Goldman’s push into consumer finance continues to be a disaster. While CEO David Solomon had grand plans, the entire move has proven to be an unmitigated disaster.

The foray cost the company about $6 billion from 2020 through the first quarter of this year. So, the great unwinding continues.

We learned yesterday that Barclays is the leading contender to take over the GM credit card business that Goldman acquired in 2020. Interestingly, its main competitor in that process was Barclays.

GM’s credit card business has about $2 billion in outstanding balances, down from $3 billion in 2020. The deal has not closed yet, and it could come undone as an agreement on price has not yet been reached.

Next on the chopping block will likely by the Apple Card which Goldman has also indicated it is interested in offloading.

It has been fascinating to watch the journey of Goldman’s consumer business since 2016. One day, it will provide a rich case study for business school students.

Featured

> GM in Talks to Move Credit-Card Business From Goldman to Barclays

Deal including roughly $2 billion of card balances could be struck by summer.

From Fintech Nexus

> Overall U.S. customer satisfaction with BNPL grows: study

By Craig Ellingson

As scrutiny of Buy Now Pay Later increases, so too do satisfaction scores among customers using the short-term financing mechanism structured like an installment loan.

> SoFi reports strong Q1 revenue and profits

By Fintech Nexus Staff

SoFi is the first publicly traded fintech to report earnings and it was a strong report with revenue, profit and member growth.

Podcast

Mitch Jacobs, Founder & CEO of Plink on transaction personalization

The CEO and founder of Plink explains why even today banks are unable to fully utilize the card transaction data that exists…

Listen Now

Webinar

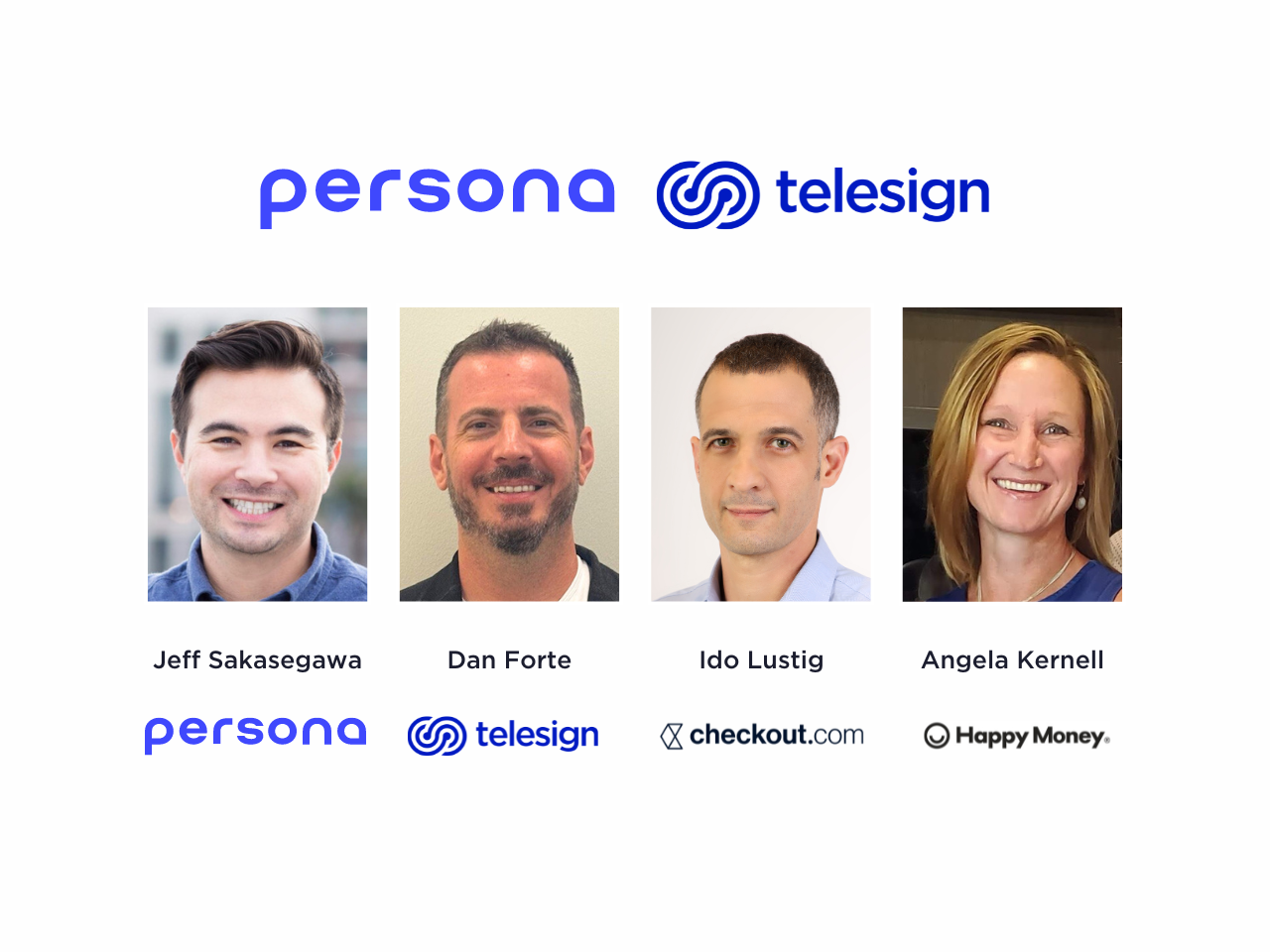

How to Maximize Conversions, Minimize Fraud at Account Opening

May 2, 2pm EDT

Both banks and fintech want onboarding new customers to be secure, simple and fast. But there is a delicate balance. Make…

Also Making News

- Europe: The ECB Warns That The IPhone Is “Incompatible With Digital Currency”

If you cannot store these keys in the SE, then you have go to some lengths to protect them inside the memory of the phone itself.

- USA: SBA’s push to revive an old idea

Isabel Casillas Guzman, administrator of the Small Business Administration, wants the agency to get involved in direct lending, a practice that was discontinued during the Clinton administration. Congress has not embraced the idea, to put it mildly.

- USA: ‘Wallet-as-a-service’ startup Ansa raises $14 million with female investors leading the way

Ansa, a startup that helps merchants develop and offer branded virtual wallets, has raised a $14 million Series A round of funding. Renegade Partners led Ansa’s latest financing, which included participation from existing backers Bain Capital Ventures, BoxGroup and Wischoff Ventures and new investor B37 Ventures.

- LatAm: JPMorgan-Backed Digital Bank C6 Posts First Quarterly Profit

Brazilian digital bank, C6, which is backed by JPMorgan Chase & Co., posted its first quarterly profit in the first three months of the year, according to chief executive officer Marcelo Kalim.

- USA: FedNow pricing aimed at avoiding market disruption

The Federal Reserve sought to “not upset the marketplace as a second mover” when it set fees for the new instant payments system last year, a central bank official said Wednesday.

- Asia: Hong Kong Bitcoin and Ether ETFs Have Soft Debut

The volume of ether exchange-traded funds came in at over $13 million, while bitcoin ETFs came in at $7.5 million.

- Global: Coinbase Plugs Into the Bitcoin Lightning Network

Users of the top crypto exchange can choose the alternate network for faster and cheaper transactions than the Bitcoin mainnet.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.