NEW YORK, N.Y. — Scale is Stuart Sopp‘s focus when discussing the fintech industry’s path to profitability.

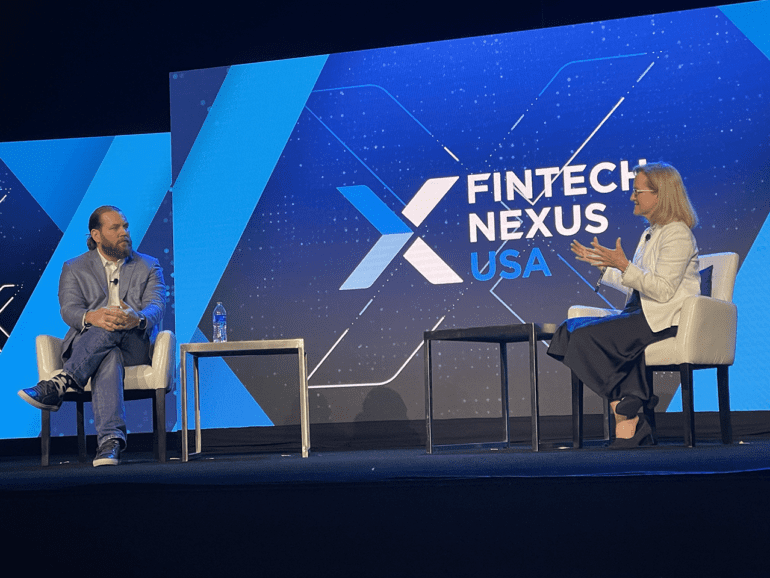

And it can’t happen fast enough, the founder and chief executive officer of neobank Current said on the keynote stage at Fintech Nexus USA 2023.

“It’s measured in a few quarters, not years,” Sopp, who worked developing and trading financial systems at Morgan Stanley, Citi, and Deutsche Bank before founding Current in 2015, told Penny Crosman, executive editor, of technology, at American Banker, in a question-and-answer talk.

“A year ago, maybe two years ago, no one talked about profitability … It’s not because fintech doesn’t want to be profitable, it’s just that when the cost of capital is so low, it just made sense to reinvest that money and that focus back into growth, so it’s growth at all costs.”

Sopp said the state of fintech in the U.S. is at a “more mature phase” than in other countries and that it means “scale matters, revenue scale matters, customer scale matters” for American companies.

“It’s like, how are we going to get to that as quickly as possible? There are going to be a lot of M&As in the market. There’s going to be a lot of innovation and focus on unit economics,” said Sopp, whose challenger bank has become one of the fastest-growing fintech startups in the U.S., with more than two million customers and partnerships with major retailers such as Walmart and Amazon.

“Unit economics was like swearing until three years ago — growth of all cost — but with the profitability focus, unit economics are very important. That’s really what drives the financial side of this business.”

Lending will drive ‘next wave’ of neobank profitability

Regarding ways for neobanks to drive profitability, the lending space is one place neobanks “have to get into” to increase revenue.

“I think that deposit wars, if I can term it that way — we’ve got Chime, Varo, Current, Cash Out, and many others — everyone’s going out for the deposits and the conflation of banking,” Sopp said. “The next wave, if you talk about unit economics and profitability, you really have to get into lending. There are a bunch of different ways you can do that. We are personally going into credit building. I think that’s a good first step. But many other companies are dealing with this differently. You see unsecured revolving credit; you see the BNPL wave.”

“Lending traditionally is how you monetize banking. We all know this is a long-duration game, but If you have a banking license, it also has its problems. We’re watching carefully around that.”

Digital wave here to stay

Regarding predictions by analysts that 90 percent of the 400 neobanks will go out of business, Sopp said he expects ‘some consolidation’ and fallout to be “more medium, more measured in the middle.”

“This digital wave is not going away. It’s just happening,” Sopp said. “But yes, there is a breath of pause. And the focus on profitability, which I think is healthy, there’s a focus on regulation and compliance. These are good things. If you’re an incumbent, the ones coming through this will be really strong. You can’t poke too many of those bears anymore because they’re fixing the problems, and they’ve been forced to fix them. If they start rolling up, you start getting to profitability quicker and to a scale that starts encroaching on maybe an incumbent. I think that’s what’s going to happen.

“I think the U.S. is more of a mature market, I think that (because of) the compliance or regulatory overhead, it’s much harder to start a fintech than ever before, so I feel sorry for the seed and Series As. They may get funded, but I think they will struggle a little. It’s going to be hard for them. And then externally, like Latin America and some more developing nations. I think there’s more growth, early growth opportunity, but then you have more fraud, you just do, and then you have more risks around that. They have currency risk, all those things.”