The word “crypto” has picked up a set of connotations in the U.S .that differ somewhat from early 2022.

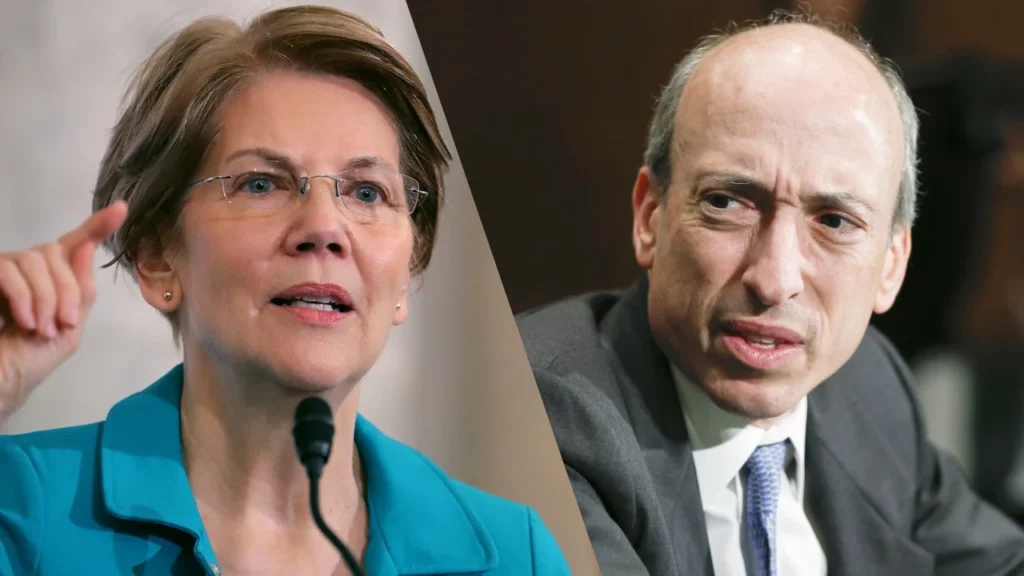

At its utterance, images of bountiful wealth and utopia have been replaced by a scandalized Senator Warren and an increasingly stern Gensler hunched over their microphones as they tell another crypto company why their business model (which until then this point had been infallible) is a threat to the financial landscape.

RELATED: Enforcement instead of regulation: Coinbase faces the SEC

While many agree that the crypto space needs some pruning, the U.S. government’s stance has switched from slightly apathetic to outright hostile, turning to enforcement before implementing clear regulations. This has made garrulous company reps, once so eager to roll out the marketing spiel about their “crypto strategy,” stumble and stutter, silencing their favorite buzzword.

However, the DeFi space is yet to tank as a response, with some suggesting a new bull run may be in sight.

The financial industry won’t touch “crypto” with a barge pole. “Digital assets,” on the other hand, could still be the tool for the future.

Coinbase Report showed bright outlook for digital assets

Before the fated FTX failure, still amid “crypto winter,” Coinbase studied institutional investors’ outlook for digital assets. Surveyed between Sept. 21 and Oct. 27, 2022, the report found that, despite the crypto winter, 62% of institutional investors had increased their crypto allocation, using it “as an opportunity to learn and build for the future.”

Sentiment had remained positive, with 72% supporting the view that digital assets were here to stay.

Then chaos broke forth. FTX’s fraud was exposed, continuing to unravel, U.S. regulators have picked fights with major crypto companies, and two of the most significant crypto banks on their soil have ceased to exist. Headlines spread the news that businesses are sunsetting their crypto operations, and some outlets have gone so far as to outcry about the possible end of crypto.

You would be forgiven for believing that the outlook for digital assets could have changed from Coinbase’s November 2022 conclusions. However, still, experts are seeing increased interest in digital assets and Web3 technologies.

Shifting approach, not abandonment of long-term adoption

“The U.S., from a regulatory standpoint, has always been somewhere in the spectrum of mildly uncomfortable to hostile,” said Stan Miroshnik, Partner and Co-founder of 10T Holdings.

“But crypto is such a global business that people can ship intellectual property elsewhere. The regulatory pressure is a negative for the U.S., but I think it’s a positive for elsewhere where people are more constructive.”

For many, the decentralized existence of the space has provided it with resistance to external conditions.

“Blockchain is here to stay,” said Seamus Donoghue, Chief Growth Officer at Metaco. “Things like DeFi are pretty revolutionary in what they can do.”

“What we’ve seen since 2021 is a perfect combination of institutional clients asking their banks to build capabilities around custody and tokenization. And banking peers have all built. Financial institutions operate in herds in many ways; none want to be first. But first is past, that ice has been broken already, and now the risk is this competitive pressure. You don’t want to be last. So they’re not looking at whether bitcoin is down X percent or that Terra blew up and has gone. That’s not driving the decision. The decisions have already been made. The technology is transformational, and they’ll build on it.”

“Now, whether they start with crypto or broader digital assets is a different question that really depends on the jurisdiction. If you look at the U.S., there’s a lot of regulatory opacity. There’s pressure on the banks not to bank crypto businesses.”

Elsewhere in the world, regulators have been working to accommodate the technology to protect users while still allowing for innovation. Donoghue explained that regulatory bodies such as Germany’s BaFin had clarified for companies to conduct crypto operations relatively easily, allowing them to continue development in the space. However, the U.S. still sees its fair share of digital asset development.

“Many U.S. banks are still building this space, initially internally, around working with blockchain and potentially transforming internal processes. But it’s the same technology if they want to get involved in crypto at some point.”

He explained that this is where the U.S. approach to DeFi technologies had changed. Where before, companies had initially embarked on crypto offerings that could expand to general digital assets, the focus shifted to implementing Web3 technology to improve efficiencies.

“A couple of years ago, we said to build for crypto because crypto has the highest security requirements, you learn how it works, and then you get tokenization for free,” he said. “Now, where there’s opacity around the regulation, they’re building tokenization first around internal assets and internal processes, and then they’ll decide to do crypto if it’s strategic to their view later on when the regulations are clear.”

This could be tokenization’s ‘big year’…finally

For a few years now, there has been a buzz around the idea of tokenization and its potential for financial services.

“Tokenization has been the ‘big opportunity next year’ for the last five years. It’s been an unfulfilled promise. I think now. Finally, you have the largest institutions building in the space so that it could become a reality,” said Donoghue.

“They have both sides of the investment game, so it’s really about providing more efficient processes. All the banks are looking at this around efficiencies around how they can deliver more effective services to their clients and potentially create new business models and asset classes effectively. So I think it really depends on where they start.”

“In the U.S., you’ve seen things around banks embracing their own stablecoins for internal clearing purposes for their clients. And you can think of it as layer two on top of the traditional payment rails. They can offer a lot of treasury efficiencies to their clients, especially for the global multinationals that operate across jurisdictions and have a lot of friction in moving funds around the Treasury.”

He explained that NFTs had also been seeing a lot of interest due to their capabilities in improving efficiency. When perceived as a tool to help automate a set of processes, the assets could provide powerful advantages extending past their capacity as instruments of digital art ownership.

RELATED: NFTs: The next logical step for incumbents?

This was a trend Miroshnik had also observed. He explained that as the technology behind instruments like NFTs had become more understood, their value had become more recognized, leaving the market open for extensive innovation.

“My view is that the digital assets base will be so ubiquitous, the way the internet is, all companies will touch digital assets in some way, whether they’re using NFTs or transacting in tokenized treasury bills,” he said.

While the capacities have become revealed, the institutional players’ involvement may have made all the difference in the adoption of tokenization within the larger sphere of finance.

“There are not a lot of standards in the market, so there are bonds issued here or there that are more like one-off experiments,” explained Donoghue. “One of the things we’re very focused on is really bringing large custodians together to help drive standards and address some of the things that are a little bit chicken in the egg. For example, there’s no secondary liquidity. And if there’s no secondary liquidity, you’re not going to get the best issuers because, really, the whole reason to do a lot of this stuff is better liquidity, better pricing, better efficiencies.”

“The tokenization capabilities are being built. You have foundational technologies that make it possible. But it takes the largest players in the market to get there. And I think we see them collaborating increasingly with companies such as Metaco for them to get there as an ecosystem.”