In what is essentially a love letter to CBDCs and tokenization, the BIS recently released a report outlining a vision for the financial system.

While the report hailed the advantages of tokenization, it maintained that current approaches of crypto fall short of the mark. Underlying this failure lies the lack of trust, something that remains firmly embedded in the use of central bank money.

“Building on the trust in central bank money, the private sector uses its creativity and ingenuity to serve customers,” the introduction states. “Supported by regulation and supervision, this two-tiered structure preserves the “singleness of money”: the property that payments denominated in the sovereign unit of account will be settled at par, even if they use different forms of privately and publicly issued monies.”

However, monetary systems are flawed, and BIS maintains that tokenization, despite DeFi’s recent fall from grace, could be the answer.

Crypto and decentralized finance (DeFi) have offered a glimpse of tokenisation’s promise, but crypto is a flawed system that cannot take on the mantle of the future of money.”

BIS Blueprint for the Future Monetary System

Crypto Falls Short

The BIS “Blueprint for a Future Monetary System” builds on the work stated in the bank’s 2022 annual report – “The Future of Money”.

Still reeling from the Terra/Luna collapse, the 2022 report outlined in painstaking detail why crypto falls short of its promise. BIS stated that the collapse showed inherent weakness in the DeFi system, which this year it has dubbed “self-referential.”

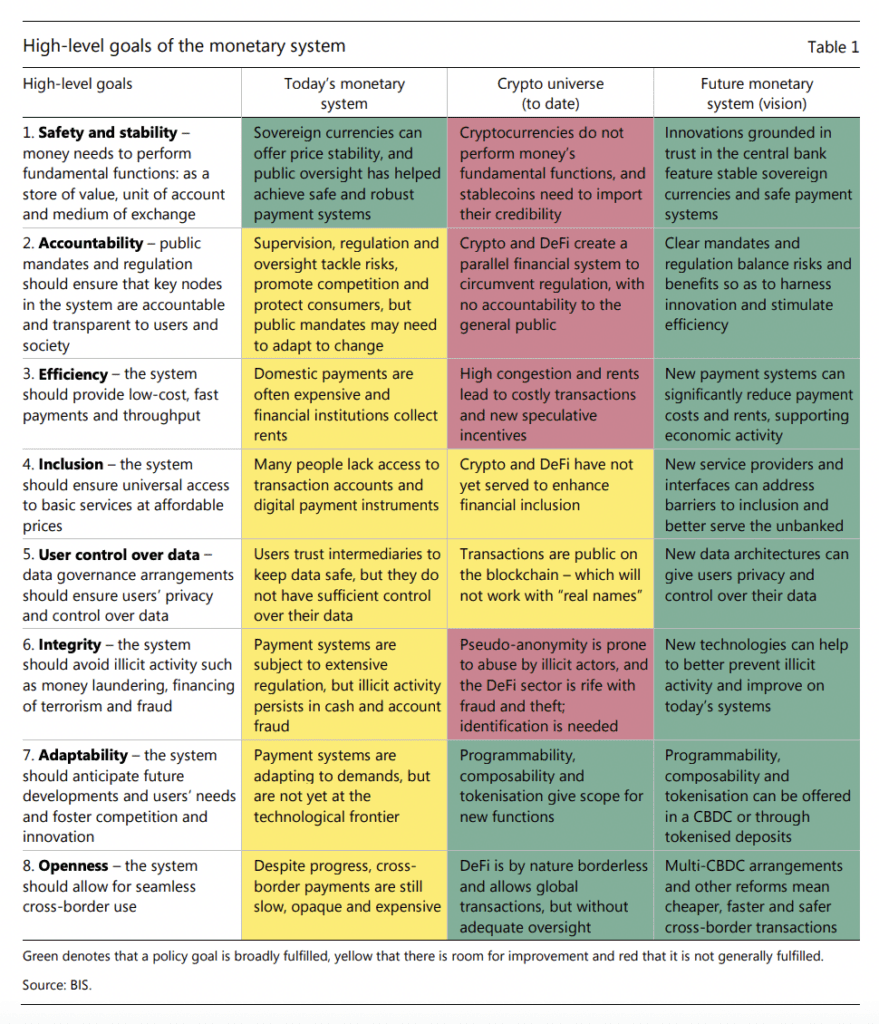

In the BIS 2022 report, the Bank stated that while the crypto universe gives scope for new monetary functions, major areas lay against the monetary system’s “high-level goals.” Crypto’s position outside the financial system is portrayed as a breeding ground for illicit activity, without oversight and accountability to the general public.

However, it noted that crypto had shown one redeeming factor – “a glimpse at tokenization’s promise.”

Tokenization provides an opportunity. Made up of digital assets that hold within them information and rules, it adds a layer of programmability that could greatly impact the financial world. Regardless of decentralization, it could streamline processes, improve transparency and friction, and reduce costs.

RELATED: Real-world asset tokens – a ‘killer use case’ for blockchain

Already, innovators have seen its potential, and the current global market value stands at an estimated $2.87 billion, growing at a rate of around 24%.

The merging of the two worlds was perhaps inevitable as many strived for mass adoption. The last year is testament to why the sector, as it grows, could not go on without regulatory guidance.

The BIS’s idea for the future aims to combine the monetary system with the unparalleled benefits posed by crypto technology – working to fulfill the system’s “high-level goals” that current approaches fail to achieve.

The Unified Ledger

The cornerstone of the BIS 2023 report is the concept of the unified ledger, made possible only by the presence of tokenization in the monetary system.

Ledgers underline the efficiency and transparency of tokenization, and BIS’s vision for a unified ledger aims to automate and integrate multiple financial functions.

“The full benefits of tokenization could be harnessed in a unified ledger due to the settlement finality that comes from central bank money residing in the same venue as other claims,” stated the bank.

The report outlined a single platform where processes could be “bundled” together, eliminating delays and uncertainty. In addition, it explained that the single location could provide a setting for automating similar processes, thus expanding “the universe of possible contracting outcomes.”

The described result is a utopian system where new types of economic arrangement are possible because the ledger negates “incentive and informational frictions.” While the name “unified ledger” implies the existence of a singular, all-encompassing platform, the BIS report states that multiple could coexist, connecting through the use of APIs or additional assets to create a “network of networks.”

In something akin to the tech revolution sparked by the invention of the smartphone, it is stated that “The eventual transformation of the financial system will be limited only by the imagination and ingenuity of developers that build on the system.” Still applying the “two-tiered” approach believed to provide the “singleness of money,” tokenization could, in this way, be brought into the financial system while maintaining the safety and security of the traditional system.

CBDCs fall neatly into context, combining the stated security and trust of the traditional monetary system with tokenization’s programmability.

“The success of tokenization rests on the foundation of trust provided by central bank money and its capacity to knit together key elements of the financial system,” states the report. “This capacity derives from the central bank’s role at the core of the monetary system.”

The BIS argues that the monetary system, in whatever form, requires a monetary unit to denominate transactions. Therefore, the tokenized system calls for a tokenized central bank currency to accompany it. It states that the development of a wholesale CBDC is paramount to this purpose, forming the foundation for a world of private tokenized “monies”.

Undermined by Current Approaches

However, the proposal is but a starting point, and some focused on tokenization believe it to omit fundamental factors that could undermine its adoption.

“While this report from BIS offers an important endorsement for tokenization, a significant issue remains unaddressed within asset tokenization practices: standardization,” said Ralf Kubli, Board member of the Casper Association.

He explained that the benefits outlined by BIS that unified ledgers could pose could not be realized by current tokenization methods.

“Currently, tokenization platforms only digitize the asset, not the liabilities or cash flows. This means that tokenized assets — designed to be more efficient and automated — still require human intervention to calculate cash flows, which can introduce errors and discrepancies.”

“Without an open source, standardized and algorithmic definition of the underlying financial instrument, none of these new DLT or blockchain-based rails will be adopted at scale, as the new rails will just add costs to existing players and not change the value chain.”