On June 5, 2023, the SEC made headlines again, filing a complaint of 13 counts against the largest crypto exchange worldwide, Binance.

Another day, another alleged securities violation from the SEC in the “war against crypto,” this time directed at Binance — watching CEO Chengpeng Zhao’s Twitter, this is the angle you would be led to believe.

However, intertwined in the alleged breaches of securities law are allegations of misleading investors, comingling and diversion of funds, and wash trading, making for a nuanced complaint against the company.

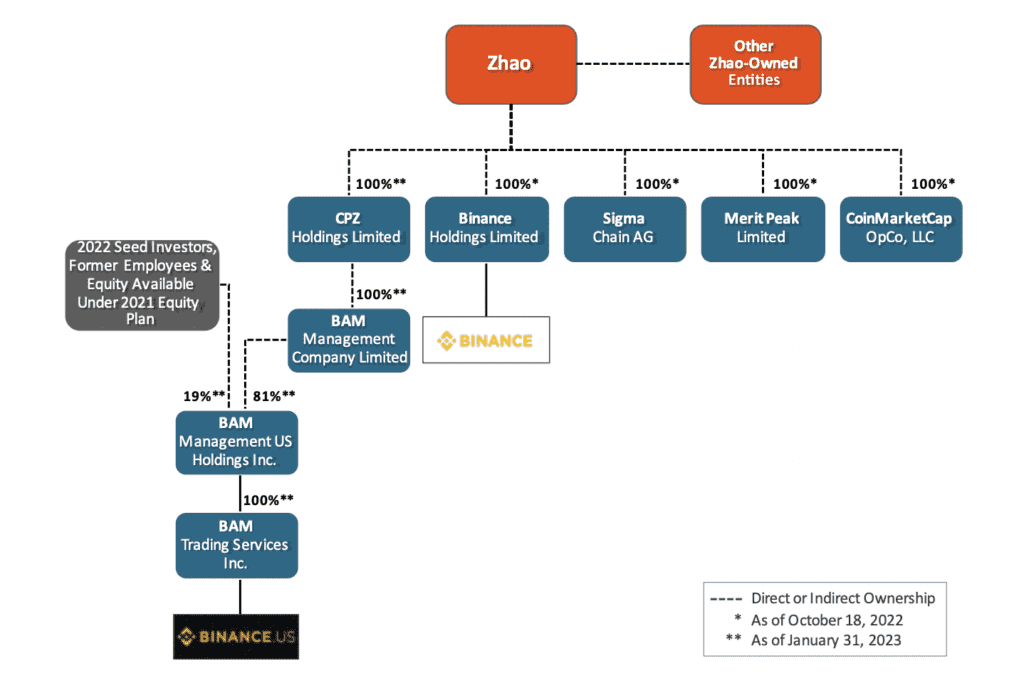

In the opening pages, the complaint detailed how, through an “opaque web of corporate entities,” Binance and its CEO had executed plans to knowingly avoid regulatory oversight from the SEC despite engagement from US-based investors.

Opening with Binance’s ex-CCO’s blunt 2018 admission of:

We are operating as a fking unlicensed securities exchange in the USA bro

Samuel Lim, Binance Ex-CCO, 2018

The ensuing complaint goes far beyond the classic securities/commodities debate.

The ‘web of deception’

At the center of the SEC’s argument is the “web” of entities surrounding the Binance brand, which they allege were all controlled by Binance.com and CEO Chenpeng Zhao (CZ).

In an effort dubbed the “Tai Chi” plan, the regulators outline the communication between a consultant and Binance leadership to “protect [Binance].com from U.S. regulatory engagement.”

The SEC alleges that in 2018 senior officials at Binance were warned against keeping Binance.com with unrestricted access to U.S. customers. As a result, a “moderate risk” plan was advised, involving establishing a U.S.-based entity dubbed “Tai Chi.”

The consultant is said to have advised this option would “become the target of all built-up enforcement tensions,” “reveal, retard, and resolve built-up enforcement tensions,” and “[i]nsulate Binance from legacy and future liabilities.”

The ensuing plan allegedly involved providing the entity with liquidity and market access from Binance.com, the use of the “Tai Chi” entity’s OTC services to provide “functional fiat capacity,” and that key wallets and personnel act outside the U.S. to avoid enforcement action.

In addition, the complaint states, “the Binance Consultant also recommended that, “just for publicity,” the Tai Chi entity should “release a long and detailed Howey Test Asset-Evaluation Framework … to show Howey test sophistication” and then engage with the SEC to discuss the “formation or acquisition of a broker/dealer or alternative trading system (ATS), with no expectation of success and solely to pause potential enforcement efforts.”

CZ is then reported to backtrack, opting for a more “conservative approach” with U.S. law firms. However, he allegedly stated that there were still “elements” of the plan that he wanted to combine and that Binance and the consultant should “work as a team.”

The SEC then stipulates that the plan’s elements were implemented, leaving Binance.com and CZ in complete control of the U.S. entity. This ran against public statements that it was a completely separate entity.

Actions were taken to mislead and reportedly were not purely reserved for U.S. regulators.

Under the control of CZ and his senior management, customer funds were allegedly diverted between the entities, with Binance.com still heavily involved in using U.S. bank accounts.

The company and affiliates are said to have used the entities to comingle funds. Merit Peak, a company owned by CZ, reportedly received over $20 billion, including customers’ funds, which were then used to buy Binance’s native stablecoin, BUSD.

Additionally, the U.S.-based BAM entities are said to have falsely reported the platform’s trading volumes, and their efforts in trade surveillance misleading investors.

This misappropriation and comingling of funds had been reported in multiple Reuters reports in the prior weeks, which Binance had publicly denied.

The age-old debate

Of course, the allegation of offering unregistered securities appeared, sparking outrage among the crypto community.

The list of said “securities” included some of the biggest names in crypto, such as Solana (SOL) and Cardano (ADA).

In addition, the complaint alleges that Binance had offered and sold BUSD as an “investment contract, therefore a security,” from September 2019 to February 2023. The regulators’ position, categorizing BUSD as a security, was made evident in February of this year in a filing against its issuer, Paxos.

Staking and yield services offered by Binance and its affiliates were brought into the firing line as further securities law violations.

Chairman of the SEC, Gary Gensler, has only publicly stated that bitcoin is not a security during his time as the regulator’s head, leaving the rest open to interpretation. With every new lawsuit, other currencies have been added to the SEC’s classification of crypto security with little warning. This has led many to criticize moves as “enforcement, not regulation.”

Related:

Where does the trust lie?

The SEC’s continued lack of clarity and actions of enforcement has not helped their case in the eyes of the community.

“U.S. regulators, led by Gary Gensler at the SEC, appear to be out to unseat the largest companies in the cryptocurrency space. Gensler’s continued refusal to define digital assets – even in the face of demands from Congress and beyond — leaves companies like Binance and Coinbase vulnerable to enforcement action at any time,” said Stefan Rust, CEO of Truflation.

“Meanwhile, though, approvals continue to go through for established incumbents. Just yesterday, while SEC is suing Binance and other leading blockchain projects, the Commodity Futures Trading Commission approved an amended order of registration for CBOE Clear Digital, which will allow it to provide clearing services for digital asset futures.”

“This continued drive to remove the biggest crypto firms from the U.S., however, will leave a large hole in the industry — a hole that can be filled by JP Morgan, Fidelity, and other U.S.-based financial behemoths that have been expanding their cryptocurrency offerings. Indeed, it seems clear that the SEC favors Jamie Dimon, David Solomon, and James Gorman over entrepreneurs like Elon Musk, Mark Zuckerberg, and Brian Armstrong.”

Despite the complaint’s extensive detail of deception, much of the crypto community on Twitter is still siding with Binance.

Public reaction to the case has centered on the securities argument, drawing comparisons to other entities facing the SEC this year. Some have deemed the text a result of a regulatory “Chokepoint 2.0,” and many are predicting that if the case were to be won by regulators, ethereum would be the next coin deemed as a security, sparking a heightened level of enforcement.

Mere minutes after the announcement, statements of solidarity upholding CZ and “all he was doing for the industry” were tweeted, likening the case to many others that have battered crypto this year.

Fear that the decimation of the company will spell the end of Web3 technology has also run amok. Individuals have stated a need to set aside “opinions” on Binance and CZ, banding together for “the greater good.”

However, for some, the movements outlined in the complaint and the Reuters report prior, peppered with the outcry of an outspoken CEO, smell vaguely familiar.

If the allegations are true, crypto is again faced with a very public example of underhand dealings. A space that touts its transparency and disruption of the status quo produces a stream of case studies that would state otherwise.

Cory Klippsten, CEO of Swan, stated, “Binance slows us down. Cut the dead weight (it’s not just dead weight as they’re pulling opposite the mission), and we’ll run much faster.”

Ultimately, however, in the eyes of the public forum, the bedrock of this case is trust and their belief in a fundamental question still stands:

The answer could lead to Binance’s ultimate portrayal — either the villain or the martyr.