This is the first post of a two part series on Lending Club loan descriptions by guest writer Sam Kramer. Sam spent the last 15 years working in the finance industry, where he was exposed to financial analysis and consumer credit. Sam is married, has two children, and includes investing in Lending Club amongst his hobbies. He can be contacted on Twitter @P2P_CT.

When I first started investing in Lending Club (“LC”) about one year ago, I was drawn to the large data files and ability to analyze the loan data. At the time, I conducted an analysis of default rates relative to loan description length. The result surprised me, as loans with no description showed a lower default rate (in this analysis, default is defined as any loan which is 16 or more days’ late, defaulted or charged off) than loans with any length of description. I did not feel comfortable forming my investment thesis around loans with no description, and decided to test my ability to choose loans based on their description by reading a number of old descriptions. I was not happy with my performance of selecting loans by their description length, so decided to focus on other metrics when deploying my initial investment in the LC platform.

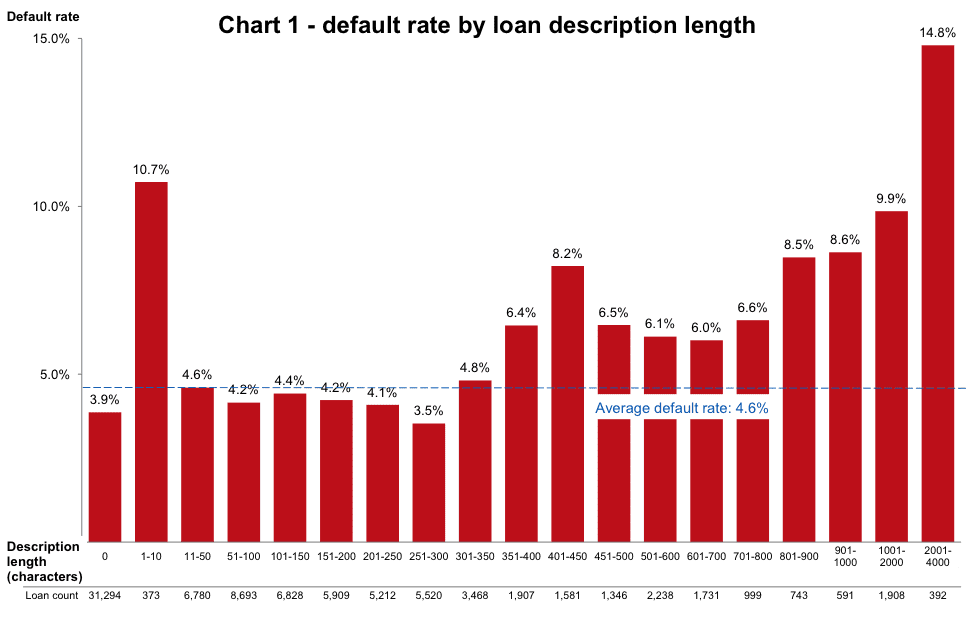

I have given this topic a lot of thought over the past year, and now find myself revisiting loan description lengths to determine whether they might be useful when selecting loans. I have updated my findings in this chart – loan description length is calculated using Microsoft Excel, and makes adjustment for phrases like “Borrower 123456 added on 8/14/10>” (click on the chart to enlarge it):

The above chart demonstrates that very short loan descriptions (between 1 and 10 characters) have quite a high default rate. However, short loan descriptions (11-350 characters) have a default rate which is closer to the default rate of no description loans. Once again, no-description loans appear to have a lower-than-average default rate.

I decided to break my analysis into three areas: no descriptions, very short descriptions (1-10 characters), and all other lengths (11+ characters).

No description loans

I noticed that no-description loans make up a large proportion of the total population (36%). This surprised me – surely more than two thirds of borrowers would feel the need to enter some type of loan description when submitting their loan application? .

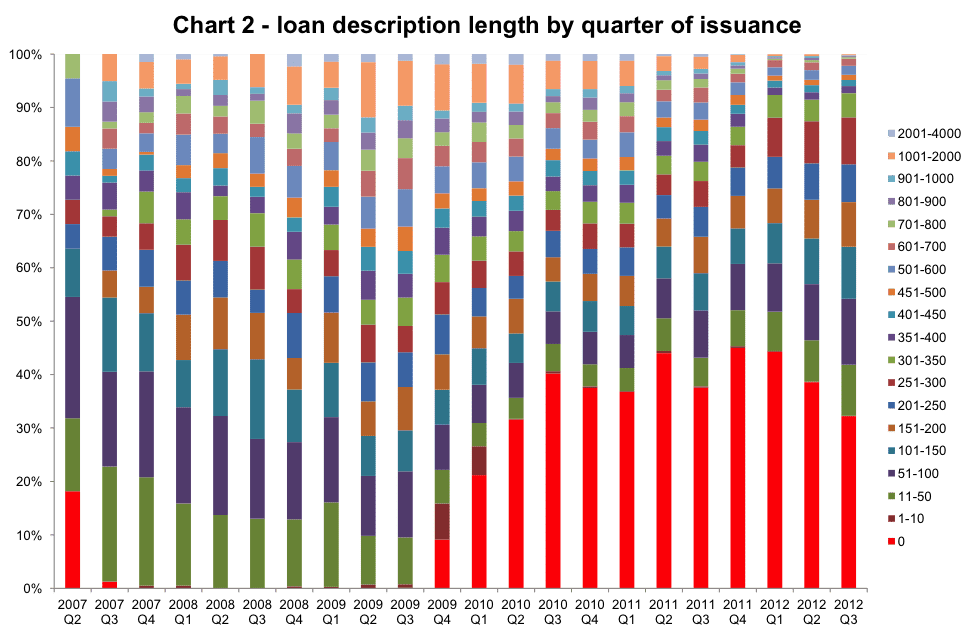

Perhaps an additional factor is at work here. The data appears to support this intuition:

The chart above shows the loan description lengths as a percentage of loans issued by quarter. The bright red bars represent the percentage of quarterly loan issuance without descriptions. This chart implies that around Q4 2009, something happened which resulted in a large proportion of loans being issued without descriptions. A closer look at the underlying data shows that starting in October 2009, a large number of loans started being issued without loan descriptions. This rapid change in the data makes me think that borrowers might not be the ones responsible for the large proportion of no description loans.

This data also made me think that my initial default analysis needs to be revisited, as the loans issued in 2007 – 2009 are, for the most part, fully repaid (and have an established default rate), while the 2010 and newer loans still have a larger portion of their balances outstanding, and in all likelihood the default rates on these vintages will increase in the future. Put in other words, the newer loans (which are the only area where no-description loans are present) currently have a lower default rate than the older loans; because no-description loans (in large volumes) are a relatively new phenomenon, they will naturally have a lower default rate than the loans with descriptions.

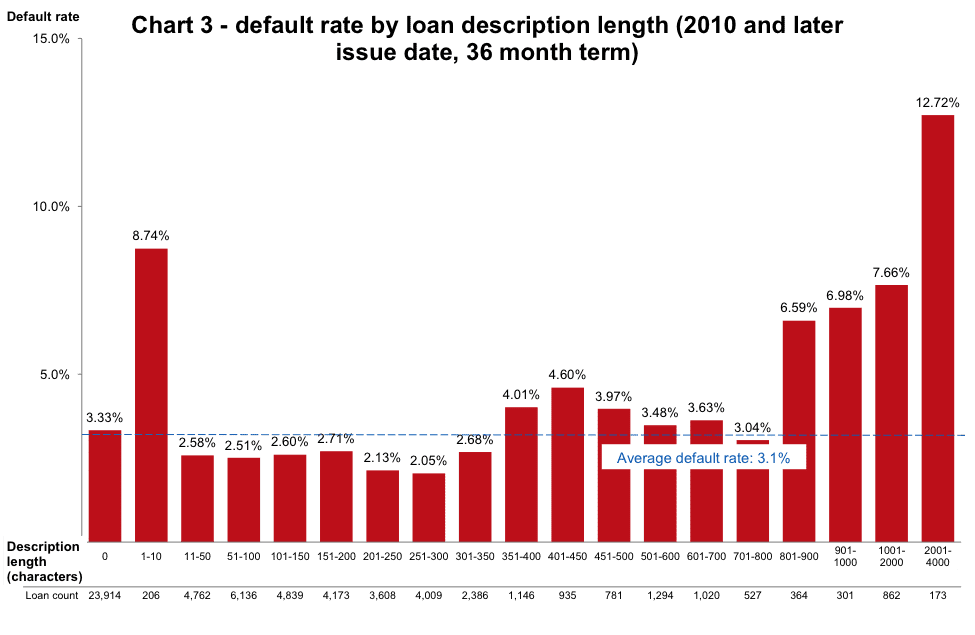

In order to more closely analyze the default rate on no-description loans (and to avoid the dates when there was a low instance of no-description loans), I narrowed my analysis to 36-month loans issued after January 1, 2010. The revised default rate is as follows:

This revised analysis shows a no-description default rate which is slightly higher than the average default rate for this population. The default rates on the other loan description lengths have a shape similar to Chart 1.

This analysis demonstrates that no-description loans do not perform better than average, but rather perform in-line with the overall population. As such, I do not believe that no-description loans give insight on credit risk. Rather, investing in no description loans is akin to ignoring loan descriptions entirely.

This is interesting, but is only useful here in that it says we can ignore these loans when establishing a loan selection strategy based on descriptions.

In the second part of this series we will take a look at both the very short loan descriptions that seem to have a much higher default rate as well as other loan description lengths.