driven that deposit number.”

He explained that a sustained uptick in deposits could influence the deployment of other future products, particularly in taking advantage of opportunities in the loan space.

“There are several businesses we’re not in today that would leverage deposits, including small-medium business loans, and being in that entire sector would require deposits as well, that we can leverage obviously, growing deposits from small and medium business also.”

“So if we get to the point that our deposits are significantly higher than they are today, we can deploy them in many other ways to drive a great return for the company.”

Tech segment enhancing innovation, areas of return

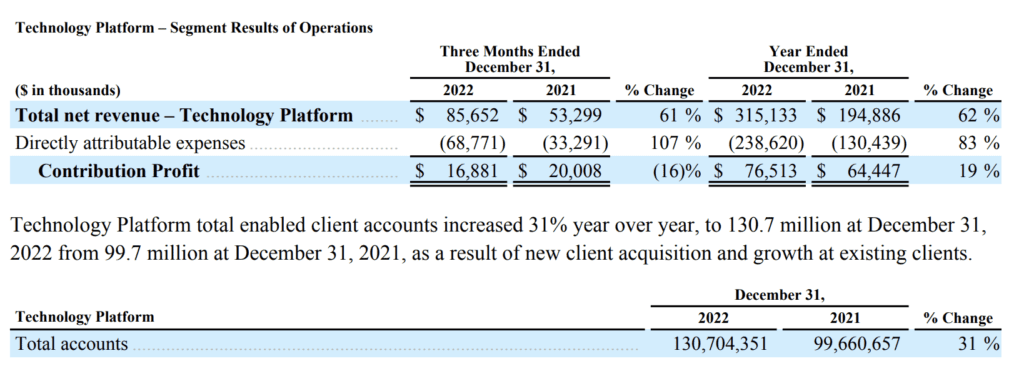

While the tech segment of the business showed a 19% growth in contribution profit between 2021 and 2022, the fourth quarter showed a 16% loss. Revenue had, however, increased significantly.

SoFi’s acquisition of Technisys in Q1 2022 reportedly boosted this revenue growth.

Noto explained that 2022 had been a year of refinement for SoFi’s tech segment strategy.

“Now that we’re operating on one unified platform with both Technosys and Galileo, we can leverage the combined go-to-market, and that does drive some synergy cost savings,” he said.

He continued, outlining the company’s investment into the sector and the focus on adding partners, which they believe will enrich the segment for the year ahead.

“As we look at that macroeconomic environment and where we sit, we think the right strategy for the year is to focus on durable companies with large installed bases or well-capitalized companies that we know can make the transition and that will get a great return to leverage or leverage our platform capabilities.”

Noto outlined their expected investments to “bear fruit” in 2023. The company is expanding its B2B channel, an area that many in fintech are leaning on for stable revenue generation for the year ahead.

Fraud platform rollout

In addition, SoFi is looking to roll out a fraud platform to assist their partners in curbing losses and products to help boost engagement. Noto explained that the company had launched its first product on Galileo and Technisys that will engage innovation and diversify from SoFi’s typical partner.

“A Pay-in-4 product is much better for them than a secure card, unsecured loan, or credit card. And that product can be launched turnkey with a much higher interchange of about 3% compared to what they’re generating at 1% in debit.”

“It does bring with it some risk. And so we’ll have to wade cautiously into that market with our partners. But it’s another example of the innovation we’ve driven up that we now think we can get a return on revenue.”

He explained that the acquisition of Technisys also enhances the company’s ability to drive penetration into the LatAm market.

SoFi’s future could be strong

Approaching the fifth anniversary of his time with SoFi, Noto reflected positively on the growth over the period.

“It’s very humbling what we’ve achieved during such an unprecedented period,” he said.

His outlook for the future was tentatively positive, noting improved micro and macroeconomic conditions on those previously forecasted.

“Many can prognosticate what lies ahead for the economy and interest rates. But in my view, the political background and the regulatory background remain very uncertain. Those exogenous factors are out of our control regarding what lies ahead.”

He felt the focus on SoFi’s diversification and pipeline for products could cause significant tailwinds in the company’s development. And, when the IPO market eventually reopens, the company was well positioned to take advantage of that opportunity.