[Update: An earlier version of this article stated that Lending Club had a down month. This was incorrect and that article has been deleted. This was my mistake as I did not double check the final numbers before publishing that article. I apologize for the error.]

The shortest month of the year saw a small increase in loan volume at Lending Club and a significantly down month at Prosper. This resulted in a total combined loan volume in February of $313 million, down from $325 million in January.

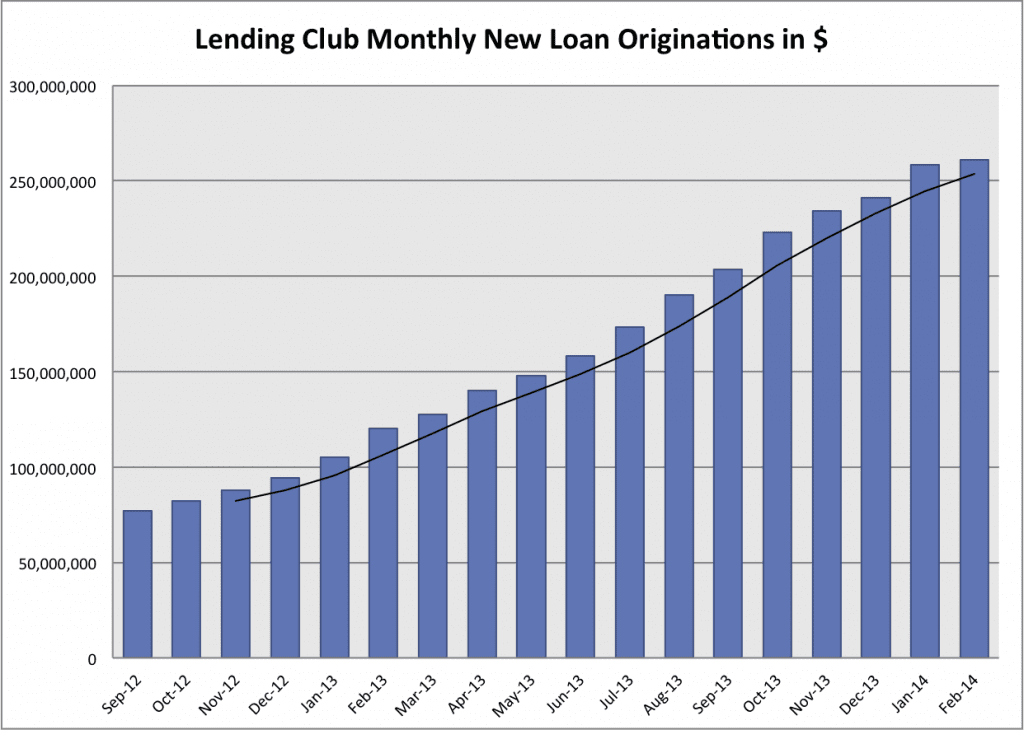

Lending Club Issues $261 Million in New Loans

Lending Club recorded a small monthly increase in loan volume and total loans in February. Their loan volume increased from $258 million in January to $261 million. Total number of loans also increased from 18,547 in January to 18,619. These are the smallest increases we have seen in some time but they have still kept their record growth streak alive – with now 36 consecutive months of record loan volume.

Loan volume on Lending Club has been very strong overall this month, particularly in the latter part of the month. In the past week there have been over 6,500 listed on the platform which is the most I have ever seen and there have regularly been more than 500 loans available at any one time.

The one change Lending Club made this month was to remove some of the data from their Policy Code 2 loans in the data download. They no longer include interest rate or loan grades for these loans. When I asked them about this they said it was because these loans are only available to a select group of institutional investors and they skew the numbers when people are looking at the averages included in the statistics sites.

Below is the Lending Club chart and some stats from the past month.

Average loan size: $14,015

Average dollars issued per business day: $13.7 million

Percentage 36/60 month loans: 71.4%/28.6%

Average interest rate: 14.35%

Percentage of whole loans: 45.3%

Total Policy Code 2 loans: $27.0 million (10.8% of the total)

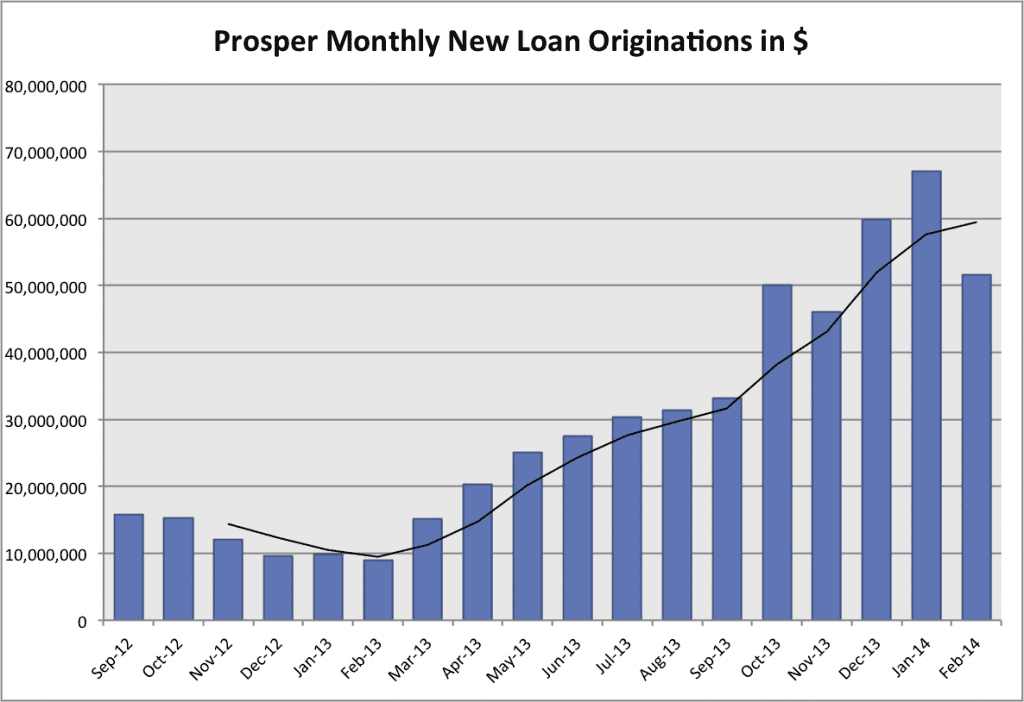

Prosper Issues $51 Million in New Loans

February was not a great month for Prosper by any measure. Even given the fact that this was a short month it was still well down from what I expected. In January Prosper issued $67.1 million in new loans and this month that number dropped dramatically to $51.6 million.

I chatted with Aaron Vermut, the president of Prosper, earlier this week to talk about what happened. Obviously, the short month didn’t help but he also talked about some IT challenges that caused a disruption in adding new borrowers to the platform and then some severe weather interrupted some of the mail deliveries for their direct mail campaigns.

These were temporary issues that have now been resolved and March should be another strong month. Certainly there is still strong investor demand with all the loans still being fully funded quickly. And with the change limiting institutional investors to 10% of any loan now, I have personally enjoyed a lot more success in finding loans this month. My cash balance got down close to zero for the first time in over a year.

Here are the monthly stats and the 18-month loan volume chart.

Average loan size: $11,958

Average dollars issued per business day: $2.7 million

Percentage 36/60 month loans: 68.3%/31.7%

Average interest rate: 15.32%

Percentage of whole loans: 75.7%

Average FICO score: 704