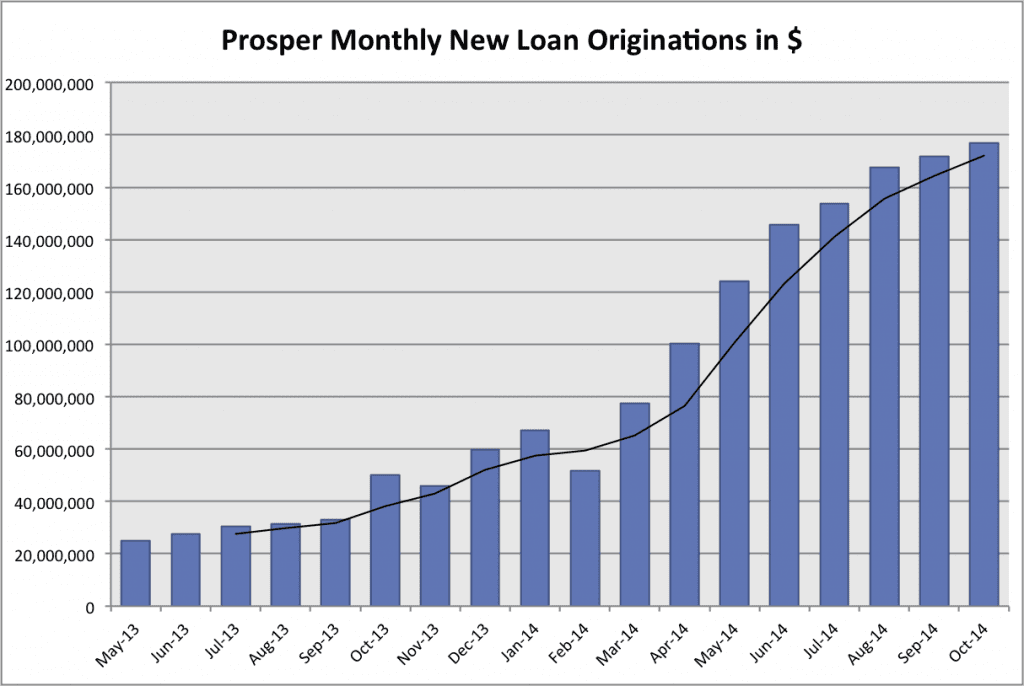

October was another milestone month at Prosper. With $177 million in new loans they crossed $2 billion in total loans. This comes just six months after crossing $1 billion back in April and keep in mind their first billion took nearly eight years to complete.

The last couple of months Prosper’s growth has slowed somewhat from their breakneck pace a few months back. Their $176.9 million October volume is up from $171.6 million in September, just a 3.1% month over month growth.

As I often do after the end of the month I chatted with Aaron Vermut, the CEO of Prosper, to get some perspective on the numbers and to see how things are going at Prosper. He said that there was never an intention to keep the fast pace of growth from earlier in the year going. Part of the reason for that rapid growth was the iteration of their credit model – they began making better offers to more targeted borrowers which lead to a large jump in conversion rates.

Cash Positive Four Months in a Row

This increased loan volume has had a very positive effect on Prosper’s bottom line. Vermut said that Prosper has now had four consecutive months of positive cash flow. He wouldn’t comment on the Prosper 10-Q for the third quarter because it has not been released yet but suffice it to say cash is flowing in to Prosper’s coffers.

Interestingly, he said profitability is not a high priority right now. While they do not want to lose money, they want to plough all they can back into the business, in particular into marketing.

Speaking of marketing, there was a change in their Chief Marketing Office position last month and Vermut couldn’t be more delighted. He said even in her first few weeks he sees new CMO Cheryl Law making a big difference to Prosper’s business.

Below are some of the key stats for last month with most metrics staying very consistent over previous months.

Average loan size: $13,210

Average dollars issued per business day: $8.0 million

Percentage 36/60 month loans: 65.7%/34.3%

Average interest rate: 15.1%

Percentage of whole loans: 89.3%

Average FICO score: 699

Note: If you are wondering about the Lending Club numbers they have unfortunately stopped updating their new loan data in real time. Their third quarter numbers should be made available later this month.