The following is an excerpt from today’s Global Newsletter.

Binance, as a surprise to no one, finds themselves the subject of a Reuters exclusive alleging they commingled customer funds with corporate accounts.

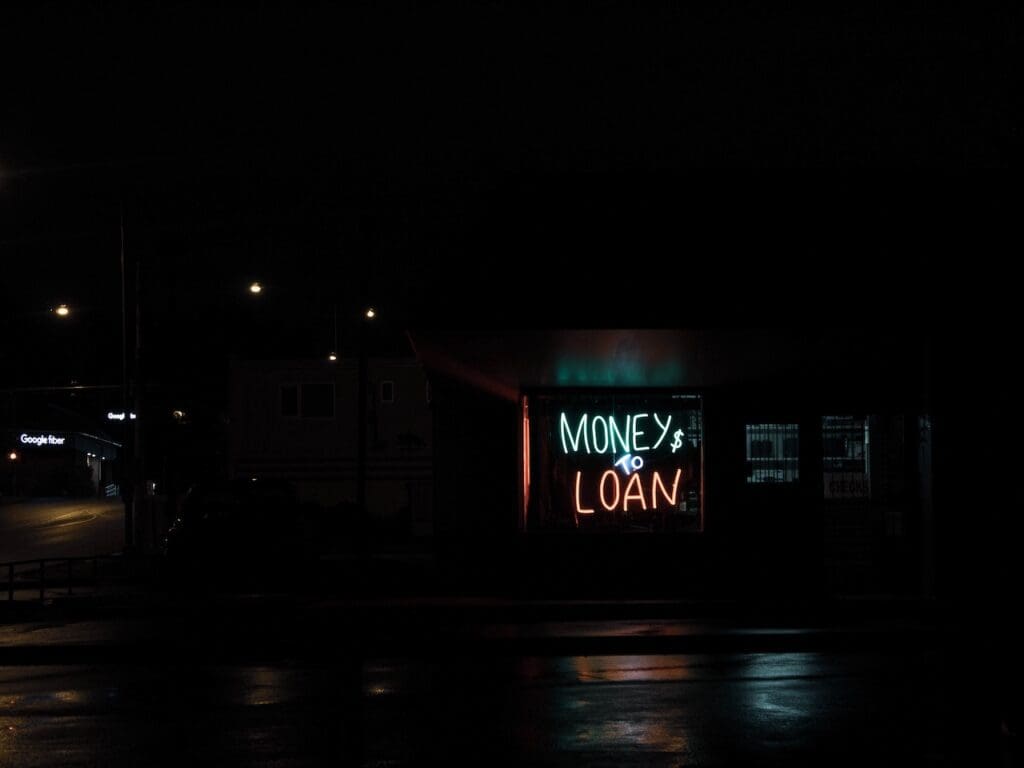

Despite official denials, the story highlights the feeling that the wild west of crypto exchanges is as rootin’-tootin’ as ever.

We’ve said in this space that CZ seemed to have protested too much, projecting public vitriol about a lack of transparency at FTX during that spectacular flameout and crash.

We also suggested the clock was ticking until a similar investigation outed alleged eyebrow-raising practices at Binance. There’s zero true insight into Binance’s activities, so speculation has been a professional sport for some pundits this year.

This scrutiny and skepticism is a natural result of pretending crypto doesn’t exist in the U.S., pushing companies offshore and into the regulatory wilderness. Americans will just use VPNs to transact and be vulnerable to bad actors thriving without real liability.

Until legitimate oversight and effective and fair regulation are in place, the fraud flood can continue unabated, and industry growth will be hamstrung.

From Fintech Nexus

By Isabelle Castro Margaroli While DeFi, could be powerful in improving lending, it has collateral limitations that on-chain reputation could solve. |

By David Feliba Digital banks in Brazil are finally making inroads into one of the most competitive and highly profitable credit markets in the world. |

Also making news

- LatAm: Citigroup to spin off its Mexico business after efforts to sell unit collapse Citigroup announced Wednesday it plans to pursue an initial public offering of its Mexico business, Banamex, making formal a long-telegraphed spinoff.

- Global: Interoperability is key to unlocking the potential of CBDCs Central bank digital currencies (CBDCs) promise enormous potential for establishing a more dynamic and modern global financial infrastructure underpinned by blockchain technology. But as with any innovation, they must be designed prudently with interoperability in mind.

- Europe: Klarna introduces credit opt-outs Klarna has updated its app to provide budget-conscious Brits with a tool to opt out of taking on more debt and called on credit card companies and other providers to follow suit.

- USA: SoLo Funds faces a new consent order in Connecticut Earlier this month, the Office of the Attorney General (OAG) of the District of Columbia (DC) and the California Department of Financial Protection and Innovation (DFPI) penalized SoLo Funds for breaching a number of consumer protection laws and operating without required licenses.

- USA: Daffy launches embedded fintech offering for charitable giving Daffy, a platform for charitable giving, announced the launch of its open APIs designed to make it easier to bring giving into financial budgeting and investing apps.

- Global: Kiwi raises $80M: Fintech empowering Latino migrants Kiwi secures $80mn funding to empower underbanked Latino migrants in the US. Innovative fintech offers affordable capital and credit solutions.