Blockchain’s scalability has long been regarded as a potential barrier to the mass adoption of the technology. The formidable prospect of a blockchain bottleneck haunts any news of mass growth and application.

The European Commission EU Science Hub outlined blockchain technology as a “promising technology” but named scalability issues such as bottlenecks as one of the primary sources of concern.

In SEBA Bank’s Digital Investor Outlook 2023, the crypto bank tipped modular blockchains as one of the big things for the coming year. Underpinned by developing technology in newer blockchains such as Cosmos and Celestia, they could be the answer to the scalability issue.

Modular vs. Monolithic

Before explaining the advantages of modular blockchains, it’s essential to add the titans of the blockchain space, ethereum and bitcoin are not modular but monolithic. As the name suggests, the differences come from their singular versus multi-level approach.

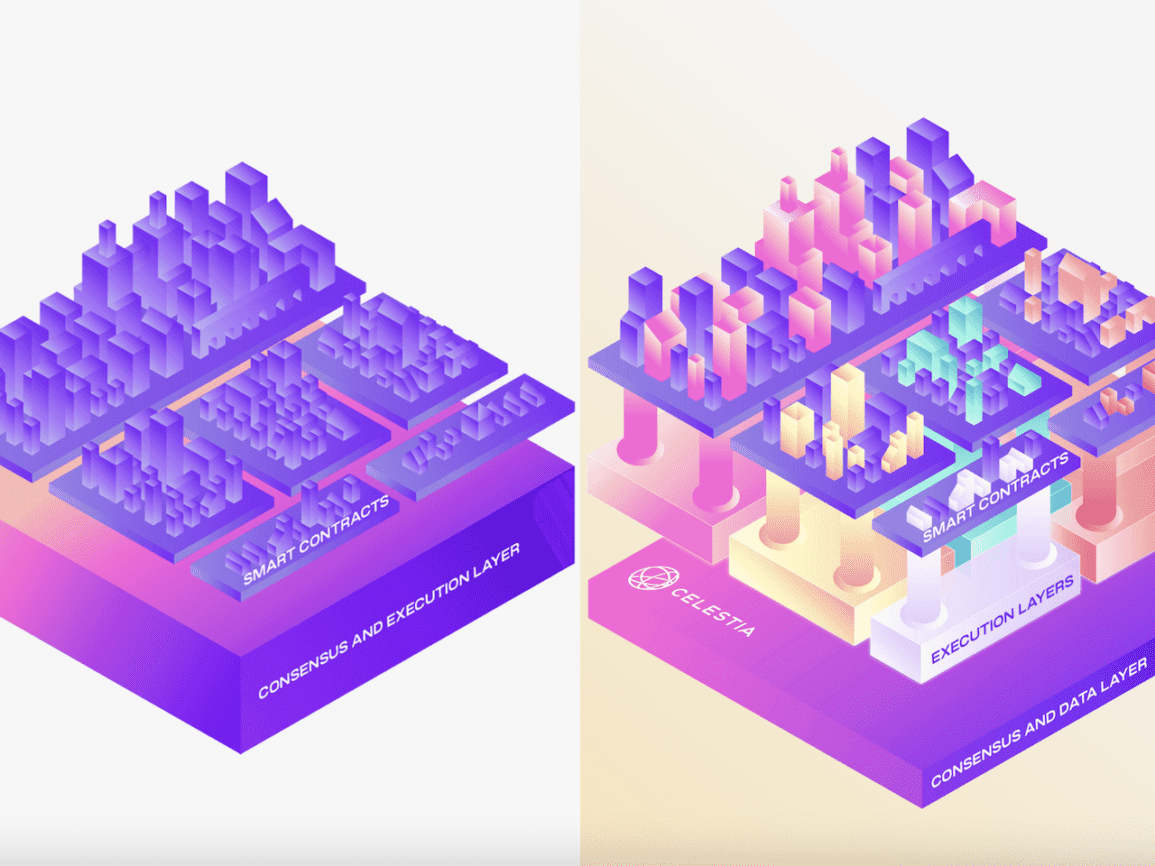

“Each blockchain does at least three things within it,” said Yves Longchamp, Head of Research at SEBA Bank. “First is data availability, then you have the consensus, and then you have the execution.” He explained that monolithic blockchains conduct these processes within the same “layer” of the blockchain. Modular blockchain separates the functions, running only a few critical processes in a base layer and separating the rest into additional layers, streamlining their efficiency.

“You make every single bit smaller and faster,” he continued. “So you add a bit more complexity, more interaction. But at the same time, you cut the big issue in small pieces, and usually, it’s lighter to work with.”

He explained that in the example of bitcoin, blocks could be made bigger to improve scalability, enhancing data availability. “This sounds good, but the problem is it becomes much heavier, a lot more costly, and it could compromise decentralization because it may need special, high-powered computers to process.”

High scalability comes with higher speeds of transactions at lower costs, potentially opening out blockchain to more applications.

He explained that the technology could also solve interoperability issues, allowing developers to build on the blockchain easily.

Still monolithic in its approach, Polkadot is built on the same principle.

RELATED: Smart contract development in the booming DeFi sector

Cosmos has shown resilience

The poster child of modular blockchains that SEBA singled out is the Cosmos ecosystem.

Although Cosmos has yet to be given as much airtime as the likes of ethereum, many have heard of the blockchain due to its association with Terra. While connotations of fear and dread come with Terra, Cosmos has remained untouched by the failure.

“Terra Luna is part of the cosmos ecosystem. But Cosmos was not affected, which shows some of its advantages,” said Longchamp. “Cosmos provides the modular framework to allow you to make your own blockchains and applications without jeopardizing the entire ecosystem if something happens.”

“So the risk is not systemic. It’s limited to your own sub-ecosystem. You saw the Terra sub-ecosystem collapse completely, that’s clear, but no one ever mentioned that Cosmos will be under pressure.”

This breakdown into sub-ecosystem does come with risks, however, as the security of the blockchain is also broken down according to the sub-ecosystem. “This is the trade-off the technology faces and where blockchains like Polkadot have an advantage,” Longchamp continued. “The security of the Polkadot is shared across the full system.”

Cosmos does not implement the tokenomics of Polkadot, and a proposal to change the system into Cosmos 2.0 (where the associated ATOM tokens would have a more significant role) was recently rejected.

Celestia could bring easy scalability.

Another newer modular blockchain, Celestia, is also being explored by the SEBA research team.

Self-dubbed the “first” modular blockchain, Celestia claims to offer the advantage of deploying a blockchain “as easily as a smart contract” on their primary ecosystem. They aim to provide consensus and data availability “on-demand,” creating a plug-and-play system that supports different execution environments.

“One can consider it to be aimed at becoming a decentralized cloud computing company,” stated SEBA bank in their report. “What Amazon Web Services has been to Web 2 companies, Celestia aims to be for Web3.”

Although currently running in the test net phase, the main net is projected for 2023. The development could breed a rash of new Web3-based projects for a mainstream market.