Yesterday, in a 7-2 vote, the U.S. Supreme Court ruled that the funding structure of the Consumer Financial Protection Bureau is constitutional.

This is a big deal for financial institutions. Even though the agency has been a thorn in the side of many fintechs and banks, if the Supreme Court found it unconstitutional, it would undo more than a decade of work and could mean chaos for the industry.

Now, we can move on with confidence. Whether or not we like the CFPB, its right to exist is now settled.

One of the CFPB’s big new initiatives is implementing its rulemaking on open banking, known as Section 1033.

This will likely lead to a flurry of fintech innovation that will give consumers control over their own data, and that is exciting to me.

Featured

> Supreme Court Ruling on CFPB Paves Path for Open Banking

Reading the Thursday (May 16) Supreme Court ruling upholding the constitutionality of the Consumer Financial Protection Bureau’s funding mechanisms — and ensuring the agency’s survival — takes one through centuries of history. All the way back to England, Parliament and the Crown.

From Fintech Nexus

> Stash announces new B2B offering called StashWorks

By Peter Renton

StashWorks is the new B2B offering from Stash, allowing any employer to add savings and investing as a benefit to employees.

> Generation Z has it tougher than millennials: TransUnion report

By Tony Zerucha

While both Generation Z and millennials are maturing during difficult financial times, TransUnion’s study Solving for Z shows Generation Z has it harder.

Podcast

Brendan Carroll, Co-Founder & Senior Partner of Victory Park Capital, on the growth of private credit

The Co-Founder of Victory Park takes us through the history of asset backed lending, how the industry has grown, and what…

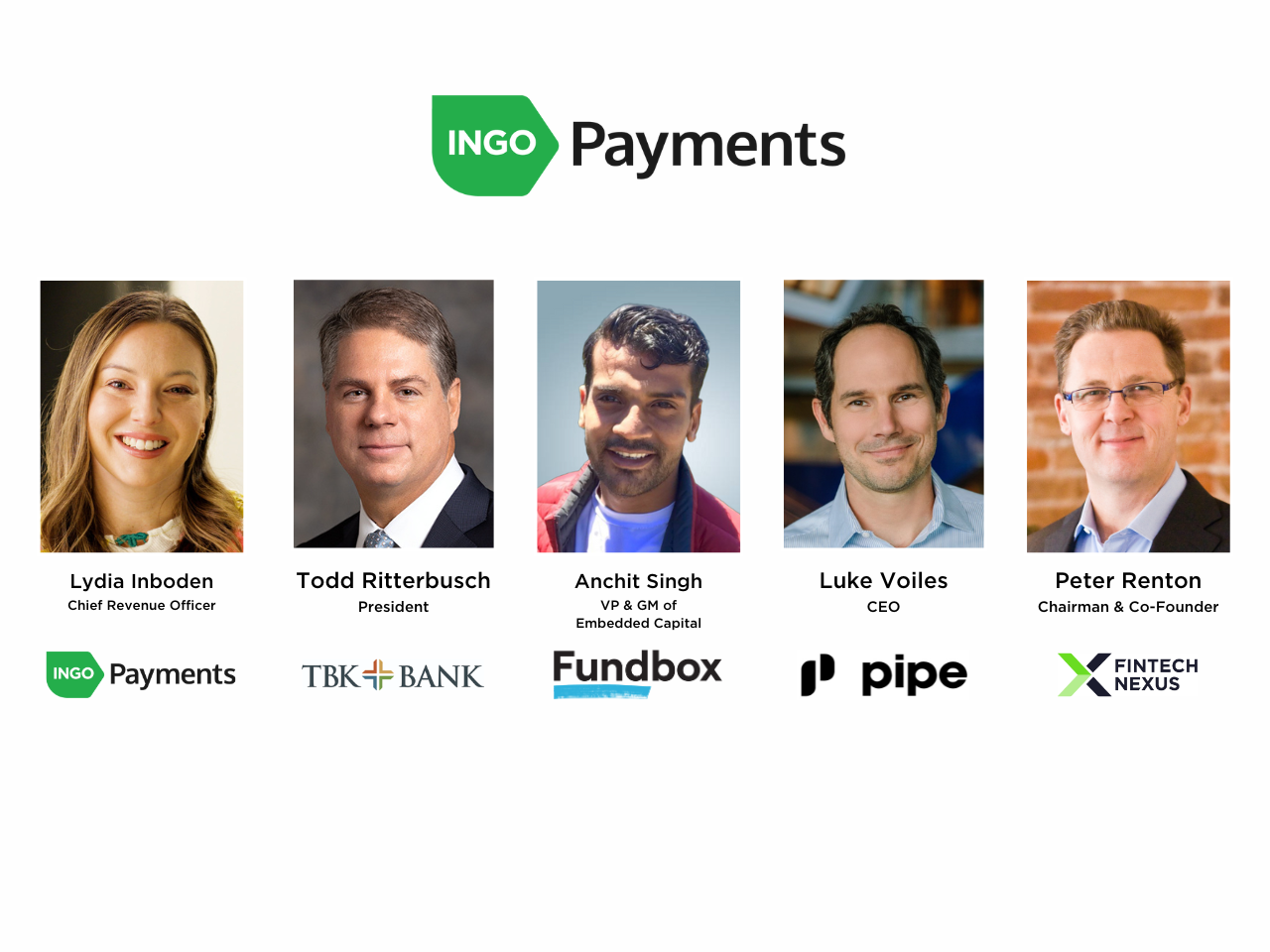

Webinar

Instant payments orchestration: an essential tool now for lending and factoring

Jun 5, 2pm EDT

In today’s on-demand economy, instant payments are moving from a nice-to-have to a must-have. In the small business space,…

Also Making News

- USA: TD tests generative AI in contact centers, software development

The work of the TD Invent group and Layer 6 AI, a startup TD bought in 2018, show how innovation teams at large banks can cut through the bureaucracy and fiefdoms that exist in every big company to deploy and scale new technology.

- UK: Embedded finance is still trendy as accounting automation startup Ember partners with HSBC UK

Ember has partnered with HSBC in the U.K. so that the bank’s business customers can access Ember’s services from their online accounts.

- USA: Kudos lands $10M for an AI smart wallet that picks the best credit card for purchases

Kudos uses AI to figure out consumer spending habits so it can then provide more personalized financial advice, like maximizing rewards and utilizing credit effectively.

- USA: A2A payments firm Aeropay raises $20m

American open banking account-to-account payment fintech Aeropay has raised $20 million in a Series B funding round led by Group 11.

- USA: Banking on wheels: Fifth Third and SpringFour are taking financial wellness for a spin

Factors like disabilities, poor financial health, and a lack of bank branches in local neighborhoods can keep people out of the banking system. Currently 19 million households are considered underbanked in America, according to recent FDIC data.

- Asia: Hong Kong allows China’s digital yuan to be used in local shops

Hong Kong will allow mainland China’s pilot digital currency to be used in shops in the city, the head of its de facto central bank said on Friday, marking a step forward for Beijing’s efforts to internationalize the yuan amid rising geopolitical tensions.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.