Fintech is posing an ever-increasing problem to financial institutions still reliant on legacy structures.

Until now, traditional finance has managed to stave off fintech’s disruptive forces, relying on their decades of establishment to install trust and an air of stability for the consumer. But there are signs that this is starting to change.

“The ability to rapidly innovate and iterate is fast becoming a competitive differentiator,” wrote Aite-Novarica Group in a report. “However, the demand for innovation poses a significant resource management challenge. One made worse by financial institutions’ ongoing reliance on legacy architecture and an extremely competitive market for technical staff.”

Banks have, for some time, seen a drain on consumer deposits, and it seems that fintechs are making up the difference. A new report by Cornerstone Advisors found that so far this year, fintechs have managed to capture 47% of new checking account openings.

“Established financial services and insurance companies are facing a perfect storm of challenges, including nimble fintech startups, legacy core platforms that aren’t sufficiently agile to support modern imperatives such as digital transformation, personalization, and rapid application development, and pressure to modernize core platforms safely and securely,” said Teodor Blidarus, CEO and co-founder, FintechOS.

One approach could be to partner with fintechs, which can bring scalability. However, it can be a long, multi-step process that requires extensive negotiation and, in some cases, an overhaul of organizational processes to accommodate the new addition.

For those that prefer to continue in-house, a reevaluation of the core infrastructure is key to maintaining innovative prowess.

Legacy Systems Replacement: the silver bullet?

The legacy systems of these institutions pose a significant issue when competing with fintechs. Outdated code and layers of the network create friction, a key disadvantage when competing with fintechs which can quickly evolve to meet consumer needs.

According to Capgemini in its World Retail Banking Report 2022, “Structural challenges keep most banks from fully leveraging data-driven analytics to attract customers and grow relationships.”

In response to Capgemini’s survey, 95% of financial institutions said outdated legacy systems and core banking modules inhibit efforts to optimize data- and customer-centric growth strategies. In addition, 80% agreed that underdeveloped data capabilities hinder customer lifecycle process improvements. Over two-thirds said they have difficulties identifying new customer segments, and half reported difficulty in providing seamless onboarding experiences.

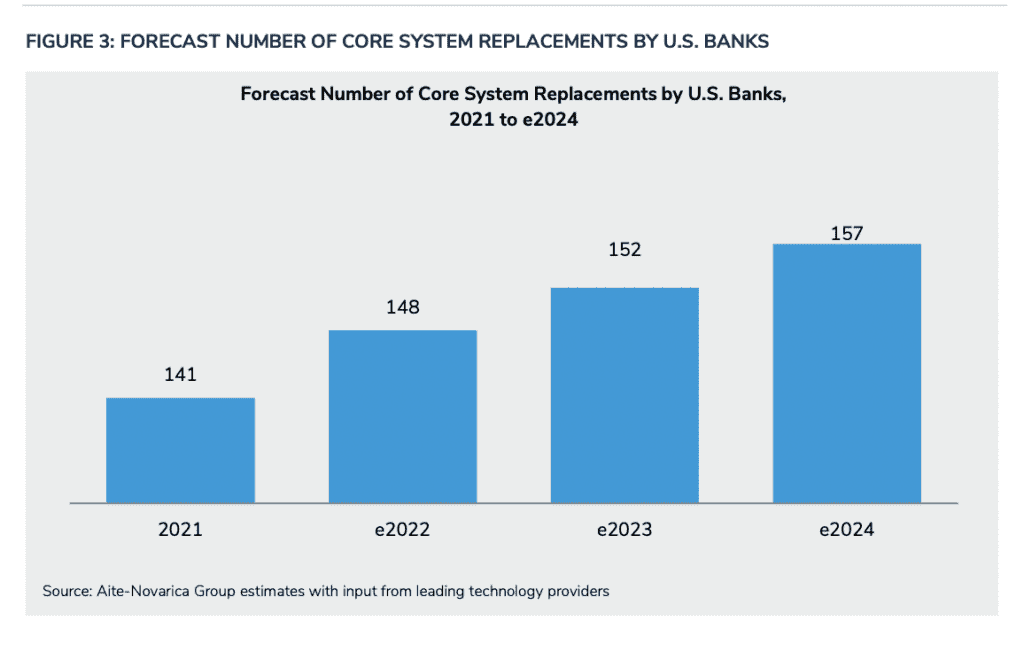

An answer to the issues with core structures would be to “just” replace them. Core system replacements are rising each year, but according to McKinsey, only 30% succeed.

The change requires significant resource allocation, and due to the complexity, critical elements are often overlooked.

“In particular, core modernization programs that inadequately plan for connectivity and interoperability across the bank stack lower their efficiency and effectiveness in driving innovation. This notably includes connectivity to increasingly important third-party fintech ecosystems, as well as the critical customer engagement layers that all FIs rely on,” wrote Aite Novarica.

However, the exercise is unavoidable, and as technology development speeds on, core architecture remains further and further behind.

“Now is the time for banks to modernize core banking,” says Jerry Silva, vice president of IDC Financial Insights’ Worldwide Banking Digital Transformation Strategies program. “Between modern technology approaches like microservices and APIs and the use of cloud platforms ensuring scalability and resiliency for the bank’s back office, banks would do well to start the journey to core system modernizations without delay.”

So what’s the solution?

Each core system is, unfortunately, unique, meaning the strategy has to be customized.

According to Aite Novarica, Currently, there are three classic approaches, each with its own challenges:

- “1 – Full “rip-and-replace” of existing core infrastructure: Big-bang approaches to core replacement can effectively deploy new modern capabilities but are intensive, resource-heavy projects with very high levels of risk. This includes the potential for projects to spiral out in cost and timescale and as threats to service levels for existing clients.

- 2 – Greenfield launch: Typically involving cloud-based platforms, these rollouts involve FIs running a greenfield tech stack that operates parallel to existing bank infrastructure. New clients are onboarded into the greenfield core, while older clients are later migrated to the new platform. This approach can lead to significant disruption for existing clients and requires a costly doubling of resources due to running parallel operations.

- 3 – Wrap-around, or core-hollowing: This approach typically uses containerized systems, or a microservices approach, to deploy modern capabilities piece by piece, with the option of outright core replacement at some point. While risks are reduced, this approach requires supporting a viable legacy core system for several years, lengthening the time for the overall core modernization process. Additionally, FIs must prioritize areas for modernization, and they incur risks due to significant customization, creating new forms of legacy technology problems.”

However, new solutions are being developed.

RELATED: Generative AI in fintech goes far beyond the ChatBot

One many are turning to is the use of fintech enablement strategies.

A fintech enablement platform is an infrastructure that acts as an operating system for innovation. Reducing the complexity of launching innovative projects, it is made up of prebuilt and modifiable components many times using low-code approaches. These can be deployed in a more agile and responsive method than most traditional development cycles.

While it isn’t a solution to the tangled web of core infrastructure, it can provide a more streamlined approach to innovation.