The economy has been through the wringer for the past few years. Skyrocketing inflation in the wake of the COVID-19 pandemic brought with it a series of rapid rate rises that still may not have reached an end.

Financial fear has set in, and many vulnerable consumers are becoming even more vulnerable by the day.

In a report released by the Financial Health Network (FHN), “potentially worrying” signals were found throughout the levels of household spending. Debt has been mounting, and consumers have been increasingly reliant on high-cost credit.

Most acutely affected are those deemed “financially vulnerable” whose growing reliance on credit could impact their ability to recover from the strain.

It’s an environment that could affect US households for years to come. While some regard it as a return to “normal,” some consumers could be locked into a debt cycle that could benefit from a change.

Financial Health walks a thin line.

Taking into account consumers’ spending, saving, and borrowing habits, as well as their approach to financial planning, the FHN can determine indicators of financial vulnerability.

The network found that the areas that consumers had been most affected were shown in fees and interest derived from credit and loans.

Savings have hit a new low since 2015, dropping to below 5% of incomes for the duration of 2022.

More often, consumers were leaning on credit and loan products. Gone is the financial cushion that many used to weather out the financial strain of the Covid19 pandemic. Gone too, are the pandemic-era measures that assisted in loan payments, buoying delinquency numbers.

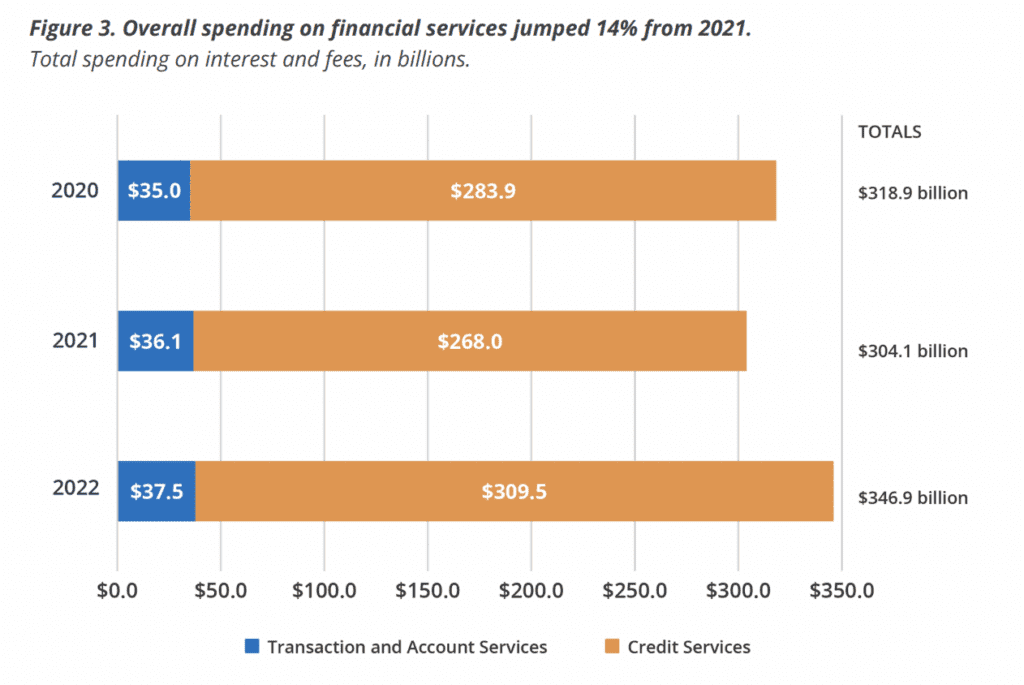

The total interest and fees paid on a variety of nonmortgage financial services increased between 2021 and 2022 by 15%. From credit card interest alone, costs grew by $20 billion.

Rate hikes are partly to blame, accounting for around one-quarter of the increase. However, increased card usage drove the majority of fees. In 2022, just over half of credit card users reported having carried a balance, with clear delineations by financial health tier.

While credit delinquencies had remained low post-pandemic, levels, have started to creep up. Total debt balances grew by $394 billion in the fourth quarter of 2022, the largest quarterly increase in 20 years. The Federal Reserve Bank of New York reported an uptick in credit card delinquency rates towards the end of 2022.

“Altogether, this paints a picture of debt that could really start to strain the checkbooks of American families,” said Meghan Greene, senior director of policy and research at Financial Health Network. “Toward the end of 2022, there were a number of signs that defaults were starting to grow, so that gives us a worrisome picture of how much debt people are carrying.”

Financially vulnerable bear the brunt

According to the survey, while the unbanked population had decreased by 1.8% within the year, those who remain unbanked are disproportionately made up of populations of color and households earning less than $30,000.

The proportion of unbanked is an ever-changing experience, according to the report. Many respondents who said they had no bank account reported closing their checking account in the past 12 months.

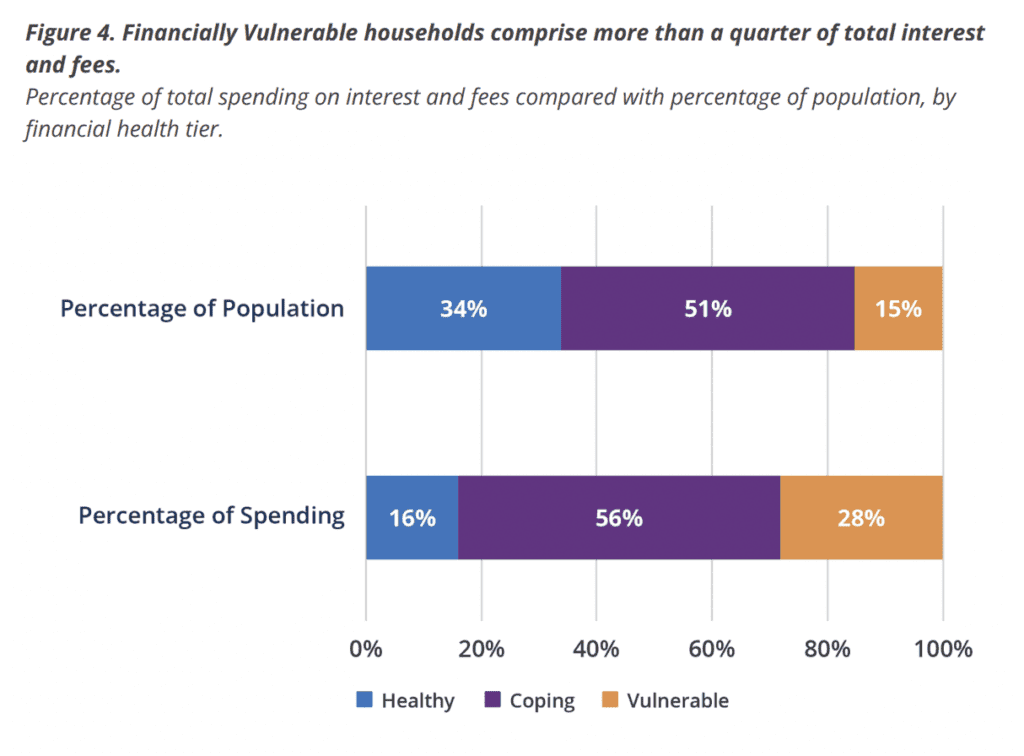

The worsening conditions of vulnerable consumers is a running theme throughout the report. In 2022, it was found that financially vulnerable households allocated 14% of their incomes to fees and interest alone, compared to an average of 1% among the financially healthy.

Individuals that are deemed to be struggling with most or all areas of their financial life spent an estimated $98 billion on interest and fees in the last year. They drove 28% of all fees and interest payments, despite only making up 15% of the population.

The report also found that Black and Latinx households had to allocate more of their income towards covering fees and interest, and a “startling” number of the demographic have had to turn to high-cost loans.

In conclusion, the FHN warned of future scenarios where an already gaping divide in financial health continued to grow wider. “The burden of increasing costs of borrowing will continue to fall disproportionately on those who are less likely to be able to afford it.”

RELATED: Financial Health Network posts grim 2022 Report