May will certainly go down as a milestone month for the U.S. p2p lending industry. We had the much talked about Google/Lending Club deal and then we had major milestones being hit by both Lending Club and Prosper. Lending Club issued more than 10,000 new loans for the month for the first time and Prosper continued their record setting ways and issued $25 million in new loans.

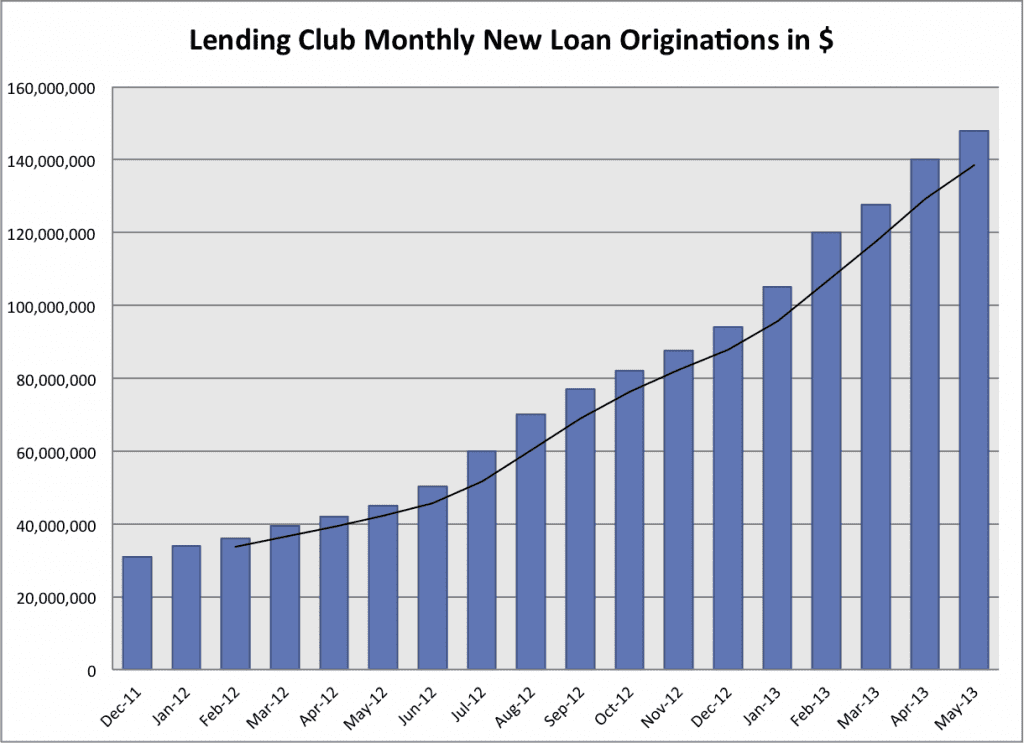

Lending Club Issues $148 million in New Loans in May

Total loan volume was up 5.6% over last month at $148 million with the official number of new loans coming in at 10,350 or 470 per business day. The average loan size was down slightly to $14,303. Let’s put Lending Club’s growth in perspective. In May 2012 I gushed about Lending Club’s rapid growth as they issued $45 million in new loans – they are up an astounding 228% in loan volume since then.

The average number of available loans stayed steady as investors continued to snap up loans as fast as Lending Club can list them on the platform. Most of the time there are between 100 and 200 loans on the platform at any one time these days. This seems like a new normal for Lending Club with most investors adjusting to the new reality.

Below is their impressive 18-month loan volume chart. The black line is the three-month moving average.

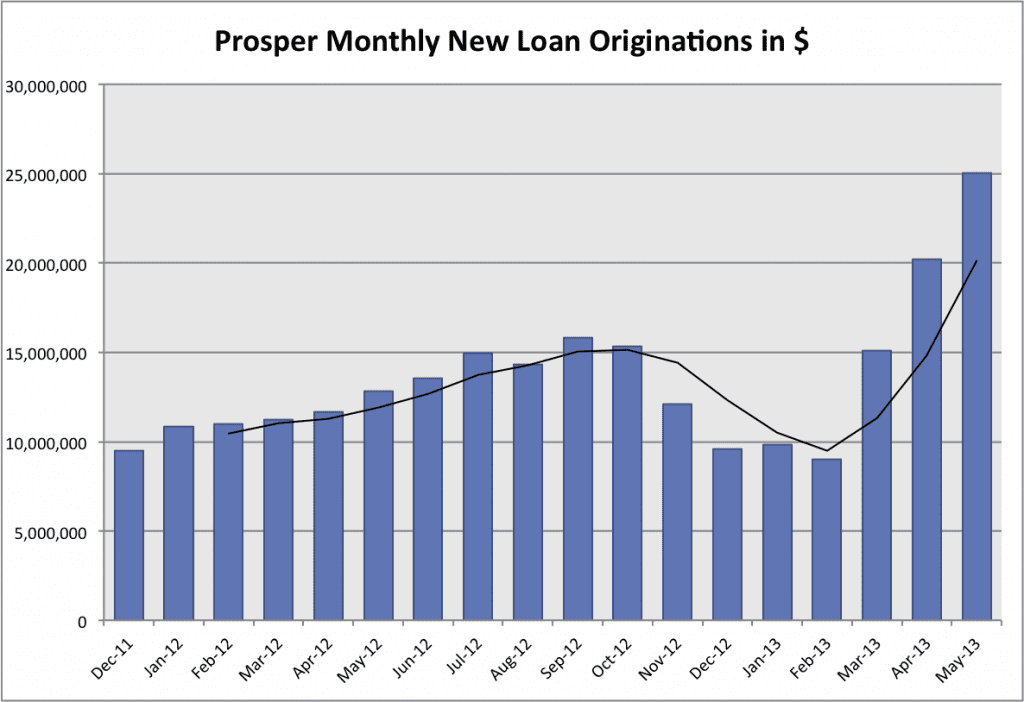

Prosper Keeps Up Their Rapid Growth in May

It has been a remarkable turnaround at Prosper. From December through February total loan originations were below $10 million well down from their high of $15.8 million last September. Many investors questioned on this very blog whether Prosper would make it. Now, they are going from strength to strength with very strong investor interest.

Here are the official numbers. Prosper issued 2,436 new loans (up nearly 500 loans from last month) totaling $25 million in new loans in May. The average loan size stayed steady at $10,278. In May 2012 Prosper issued $12.8 million in new loans so they are almost back to their 100% year over year growth

I spoke with Prosper president, Aaron Vermut, yesterday. about their month. He was obviously very pleased with the results, he said particularly when you consider Prosper moved into a new office space during the month. He said that there has been continued strong institutional investor interest and that retail investors are also showing gains again. Now, that institutional investors are restricted to 75% of any loan in the fractional loan pool retail investors are finding it easier to put their money to work.

Below is Prosper’s 18-month loan volume chart with the three-month moving average which has an almost hockey-stick like shape to it now.