Big Tech’s dominance is increasingly coming into question, and yesterday, the CFPB took aim at its monopolization of the Tap-to-Pay industry.

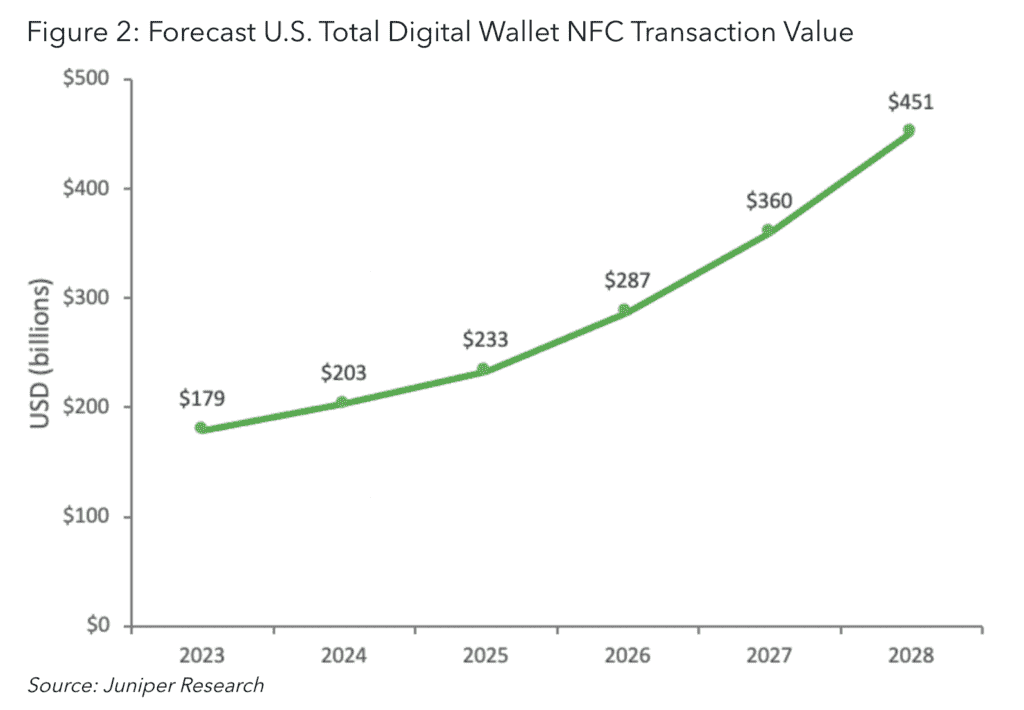

Tap-to-pay has increased in importance to the payments industry, enabling a forecasted $179 billion of transactions in 2023. Analysts expect this number to grow considerably, rising by 150% by 2028.

Although the Near Field Communication (NFC) technology underlying tap-to-pay emerged in 2010, the use of mobile payments has increased substantially in recent years, driving its popularity further. This year, Visa reported that one in every three Americans has used tap-to-pay, seven times the number three years earlier.

CFPB Director Rohit Chopra explained during his speech at the Federal Reserve Bank of Philadelphia’s Annual Fintech Conference that the pandemic had accelerated shifts in how consumers make payments at point of sale.

“The pandemic had a pronounced effect on how we engage in digital transactions… use of digital wallets, credit cards, and debit cards grew, with digital wallet use jumping by around 40 percent,” he said. “We all saw the acceleration in e-commerce, but even as Americans returned to in-person shopping, consumers and merchants further embraced contactless payments.”

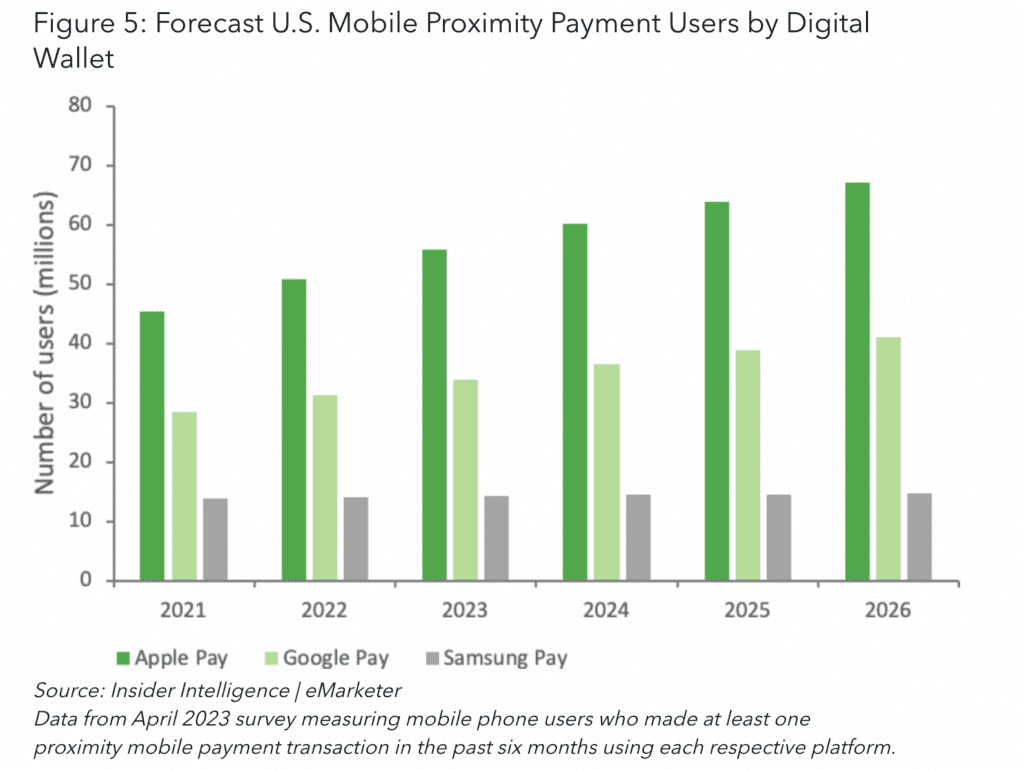

The CFPB’s argument against Big Tech’s power over the tap-to-pay space was focused on Apple and Google, which dominate the market for mobile operating systems. Currently, Apple iOS is installed on around 55% of phones shipped to the US, Google’s Android system is installed on 45%.

The companies’ monopolization of the operating system market has given them significant clout over the regulation of the tap-to-pay industry. Apple, in particular, has implemented restrictive terms of use that do not allow third-party apps to use the NFC technology on iOS systems without registering with Apple Pay and incurring fees. In 2022, Apple Pay alone enabled $199.41 billion in US point-of-sale payments.

“Regulations imposed by Big Tech firms have a big impact on whether consumers and businesses can make payments using third-party apps,” said Chopra. “If an app does not comply with Apple’s or Google’s regulations, the app could be denied access or face removal from the App Store and Play Store, making it inaccessible as an app to nearly every mobile device.”

Big Tech’s dominance may stand in the way of an open, decentralized payment system

Chopra explained that as the US makes steps towards open finance, Big Tech firms’ power over the payments space could work against innovation.

“Apple and Google dominate the smartphone operating system market,” he said. “As adoption of contactless payments on mobile phones continues to increase, these two companies, and the business models and choices they employ, will have profound impacts on the competitiveness of the payments market and the future of open banking.”

The disruptive innovation of startups has proved itself time and again in the payments industry, driving development forward. Chopra explained that for tap-to-pay, this innovation could be stilted by Big Tech’s dominance.

“In a more open and decentralized payments market, we would expect that there would be a plethora of players leveraging tap-to-pay functionalities,” he said. “We might expect to see lots of companies and financial firms working to integrate tap-to-pay technology into their existing mobile apps, the same way we have seen so many apps integrate our mobile device’s camera or GPS capabilities. However, we don’t find this at all.”

Google differs from Apple’s totalitarian approach, leaving the NFC technology open for use by third-party apps. As a result, the CFPB noted an increased level of competition and innovation on Android devices. However, Google has faced a number of allegations of abuse of its power over third-party apps, placing preferential conditions to control their access to the market.

“We know that the existing financial market structure is full of chokepoints and toll booths imposed by large firms acting as mini-governments that can privately regulate markets and distort outcomes, particularly regarding payments,” said Chopra.

He stated that the CFPB’s proposed legislation authorizing increased personal data rights could help curb the companies’ power. However, Big Tech posed a challenge to reaching the goal of a more open financial system.

“While I agree that strong challenges to the dominant Wall Street banks and card networks are important,” he continued. “There is real concern that the large technology firms will be able to erect even more gates and toll booths that will prevent small firms from emerging and succeeding, even when they offer superior products.”

He stated that a “close examination” of Big Tech would be essential to avoiding this outcome.