It was nearly a year ago when an astute Lend Academy reader first noticed Lending Club’s plan to start a small business lending operation. Then, in October, Lending Club announced the hiring of Sid Jajodia, the former head of small business lending at Capital One Bank. Today, after what has clearly been a deliberately planned process, Lending Club announced the launch of their small business lending operation.

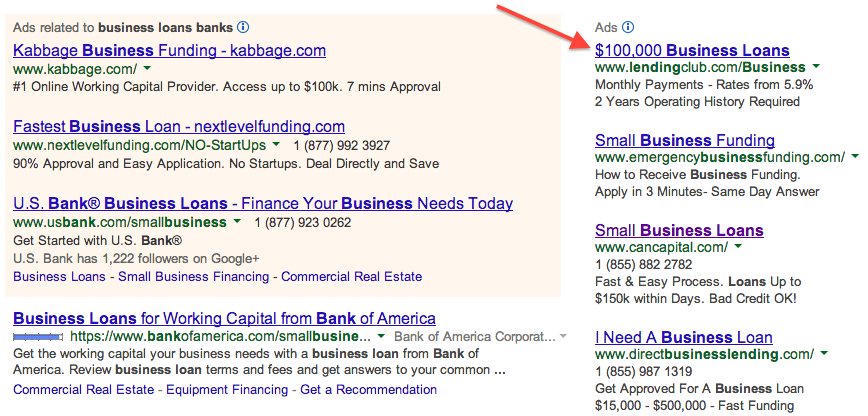

Lending Club began a pilot operation a couple of weeks ago and has been running a small test with Google ads to ensure all their systems are working. They expect to begin issuing loans in the next two weeks.

Last month I chatted with Sid Jajodia, the Vice President of Small Business and Tom Green, the Vice President of New Business Initiatives just before the launch of Lending Club’s pilot program. They provided some more information about the kinds of loans Lending Club will issue and more information about this new program.

Before I delve into the details of this new program I want to stress one point. Some investors may think that Lending Club has been providing “small business loans” for many years because that is one of the stated purposes of the loans we see on the platform today. But these are not true small business loans. They are consumer loans that are completely dependent on the credit of the individual. The small business does not receive these funds directly, it is the individual, so they are not true small business loans.

Details of Lending Club’s New Small Business Loan Program

Lending Club will offer a variety of term loans: 1, 2, 3-year and some 5-year. Initially, they want to issue a mix of all four loan durations but will limit the number of 5-year loans issued. These loans will be unsecured but Lending Club will require a personal guarantee from the business owner. Down the road they may provide secured loans backed by the assets of the business but that is not the plan right now.

The target market for these loans will be small businesses with less than $5 million in sales. But they are not focused on micro-businesses or hobbyists. These are small businesses with some track record that are looking to grow. Larger companies have plenty of lending options and will not be a target for Lending Club.

While these loans will leverage the expertise of Lending Club’s consumer lending operation, particularly when it comes to analyzing the credit of the business owner, Lending Club has put together a team, headed by Jajodia, that are small business underwriting experts.

“One of Lending Club’s key areas of expertise is integrating data sources. In the small business area there is a lot of heterogeneous data coming from multiple sources,” said Jajodia. Lending Club will be using a combination of traditional data sources as well as alternative data but they would not disclose exactly which sources they will be using.

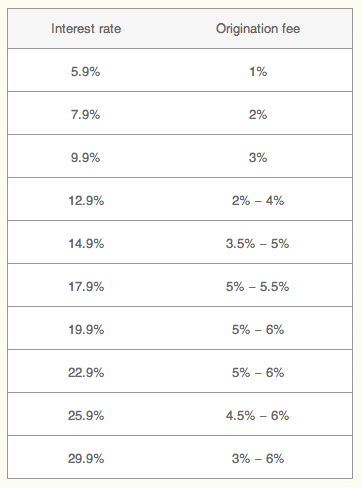

Interest Rates ranging from 5.9% to 29.9%

As you can see in this graphic there will be a broad range of interest rates offered by Lending Club that will be dependent on the creditworthiness of the business. These small business loans will be graded in a similar way to consumer loans and the data for issued loans will begin appearing in the data download shortly.

The online process to obtain a loan is a little more complicated than a consumer loan because you have to enter in your personal information as well as your business financials. But when I ran through the application myself it took just three minutes before I was able to obtain a decision from Lending Club. And for the record I was denied for a small business loan, which tells me they do have reasonably strict underwriting standards.

What’s in it for the Investor?

This is the big question, I am sure, for most Lend Academy readers. As was mentioned in earlier articles small business loans will not be available to retail investors any time soon. Lending Club has hand picked a small number of institutions to partner with in this pilot project.

While Lending Club has a high level of confidence in this new program they pointed out that it is a pilot program and therefore has a higher level of risk than the consumer loans. They wanted investor partners who understood these risks and were comfortable with them. These initial investors have committed to fund every loan issued by Lending Club during this pilot period.

The good news for retail investors is that Lending Club has stated several times now that they intend to make this product available for retail investors eventually. But given this is a new program that change is not imminent and may not happen for a year or more.

What about returns? While Lending Club is not making any specific claims regarding investor returns they did say this. Their intention is to provide returns to investors on their small business loan product that are equivalent to returns on consumer loans.

My Take

I think it is difficult to overstate the importance of this news today. Lending Club is the world leader in p2p lending and this is their first foray into a new loan product. If they execute well and provide a great product for investors, then they are well on their way to becoming the future leader in financial services. If small business loans end up performing badly and investors flee the product then Lending Club runs the risk of remaining a one-trick pony – providing unsecured consumer loans.

Most banks have been reducing their lending to small businesses over the last few years, so there are many people watching this move closely. While Lending Club will have competition from the likes of Funding Circle USA and Dealstruck, there are very limited options today in the market Lending Club is going after, and no clear winners in the online term loan market more broadly.

The timing is good for Lending Club and I happen to think they will do very well. They have clearly not rushed into this; they have taken their time and put the necessary infrastructure in place in terms of people and processes.

As a long time entrepreneur I love supporting small business. And most small businesses are being underserved when it comes to access to capital today. Lending Club can play a significant role in changing that.

What do you think? Is this a good move by Lending Club? Or would you prefer they remain focused just on consumer loans? As always I am interested to hear your comments.

There is more coverage of this news from The Wall Street Journal and Techcrunch.