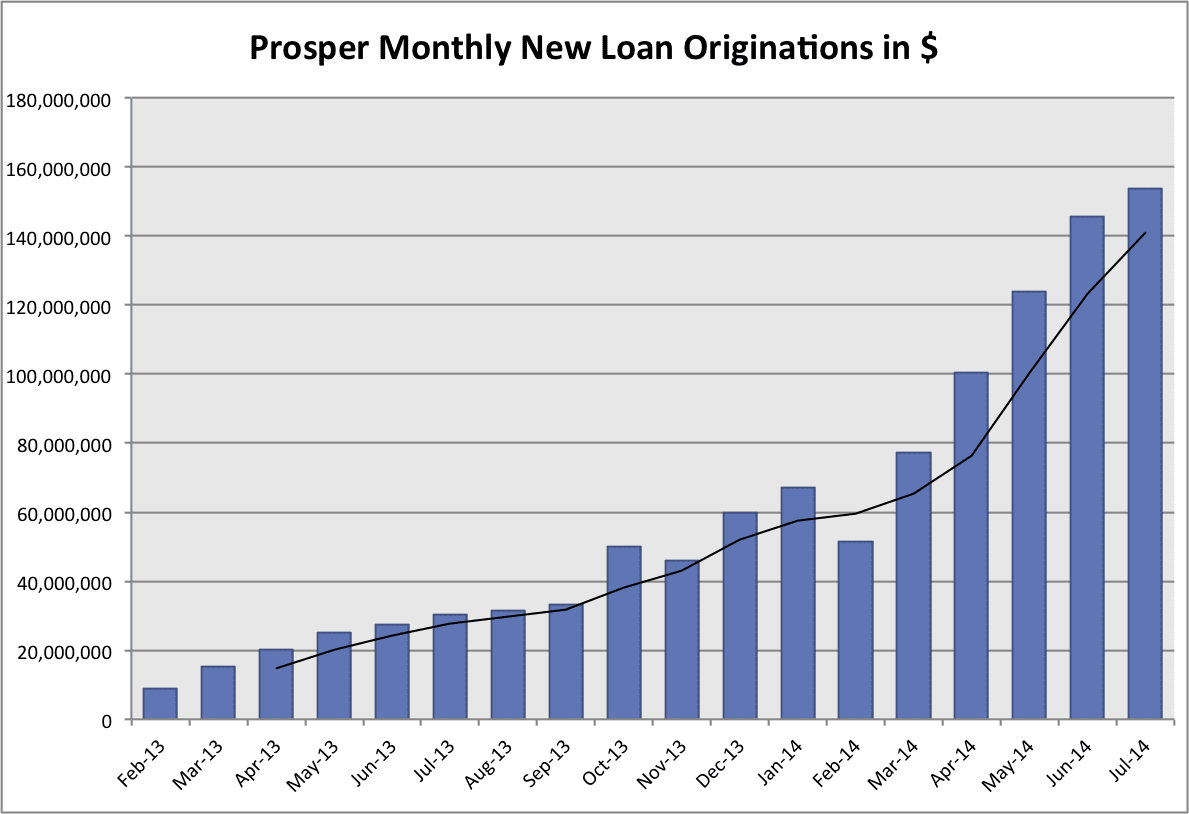

Prosper continued their strong year in July with $154 million in new loans issued, up from $146 million in June and just $30 million in July last year. The growth this month slowed to 5.6% month over month which I think is a good thing. It is difficult to grow 20-40% month over month for very long without putting incredible stress on all aspects of operations. But they have certainly had an amazing run since February as you can see in the chart above (the black line is the three-month moving average).

Below are some of the stats from loans issued in July. The average loan size has settled in to what is likely a new normal for Prosper – around $13,000. Their percentage of whole loans versus fractional loans is still a lot higher than I would like to see, I hope to see that number fall as they focus more on retail investors in the coming months.

Average loan size: $12,957

Average dollars issued per business day: $7.0 million

Percentage 36/60 month loans: 66.5%/33.5%

Average interest rate: 15.06%

Percentage of whole loans: 89.9%

Average FICO score: 699

Note: If you are wondering about the Lending Club numbers they have unfortunately stopped updating their new loan data. Their origination numbers and new loan data for the second quarter should be available later this month.