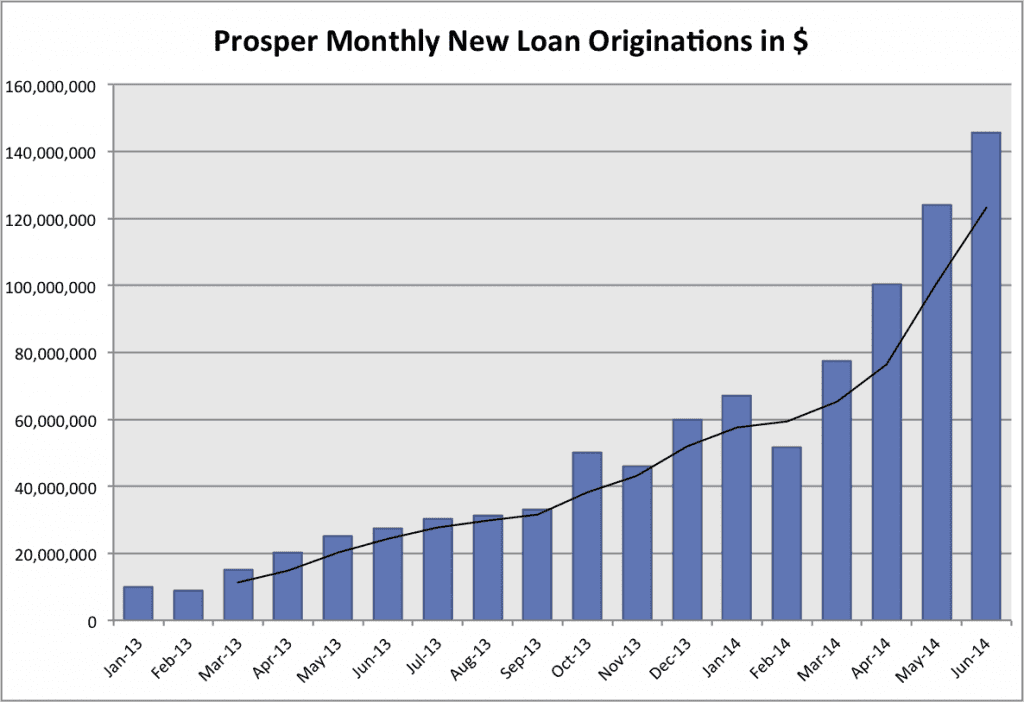

Prosper ended the second quarter very strongly with $146 million in new loans in June, up from $124 million in May. The total loan volume for the second quarter was a very impressive $370 million up from just $73 million in the second quarter of 2013.

The three month moving average (the black line in the chart above) continues to steepen. Prosper’s growth has been very strong the past four months.

Prosper is Now Running at Break-even

I had my regular end of month chat with Aaron Vermut, CEO of Prosper, yesterday and we covered a number of topics. There have been many interesting developments at Prosper lately:

- Prosper made a profit in May for the first time and while the June books are not final, as of this writing he expected the quarter to be close to break-even. Interestingly, he said that Prosper is not making a big deal out of this milestone. The plan is to operate close to break-even for some time as they continue to invest more money into the business.

- They have been hiring a lot of people lately. In the last 90 days they received over 2,000 resumes for open positions, they made 30 job offers and 28 people accepted their offer. The total head count is now around 125 people.

- They are making a big push with their mobile strategy – this includes a mobile-optimized website, apps for borrowers and investors as well as an app focused on credit education for borrowers.

- Automated Quick Invest (AQI) is being rewritten so that it will use the same engine as the API – this will be a big benefit for investors because today AQI is simply not that effective in finding loans.

- Prosper is making a big customer service push. They want to be known as the Zappos of personal finance. At their call center, which is based locally, their goal is to answer every call within 20 seconds.

Below are some of the stats from loans issued in June. The average loan size is slightly lower than last month, the average dollars issued per day is at an all time high and most of the other stats have remained relatively steady.

Average loan size: $13,007

Average dollars issued per business day: $7.3 million

Percentage 36/60 month loans: 64.6%/35.4%

Average interest rate: 15.17%

Percentage of whole loans: 88.5%

Average FICO score: 699

Note: If you are wondering about the Lending Club numbers they have unfortunately stopped updating their new loan data. Their origination numbers and new loan data for the second quarter will be available around the middle of August.