Back in the go-go days of 2021 the two biggest names in crypto were known just by their initials: SBF (Sam Bankman-Fried) and CZ (Changpeng Zhao).

They often took to Twitter arguing with each other about where the market was going and whether certain tokens were overvalued. But there were no bigger names than SBF and CZ. They controlled the biggest crypto exchanges, outside of Coinbase: FTX and Binance.

Oh, how the mighty have fallen. We know SBF is going to spend the next quarter century in prison, and yesterday, CZ was sentenced by a Seattle judge to four months after pleading guilty to enabling money laundering at Binance.

The cases and the demeanor of the two former CEOs were very different. SBF orchestrated a years-long fraud while denying he did anything wrong, whereas CZ admitted wrongdoing and took responsibility for his mistakes, but investigators found no evidence of fraud.

The sentences reflect those differences. CZ personally paid a $50 million fine and has been barred from the CEO role at Binance.

Meanwhile, this is probably unrelated, but the price of bitcoin, ethereum and other major tokens are down significantly in the last 24 hours.

Featured

> Binance founder Changpeng Zhao sentenced to 4 months in prison after plea deal

By MacKenzie Sigalos, Ryan Browne

Five months after pleading guilty to money laundering violations, Binance founder Changpeng Zhao was sentenced to four months in prison.

From Fintech Nexus

> Fintechs in Latin America Draw Venture Capital Interest, Again

By David Feliba

Funding for Latin American fintechs surged in the first quarter, raising hopes that the worst for the industry may be behind it.

> LendingClub exceeds expectations in strong Q1 earnings

By Fintech Nexus Staff

LendingClub reported Q1 2024 earnings and the company exceeded analyst expectations for both revenue and profit.

Podcast

Mitch Jacobs, Founder & CEO of Plink on transaction personalization

The CEO and founder of Plink explains why even today banks are unable to fully utilize the card transaction data that exists…

Listen Now

Webinar

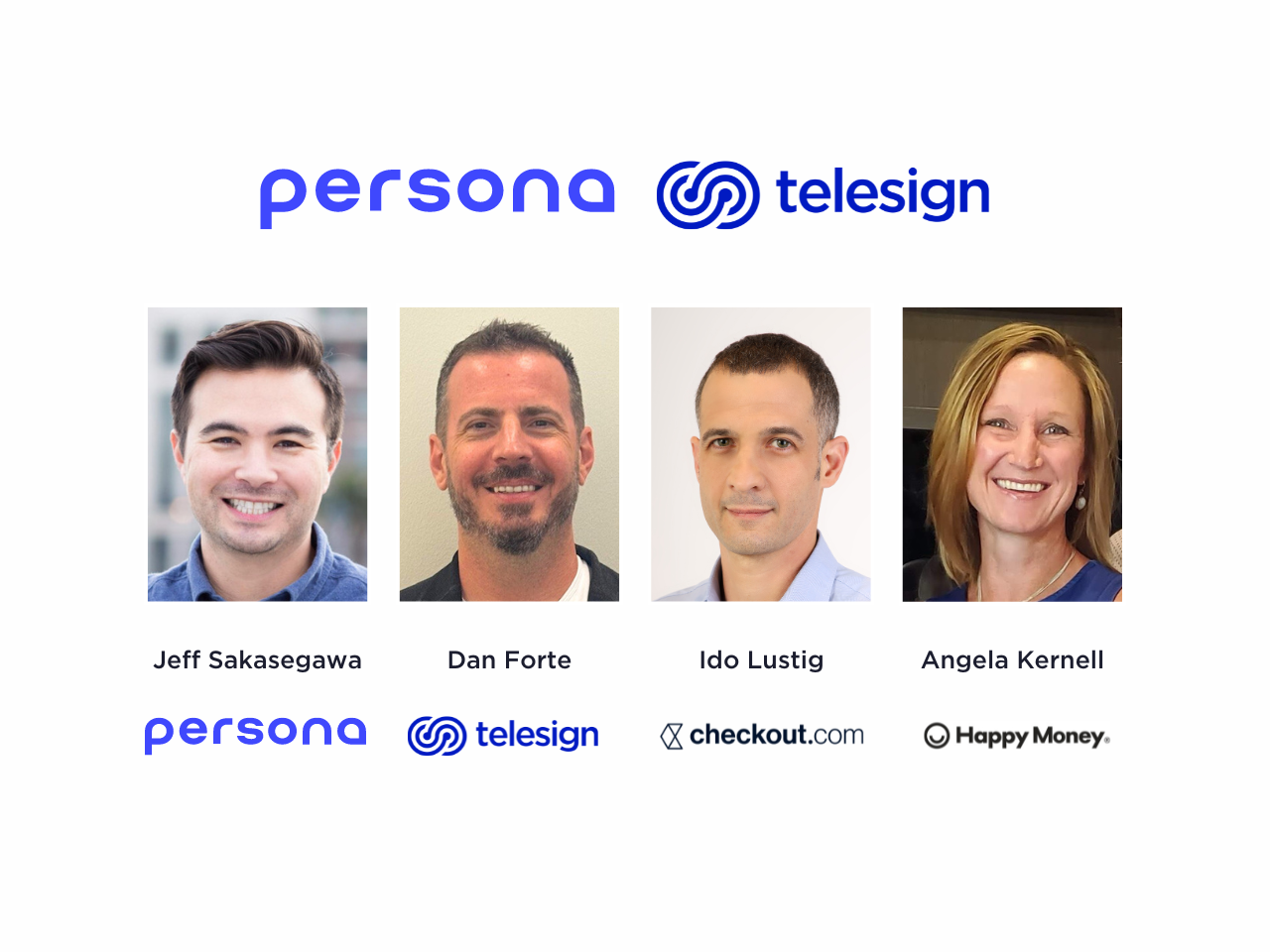

How to Maximize Conversions, Minimize Fraud at Account Opening

May 2, 2pm EDT

Both banks and fintech want onboarding new customers to be secure, simple and fast. But there is a delicate balance. Make…

Also Making News

- Global: PayPal Sees Jump in Transactions Per Account as Fastlane Checkout Boosts Conversions

PayPal is seeing double-digit percentage gains in transactions per active account, and an embrace of debit functions and rewards.

- USA: Rent the Balance Sheet: Banks Seek Ways to Skirt Capital Rules

Banks are partnering with private lenders on consumer loans. Capital rules prompt new demeanor toward less-regulated rivals.

- USA: Are Community Banks Getting Squeezed Out Of Existence?

Community banks are getting squeezed—a squeeze years in the making and exacerbated by rising interest rates. But, as Monty Python would say, they’re “not dead yet.”

- Europe: Goldman Investing Unit Leads SumUp’s €1.5 Billion Loan

Goldman Sachs Asset Management is leading a €1.5 billion ($1.6 billion) private credit loan package for London-based card reader maker SumUp Payments Ltd., people with knowledge of the matter said.

- USA: ‘Like wildfire’: Rising check fraud pits small banks against big banks

A 50% growth in losses from check fraud last year is pushing bankers in Illinois to ask regulators for a joint supervisory guidance and tougher enforcement of large banks’ “know your customer” compliance.

- USA: SMBs are increasingly opting for real-time payments, leaving credit cards behind as their preferred choice

The RTP payments network reached a milestone by processing over 1 million payments in a single day on September 1, 2023. EWA and gig worker payments emerged as the network’s primary drivers, surpassing account-to-account (A2A) transfers.

- Global: Marqeta expands Uber Eats partnership

Marqeta will expand its Uber Eats partnership to Canada, Australia, Mexico, Brazil, Colombia, Peru, Chile and Costa Rica

- UK: Monese splits in two

Mobile banking startup Monese has confirmed the break up of the business into separate consumer-facing and corporate concerns and the arrival of new funding.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.