[Editor’s Note: American Banker had some inaccuracies in their coverage of this story so you should read their corrected piece here. Suffice it to say that much of the featured story below is inaccurate as we relied on American Banker’s initial coverage].

Fraud is going to be top of mind for all financial institutions in 2024. Banks and fintechs alike are constant targets of fraud attacks.

It was interesting to read this morning about the experience of Regions Bank when it comes to check fraud.

A large regional bank based in the South, Regions was under fire from the CFPB for their overdraft practices. So, they added a feature pioneered by fintechs: access to pay two days early. But it had some unintended consequences.

In late 2022 Regions Bank introduced Early Pay and updated its policies so bank customers would receive their pay the same day Regions receives the money. The normal hold time at banks is two days.

This has led to a surge in fraud losses, $135 million between April and September 2023. Their Q3 loss of $53 million was up 40% year over year. They have now amended their policies putting a longer hold on large deposits and fraud losses are expected to be $25 million in Q4.

This points to the dance that all banks and fintechs must do. How do you provide a frictionless experience for your customers while at the same time mitigating fraud? There is no easy answer as this battle will continue.

I also should point out a recent white paper we released in partnership with Resistant AI on serial fraud. We need a wide array of anti-fraud tools to thwart the bad guys these days.

Featured

How Regions Bank unwittingly invited a surge in check fraud

By Jordan Stutts

The Alabama-based bank loosened its funds availability policy in 2022 as part of an effort to give customers early access to their paychecks. “We opened the door too wide, bad people came rushing in, and we didn’t close the door timely enough,” Regions’ CFO said.

From Fintech Nexus

> Will Embedded Finance Make Software Companies the New Community Banks?

By Luke Voiles

With community banks pulling back on lending to small businesses vertical software platforms are filling the void. They provide software, of course, but are increasingly also providing access to capital.

> Whitepaper Discusses the Threat Posed by Serial Fraud

By Fintech Nexus Staff

Serial fraud is becoming a major problem for financial institutions today as criminals use automation and scale like never before. This white paper provides actionable steps to combat serial fraud.

Podcasts

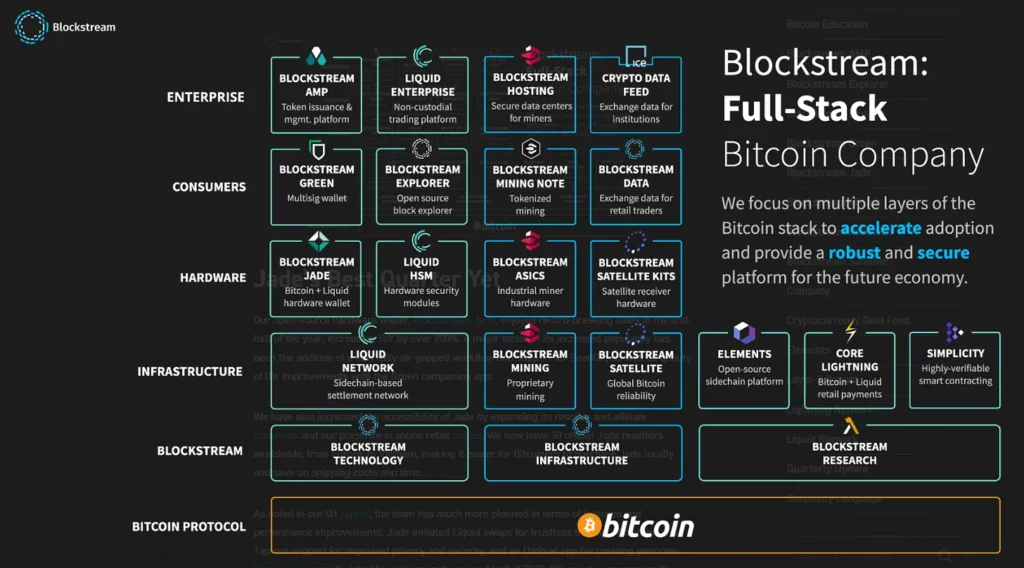

Podcast: Advancing Bitcoin with Lightning, Inscriptions, and L2s, with Blockstream’s Chief Product Officer Jeff Boortz

Hi Fintech Architects, Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can…

Webinar

Fraud Risks to watch out for in 2024

Jan 18, 12pm EST

In our highly digital world, businesses work with customers from all over the globe and at higher volumes, where decisions…

Also Making News

- USA: How state-issued IDs are driving Google Wallet’s strategy

In a crowded market for mobile payment apps, the search giant hopes to expand its support of driver’s licenses, providing a key method of authentication for more financial services.

- USA: Nearly 40% of Consumers Use Pay by Bank for Retail Purchases

Account-to-account (A2A) payments typically occur between individuals, when one consumer transfers money from their bank account to another person’s or when they transfer money between two owned bank accounts.

- Global: Former Anthemis partner soft-launches new fintech-focused venture firm

Ruth Foxe Blader has left her role as partner at Anthemis Group after nearly seven years to start her own venture firm, Foxe Capital, TechCrunch learned exclusively today. Blader is joined by former Anthemis investment associate Kyle Perez. Sophie Winwood is serving as an operating partner.

- USA: CFPB urged to strengthen open banking data protection safeguards

The Consumer Financial Protection Bureau’s planned new open banking rules do not go far enough to protect consumer data, say two industry groups.

- USA: An Inside Look at Ally Bank’s Measured Roll-Out of GenAI

Q&A: As financial institutions race to implement AI across their organizations, public anxiety and government scrutiny are intensifying. Can banks deploy and leverage AI to power growth while avoiding public backlash? Ally Bank’s approach – simultaneously trailblazing and prudent – is one promising model.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.