It has been the talk of the crypto world all week. SEC watchers noticed early this week that the regulator appeared to be getting ready to approve an ETF for funds holding Ethereum.

Yesterday, it was made official as the SEC approved a rule change that will pave the way for the first ETFs to buy and hold ETH.

This move comes less than six months after the SEC approved spot bitcoin ETFs. That move has been seen as a major success as those funds have collectively seen $12 billion of net inflows.

Many of the same fund companies, such as BlackRock, Bitwise and Galaxy Digital have started the process to launch an ether fund.

As the number two cryptocurrency by market value, around one-third of the total of bitcoin, these funds are expected to draw fewer assets.

The SEC’s order, published yesterday, does not technically approve any of the funds yet, it approves exchanges to list eight different ether funds.

But if the timeline is similar to bitcoin, these new ETFs will start ?trading in a matter of days.

Featured

> SEC Widens Accessibility of Crypto Investing With Approval of ETFs for Ether

The new funds will allow mainstream investors to buy and sell the ETH cryptocurrency as easily as stocks or mutual funds.

From Fintech Nexus

>Amdocs study shows increased personalization benefits

By Tony Zerucha

Amdocs’ Personalization and Multigenerational Banking Survey shows the more customers know about personalized banking, the more they want it.

> Study reveals half of Brits are now more wary of online banking, with online fraud a key concern

By Kate Steere

Consumer sentiment is changing towards online banking in the UK. We explore the potential reasons why official figures have shown a downward trend in customers willing to recommend their online bank and banking app over the last 4 years, and how the rise in online fraud is a key contributing factor.

Podcast

Joel Sequeira, Director of Product at IDology, on using AI in identity verification

There is no area of fintech moving faster than identity verification today. With new attack vectors coming online every day…

Webinar

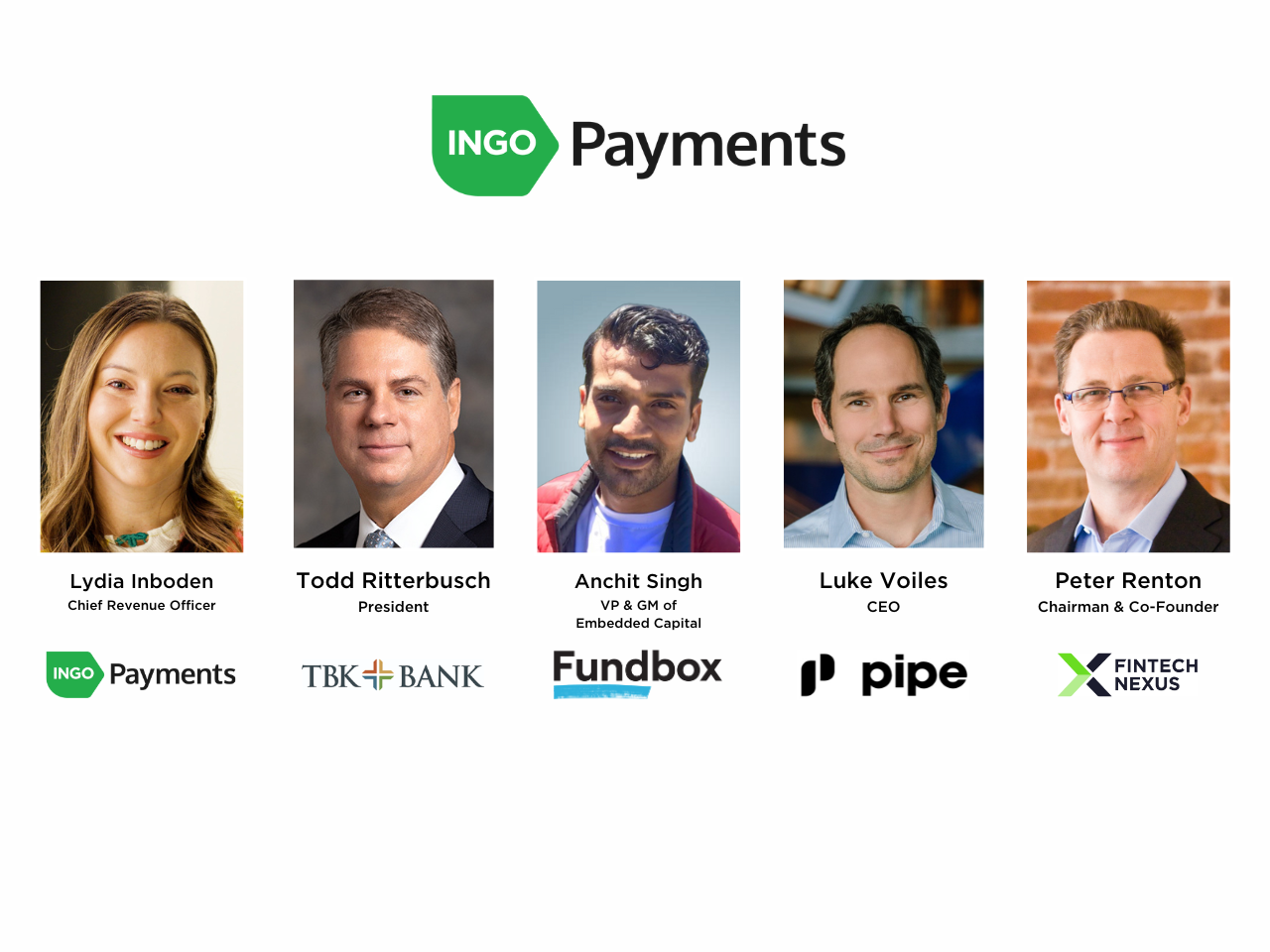

Instant payments orchestration: an essential tool now for lending and factoring

Jun 5, 2pm EDT

In today’s on-demand economy, instant payments are moving from a nice-to-have to a must-have. In the small business space,…

Also Making News

- USA: Ethereum ETFs Could Lead to ‘Serious’ Security Risks, Say Experts

Experts say that centralization concerns could lead to “serious” security risks, amid the U.S. spot Ethereum ETF approval.

- USA: Klarna labels CFPB BNPL rule ‘baffling’

The US Consumer Financial Protection Bureau’s new rule on buy now, pay later lenders has received a mixed reception from industry players, with Affirm welcoming the outcome but rival Klarna calling it “baffling”.

- Global: Banks are not stupid … just massively challenged

I talk a lot about the platform economy where the network joins us all together. In that economy, like life on Earth, there are many players. 1000’s of companies, millions of people and billions of capital. The question is: how to connect them?

- USA: Ampla, a Lender to Consumer Brands, Faces Financial Struggles

Ampla, which lent money to smaller businesses that sold clothing, home furnishings and other items directly to consumers, is struggling financially and seeking a buyer.

- USA: Uninsured bank on track for Fed master account approval

Numisma Bank, a de novo bank backed by former Federal Reserve Vice Chair Randal Quarles, is the first bank without deposit insurance to be granted conditional approval under the Fed’s new master account application framework.

- USA: Intuit Says AI Is Helping Drive Small Businesses Growth, Certainty

Small businesses are the heart and soul of America’s Main Street. But it can be hard to get a pulse check on how they are doing, given today’s dynamic operating environment as well as the sheer variety and volume of small businesses out there — taken together, they make up 40% of the U.S. economy.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.