We learned yesterday that federal prosecutors are investigating Block for widespread compliance lapses.

NBC News broke this story after interviewing a former Block employee. This person provided roughly 100 pages of documents that showed transactions involving entities in countries subject to U.S. sanctions.

This person lambasted Block’s compliance program, saying, “From the ground up, everything in the compliance section was flawed.” A second person was able to corroborate that statement.

Block has argued that it has reported thousands of transactions to OFAC and that the company received a no-action letter regarding this matter.

I liked Simon Taylor’s take. He argues that we can’t have financial inclusion and frictionless experiences without some AML risk. He also said that KYC is broken and that every large-scale financial institution will eventually be fined for some kind of failing in this area.

This is a never-ending fight for fintechs and banks. It will be interesting to see what the Southern District of New York finds in their investigation. Stay tuned.

Featured

> Prosecutors are examining financial transactions at Block, owner of Cash App and Square

By Gretchen Morgenson

Internal documents indicate Block processed crypto transactions for terrorist groups and Square processed transactions involving nations subject to economic sanctions.

From Fintech Nexus

> How fintechs can succeed on campus and grow with Generation Z

By Tony Zerucha

Fintechs are learning that college campuses are valuable markets for their unique ecosystems and the students they serve.

Podcast

Mitch Jacobs, Founder & CEO of Plink on transaction personalization

The CEO and founder of Plink explains why even today banks are unable to fully utilize the card transaction data that exists…

Listen Now

Editorial Cartoon

Webinar

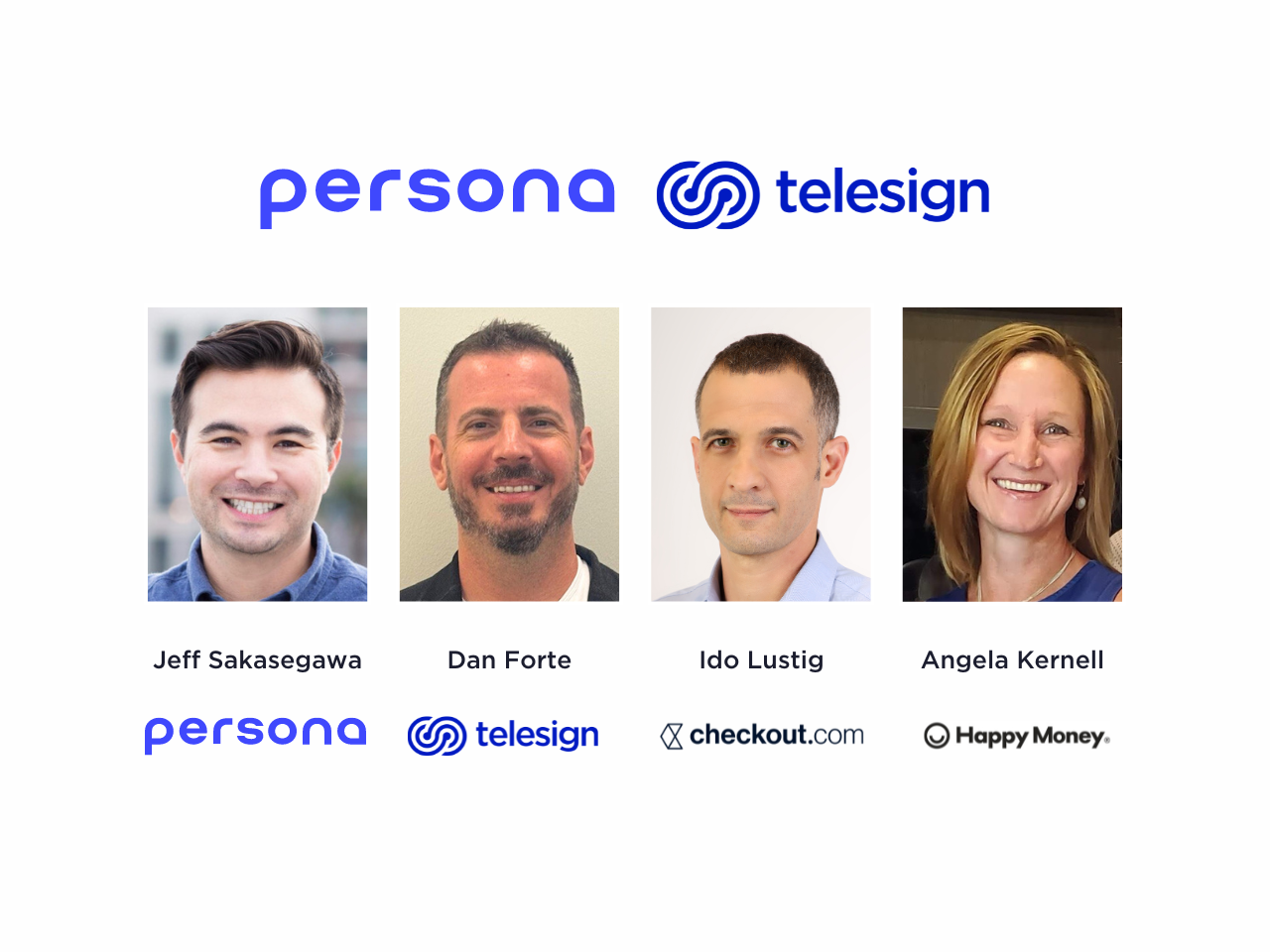

How to Maximize Conversions, Minimize Fraud at Account Opening

May 2, 2pm EDT

Both banks and fintech want onboarding new customers to be secure, simple and fast. But there is a delicate balance. Make…

Also Making News

- Global: Digital fraud detection startup BioCatch hits $1.3B valuation as Permira buys majority stake

Digital fraud detection company BioCatch has a new majority shareholder in the form of U.K private equity firm Permira.

- USA: Are Real-Time Payments Near an Inflection Point? Bank of America Thinks So

Use cases for real-time payments have never been a source of argument, even among detractors. The ability to speed bill payment and peer-to-peer flows, as well as move money instantly, has been around for a while. The FedNow® Service debuted last summer, while The Clearing House’s RTP® network has been operating since 2017.

- Asia: Mastercard poised to start processing payments locally in China

Bolstered by healthy first-quarter global card-spending trends, Mastercard is focusing on opportunities outside the U.S., including a unique card-processing arrangement beginning this month in China.

- USA: BNPL firm Sezzle turns to gamification to encourage timely payments

Buy now, pay later provider Sezzle is gamifying on-time payments with a loyalty programme designed to encourage financial responsibility.

- Global: PayPal Expands Crypto Offerings With MoonPay Integration

PayPal has linked up with MoonPay to offer its millions of users access to over 100 cryptocurrencies

- UK: Tink partners with TransferGo to launch Pay by Bank for UK customers

Pay by Bank will introduce a new way to more securely and quickly send money internationally for TransferGo’s UK customers

- LatAm: Fintech for Brazilians to Save in Dollars Plans Miami Office

Nomad, a financial-technology company that caters to Brazilians who want US dollar checking and investment accounts, is planning to open an office in Miami.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.