Authorized push payment fraud has risen across the global financial sector.

For consumers, this can be a devastating blow, wiping out savings and knocking the livelihood of vulnerable individuals. Many hold banks responsible for the reimbursements to the victims of such crimes.

UK supervision of bank reimbursements of APP fraud victims has been contradictive. On the one hand, regulators started requiring that banks issue reimbursements from June 2023 in a bid to protect customers.

However, in July, the Supreme Court ruled that Barclays would be held responsible if the fraudulent payments were authorized, setting a contradicting precedent.

So, it seems it’s been left largely to the banks to decide, resulting in a spectrum of reimbursement probability.

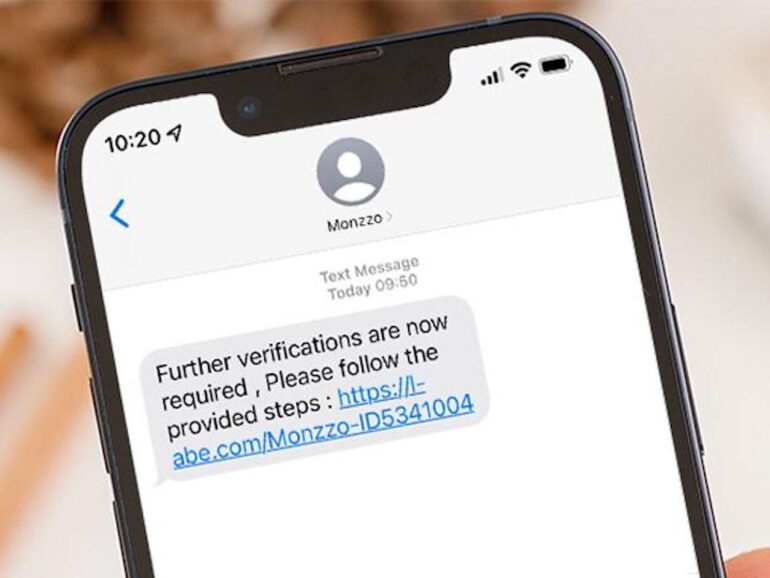

For example, if you are a customer of TSB, you have a 94% chance of having that APP scam payment reimbursed in full. If you are a customer of Monzo, however, that dropped to 6%.

It’s a nuanced issue that will likely double in the next three years, so an industry-wide solution is probably in order.

Yes, the customer technically authorized that payment, but humans make mistakes. APP fraud scams pull at the human nature of the customer, manipulating them to make that transfer to what they think is a legitimate payee. For some customers who are more vulnerable to these tricks, the payment provider is their only line of defense.

In lieu of a solution that stops the crimes from happening in the first place, bank reimbursement is the only source of protection.

FEATURED

Monzo Bank Ltd., Starling Bank Ltd. and Metro Bank Holdings Plc are the UK lenders most impacted by online fraudsters who trick customers into sending a payment to an account outside their control.

FROM FINTECH NEXUS

| SoFi reports a solid quarter as student loan repayments return By Fintech Nexus Staff SoFi reported their financial results for Q3 2023 and showed considerable improvements across all areas of their business. Banks Adapt to Survive the Digital Shift By Fintech Nexus Staff As fintechs and tech giants engage in finance through embedded solutions, banks may need to become the center of their own digital ecosystem. |

| PODCAST The Fintech Coffee Break – Ed Mallon, Pagaya This week Isabelle spoke to Pagaya’s CIO, Ed Mallon about how lenders can still fulfill demand for credit despite challenges. Listen Now |

| UPCOMING EVENTS The Most Important Policy Event of the Year! – Fintech Policy Summit Confirmed speakers include Congressman French Hill, Chairman of the Subcommittee on Digital Assets, Mark… See Details |

| WEBINAR Cash Flow is Here: Top Use Cases Helping Underwriters Today Nov 15, 2pm EST Cash flow underwriting has gone from obscurity to mainstream in just a few short years. Today, many leading fintechs are… Register Now |

ALSO MAKING NEWS

- USA: Executive Order on A.I. Tries to Balance Technology’s Potential and PerilPresident Biden announced regulations on Monday that seemed to have a little bit for everyone.

- USA: NerdWallet explains how its credit card will help vast swath of usersThe product-comparison site, which rates and ranks credit cards, is debuting its own secured credit card that it believes will help users improve their credit scores and pursue better offers.

- Global: When The Bank’s Customers Are Replaced By CustobotsGartner are right to point to bot-on-bot action for financial services moving forward. But even they may be underestimating the changes they will bring to money itself.

- USA: Stax’s latest acquisition pits it against Stripe, BlockBy purchasing the merchant acquirer Atlantic-Pacific Processing Systems, the fintech Stax has rounded out its offerings in a way that echoes the structure of larger payment companies.

- Global: Financial services expects Gen AI maturity to come sooner rather than laterFinancial services has had a mixed reaction to Gen AI ever since its launch last year. While some banks like JPMC have actively started exploring Gen AI’s use cases in the industry, other traditional banks are moving slowly and cautiously, if at all.

- LatAm: Brazilian fintech QI Tech lands $200M led by General Atlantic | TechCrunchThe São Paulo-based startup, which claims to have been profitable since its first year of operation, wants to acquire more companies.

- Asia: All About You: Woman-Led Fintech Startup YouTrip Raises $50 Million From LightspeedYouTrip raised $50 million in a Series B funding round from new investor Lightspeed Venture Partners, bringing its total funds raised to $105.5 million.

- Global: Fire Sales Sweep the Creator Economy as Startups StruggleFire-sale prices for startups. Investors hung out to dry. Founders pulling the rip cord even when they’ve still got cash left in the bank. The harsh realities facing creator economy startups are getting even harsher, prompting a stampede of founders looking for exits as they struggle to find growth and funding.