Fraud has been rising in the US. According to official estimates made by the Federal Trade Commission (FTC), consumers reported 2.4 million instances of fraud in 2022. The number has risen by 30% since 2021 and has led to $8.8 billion in losses.

The business of crime is booming, and reports of “Fraud as a Service” are becoming ever more frequent, allowing bad actors to collaborate and more efficiently find potential weaknesses to be exploited.

According to PwC’s Global Economic Crime Survey 2022, the landscape has shifted, with hackers originating outside businesses, bypassing traditional anti-fraud methods. Stolen identities are used to enter companies’ systems, and often the same identity is used multiple times without detection.

Instances of fraud have increased around the world with the rise of real-time payments. Fraudsters have been exploiting the instant, frictionless nature, and countries that have seen significant adoption of the technology also report a rise in related fraud.

RELATED: The global state of real-time payments

PwC found that digital platforms were a new frontier for the rise of crime, allowing for a wave of different types that companies are only just starting to appreciate. Due to its ability to proliferate different types of fraud across a wide-ranging scale, a network effort is needed for combat.

As FedNow comes into play on June 1, possibly bringing with it a wave of real-time adoption, the threat becomes ever more critical. There is a need for faster fraud prevention to run alongside instant payments.

Plaid, the open banking behemoth, is stepping up to the challenge.

A Network Approach

Today, June 22, the company has announced the launch of Plaid Beacon, an anti-fraud network that enables real-time, secure data sharing across the ecosystem to mitigate repeat fraud against businesses for fintechs and banks via API.

Beacon leverages Plaid’s extensive network allowing access to shared fraud intelligence. Using the collaboration of all financial institutions involved, the network aims to stop the chain reaction of fraud attacks.

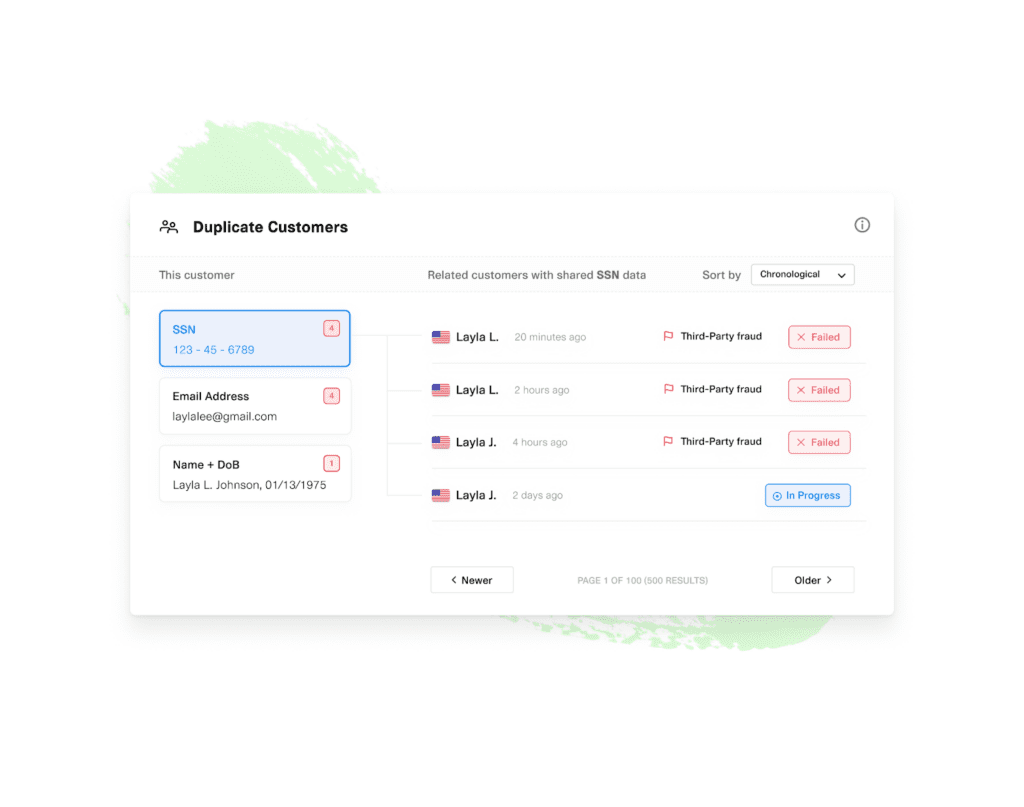

Until now, fraudsters have exploited visibility gaps that exist across the financial system, using compromised identities to defraud multiple entities. Due to the lack of a comprehensive sharing network, attackers can fly under the radar, defrauding entities without being detected until too late.

“Fraudsters are constantly trying new and creative ways to exploit the financial system,” said Anthony Schrauth, VP of Product, Tally. “Participating in the Beacon Network means we can leverage learnings from across the industry to detect those threats early and protect our customers.”

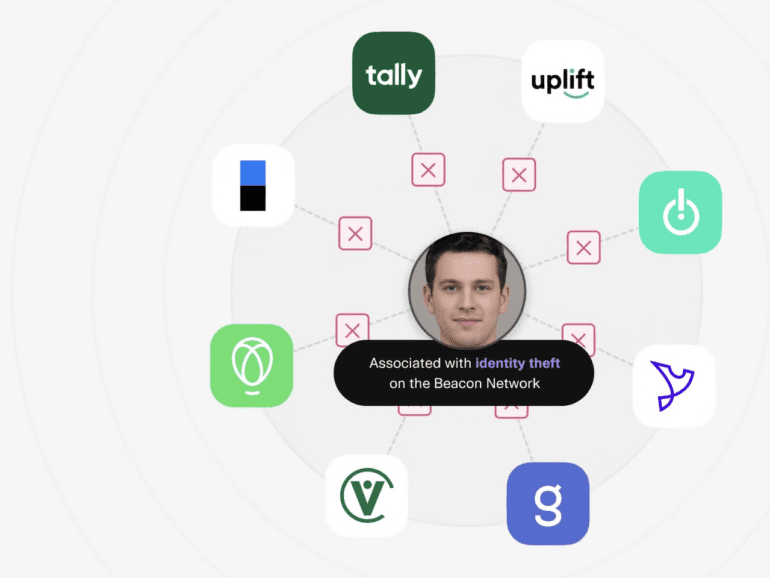

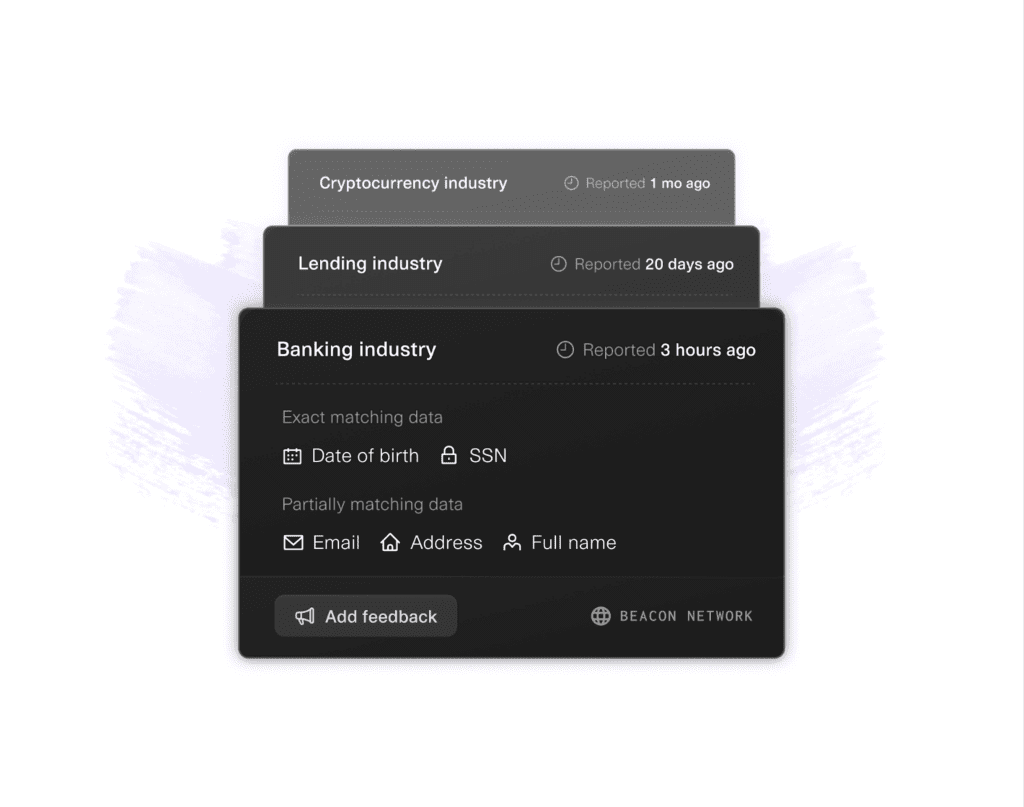

Participating members of the Beacon network contribute by reporting instances of fraud via API to Plaid and registering the incident on the system. Then, using the network, participating companies can screen new sign-ups or users against the Beacon network to detect if a specific identity has been associated with fraud on other Plaid-powered platforms or already within their own organization.

Plaid cross-references each instance of fraud, correlating attributes so identities of bad actors can be monitored despite changing or manipulating data. This can help in lowering instances of first-party fraud and protect customers’ identities and accounts from theft or abuse.

“Because of the size and scale of the Plaid network, our goal with this is to fight fraud for the ecosystem in a meaningful way,” stated Isabelle Lacombe, Communications at Plaid.

“Similar to how banks today have access to shared fraud intelligence, we want to bring that technology to fintechs and digital banks so that we can meaningfully stop fraud from proliferating in digital finance.”