It is hard to believe that it was five years ago today that LendingClub went public. December 11, 2014 marked an important moment in fintech history as LendingClub became the first online lending platform to complete a successful IPO. At the following LendIt event held a few months later in NYC there was an incredible enthusiasm for the industry as we all imagined the continued upward trajectory of the industry.

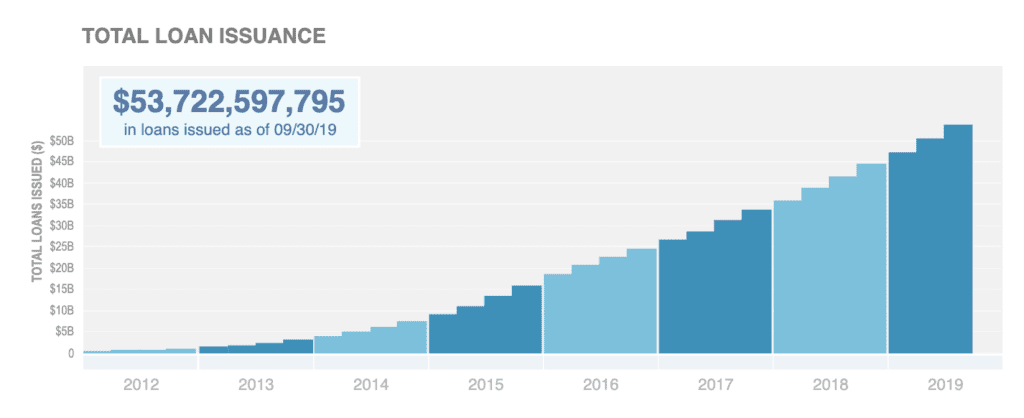

A lot has changed over the years and many are quick to point out LendingClub’s poor performance in the public markets and the LendingClub debacle which was widely reported on back in May 2016. Publicly listed fintech lenders have struggled overall while companies in the payments space such as Paypal and Square have fared much better. Peers who have remained private have had much more success when it comes to valuations which is likely why we haven’t seen many new fintech lending IPOs in recent years. Those who have gone public have tended to perform poorly at least from a stock price perspective. However, there is much more to the LendingClub story. For starters they are the largest personal loan provider in the US having issued over $53 billion in loans, a stat I believe is often overlooked.

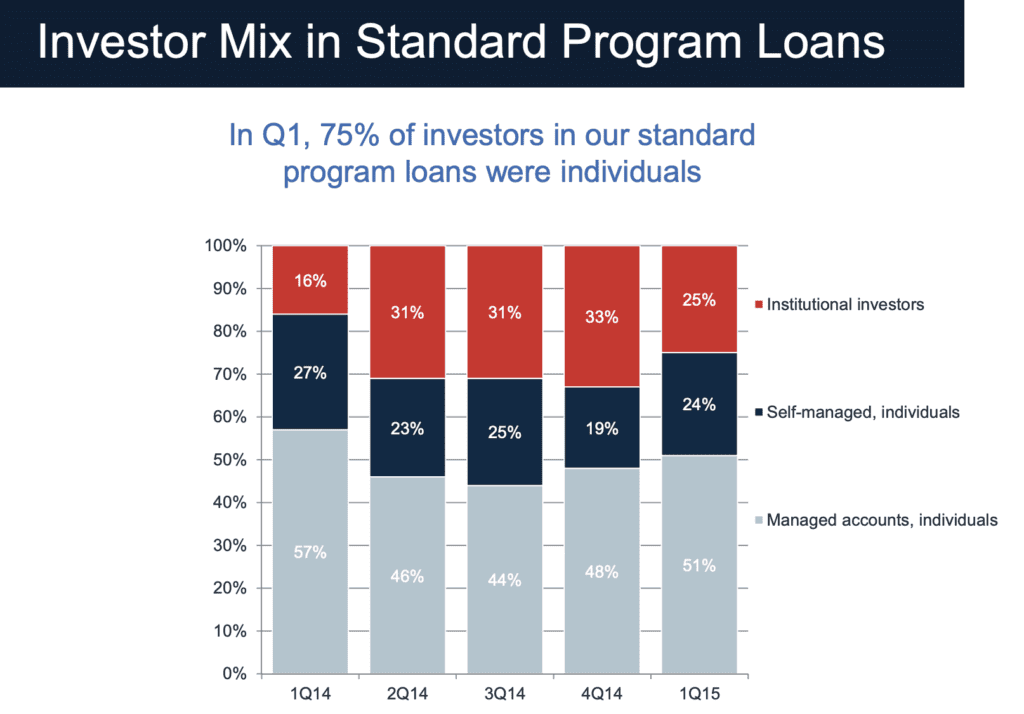

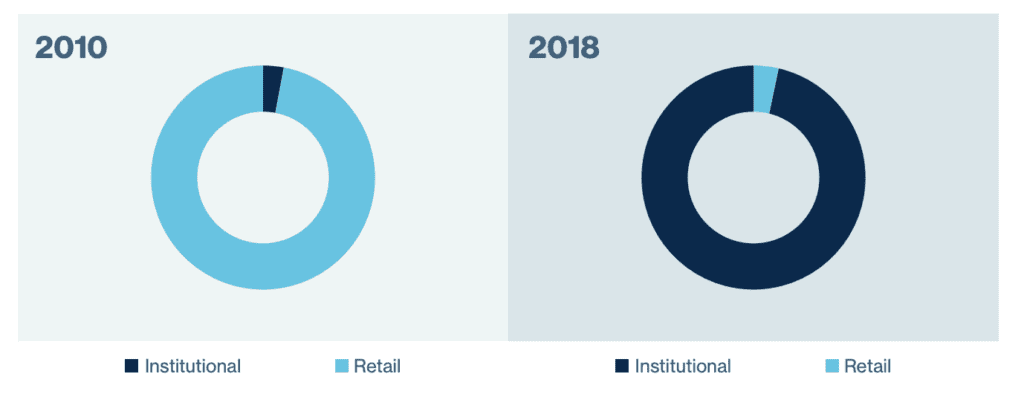

The success they have had in originations was made possible as they transformed their funding sources over time. Digging back into their Q1 2015 earnings presentation it is hard to believe that 75% of their investors in standard program loans were individuals. As of Q3 2019, self-directed investors make up just 4% of funding. We also share the graphic below that shows since 2010 the funding by retail vs institutional has flip-flopped. Over the last five years we have witnessed an ebb and flow of originations on a quarterly basis. After the events of 2016 there was a significant drop in originations, but LendingClub is back to posting record originations as of late while they have also slowly transitioned, focusing on the higher end of the credit spectrum.

The origination milestones wouldn’t have been possible without LendingClub’s success in the capital markets. This is an area where LendingClub seems to have flourished throughout the years. Even with the turmoil in 2016 they were able to retain large investors who were interested in the loans they were originating.

They now have five distribution platforms including LCX, Scale, Select, Select Plus and retail. LCX is the newest offering and gives the ability for investors to bid on loans at par, above par or below bar and offers seamless settlement of those loans. Many of LendingClub’s structured programs didn’t even exist two years ago and have brought in new and larger pools of capital, making up over $1 billion in funding in the latest quarter. This success is attributable to what Valerie Kay, Chief Capital Officer, and her team have done in recent years. Business Insider recently highlighted what Kay has been able to accomplish since she joined in 2016.

While a lot has changed with LendingClub, over time there are some areas where change has been slow. Take their auto refinance product which was first announced in October 2016. After three years, the originations from this offering don’t make up a meaningful amount of originations. However, it seems like this may be changing in 2020 as LendingClub looks to double their auto loan originations. Sanborn noted in their most recent earnings call that the product is actually ahead of where they were in personal loans over the same amount of time (remember that LendingClub was founded back in 2006). The opportunity for LendingClub to offer their customers additional offerings is still a huge untapped opportunity. On the small business side LendingClub shifted their strategy in April 2019, opting to stop originating small business loans themselves and moving to a co-branded experience with both Funding Circle and Opportunity Fund.

Conclusion

The original vision of LendingClub being a marketplace still holds true today. The company has increasingly discussed the idea of a marketplace bank and becoming a financial health club. Seeing the path that many other fintechs have taken by expanding into new offerings quite rapidly, it is a bit surprising that LendingClub has been a slow mover on this front, although this maybe about to change. Regardless they have led the resurgence and transformation of the personal loans space.

No one could have foreseen the ups and downs that LendingClub has experienced in their life as a public company. While it has not been reflected in their stock price they are, in many ways, a much more successful company today than they were five years ago.