The buy-now-pay-later industry continues to grow in popularity. And part of the reason is consumers are starting to understand that most of BNPL stands outside the traditional credit scoring system.

The Wall Street Journal reported this past weekend on the new trend of consumers making regular purchases like groceries and other essentials using BNPL. Part of the reason for this is to avoid having these transactions reported to the credit bureaus as they would be if they used a credit card.

While the credit bureaus gave BNPL companies the option of reporting their transactions to the bureaus most are choosing not to do so. To be fair, the credit bureau system is not really set up for those Pay in 4 transactions given how quickly these “loans” are paid off.

More week needs to be done. BNPL is here to stay and regulators like the CFPB have indicated they are keeping a close eye on the industry. But not much has been done in this area yet.

This is one of the many reasons that cash flow underwriting is gaining in popularity for consumer lenders but that is a story for another day.

Featured

Buy Now, Pay Later Keeps People Spending—Without Credit Agencies Knowing

Consumers are flocking to installment loans for everything from holiday gifts and groceries to laser eye surgery.

From Fintech Nexus

> Melio, J.P. Morgan unite to deliver RTP B2B payments

By Tony Zerucha

Thanks to improvements in technology, innovative businesses like Melio are bringing B2B payments into the 21st century. This week, Melio launched Real-Time Payments, supported by J.P. Morgan.

> Nubank adds stablecoin USDC, boosts crypto offering in Brazil

By David Feliba

Nubank, the largest neobank in Latin America, will introduce USDC to its Brazilian clients, a significant advancement for the stablecoin.

Podcast

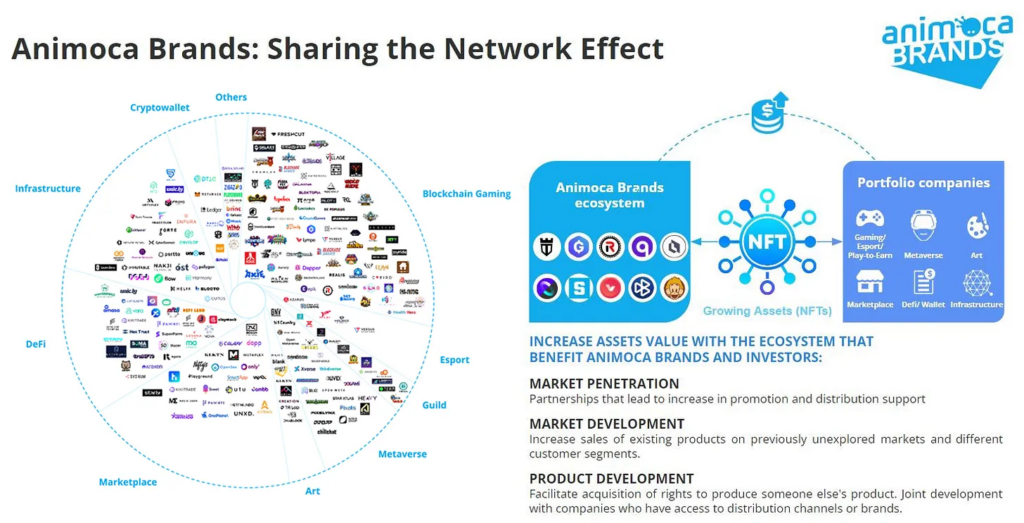

How Animoca Brands built an empire at the intersection of Gaming and Finance, with Animoca Brands Chairman Yat Siu

Hi Fintech Architects, Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can…

Also Making News

- Global: MoneyGram’s CEO on cross-border payments: ‘This is an expensive business.’

Alex Holmes talks about money transfers, the tough economy, and the role of crypto wallets in the firm’s future.

- USA: The 2023 Fintech Snark Tank Banking And Fintech Awards

As far as I know, Taylor Swift didn’t win any banking or fintech awards this year. Maybe next year she’ll offer a debit card so I can give her a Fintech Snark Tank award.

- USA: How the Fintech Rally Could Fizzle in 2024

Falling interest rates might be a surprising challenge for a lot of financial-technology stocks.

- USA: Scout’s honored to help: Meriwest Union launches a digital assistant called Scout

With $2.3 billion in assets, 80,000 members, and 8 California-based branches, Meriwest Union has launched its own digital assistant called Scout. The digital assistant is the credit union’s attempt to pad out its digital offering since its digital banking members were yielding 67% more profit than those who preferred in-person channels.

- USA: Simon Khalaf channels energy into scaling Marqeta

The Marqeta CEO is tasked with taking the card-issuing fintech to the next level amid increased competition and an uncertain economic climate.

- Global: Visa expands Fintech Fast Track programme

Visa is expanding its North America Fintech Fast Track programme beyond card issuance to connect members to its real-time money movement platform.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.