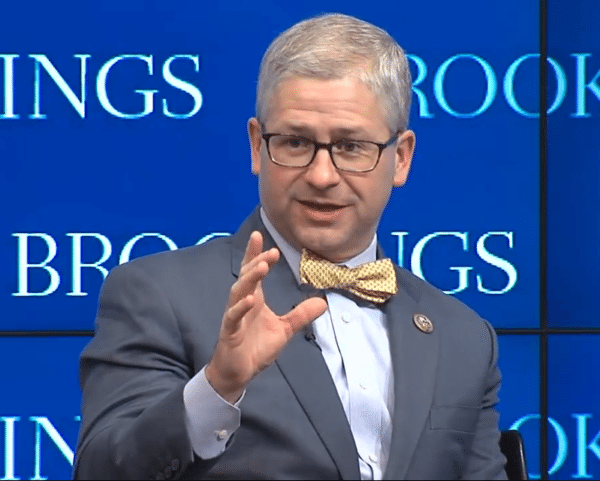

House Financial Services Committee Chairman Patrick McHenry (R-NC) announced yesterday that he will not be seeking reelection to the North Carolina seat he has held for almost 20 years.

Over the years whether serving as the Committee Chairman or as the Ranking Member, he has been a tireless champion for financial innovation on the House Financial Services Committee.

While staunchly conservative, he has often worked in a bipartisan way to advance legislation to modernize financial services in this country. When I interviewed him back in 2017 I found him to be knowledgeable, thoughtful and not afraid to bring innovative ideas to the floor of the House.

He will leave a gaping hole in the House Financial Service Committee as Doug Ellenoff, Managing Partner of Ellenoff, Grossman, and Schole said yesterday:

“I can’t adequately express how profoundly his absence will affect the financial service industry generally and all proposed financial service legislation that might have advanced and had a positive impact on capital market activities and our capital markets.”

Here’s hoping in his final year as the Committee Chairman he manages to get some of the pending legislation over the line.

Featured

Staunch Supporter of Crowdfunding, Fintech, Congressman Patrick McHenry Announces He Will Not Seek Re-Election

Congressman Patrick McHenry, a Republican from North Carolina and current Chairman of the House Financial Services Committee, has announced his intent not to seek re-election to the seat in Congress he has held for 20 years.

From Fintech Nexus

> As rates fall, LatAm fintechs gear up for credit expansion in 2024

By David Feliba

After a sharp lending slowdown in 2022, fintechs in Latin America gear up for credit growth next year as rate pressures fade out.

> Artificial Intelligence: CommerzBank uses Generative AI to create financial avatars

By Laurence Smith

Developed in partnership with Microsoft Azure, the application leverages advanced GPT models to facilitate natural conversations with customers,

Podcast

This week Isabelle spoke to Arc’s founder and CEO, Don Muir to take stock of 2023 and how fintech startups have fared.

Webinar

Payments Innovation is Hot: What to Expect in 2024

Dec 14, 12pm EST

Global payments revenue grew double digits in 2023 – wondering what the near future of the burgeoning payments space might…Learn More

Also Making News

- USA: How two fintechs are climbing back from the downturn

MoneyLion and Pagaya, which were among the many payment companies that fought headwinds in the past two years, are using product and capital markets strategies to help them recover. - Global: New PayPal CEO Fast-Tracks Upgrades to Beat Back Competition

New PayPal CEO Alex Chriss is fast-tracking an effort to bolster the company’s defenses against Stripe and Apple Pay, highlighting how the payments giant has fallen behind newer, slicker competitors. - USA: Banks map out their open banking long game

In preparation for impending changes to data sharing in the US, banks have been executing on strategies aimed at positioning them competitively. - Global: Spend management platforms are Wising up

Last week Wise announced a partnership with Webexpenses, a cloud-based provider of financial management software. Through the partnership Webexpenses customers will be able to manage and pay for their expenses, in multiple currencies, directly from its platform. - Global: UK fintech Banked builds a US presence

The company expects its pay-by-bank services for bank clients will eventually lure retailers. - India: Goldman Sachs-backed ZestMoney, once valued at $450M, to shut down | TechCrunch

ZestMoney, a buy now, pay later startup whose ability to underwrite small ticket loans to first-time internet customers attracted many high-profile ZestMoney, a Goldman Sachs-backed buy now pay later startup, is shutting down following unsuccessful efforts to find a buyer. - USA: SEC Is Talking to Bitcoin ETF Contenders—Here’s What It’s Likely Saying

What has the SEC been saying in discussions with Bitcoin ETF applicants? Recent changes in amended filings provide a few clues.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.