Affirm presented earnings (PDF Supplement here) after the bell today and they produced an impressive report, exceeding analysts’ expectations with solid growth in all areas of the business.

The BNPL pioneer reported a Gross Merchandise Volume (GMV) increase of 32% year-over-year, reaching $7.5 billion, alongside a notable revenue surge of 48% to $591 million.

The number of active consumers grew by 16% to 17.1 million, with transactions per active consumer also on the rise. The growth in active merchants by 15% to 279,000 shows expansion in its business network. However, the earnings presentation also hints at challenges in managing operating expenses, emphasizing strategic adjustments to maintain profitability amidst rapid growth.

Partnerships have played a pivotal role in Affirm’s growth, with the company establishing relationships across a wide range of categories. This diversification strategy not only expands Affirm’s market presence but also mitigates risks associated with dependence on a limited number of sectors. The notable growth in active merchants by 15% year-over-year to 279,000 further demonstrates Affirm’s expanding ecosystem and its appeal to businesses seeking to offer flexible payment solutions.

Affirm’s financial health is also highlighted by its revenue less transaction costs, which saw a year-over-year increase of 68%. This improvement in profitability metrics indicates effective cost management and operational efficiency. Moreover, the company’s strategic adjustments in operating expenses and the continued focus on technology and data analytics are pivotal in supporting its growth trajectory while maintaining a lean operational model.

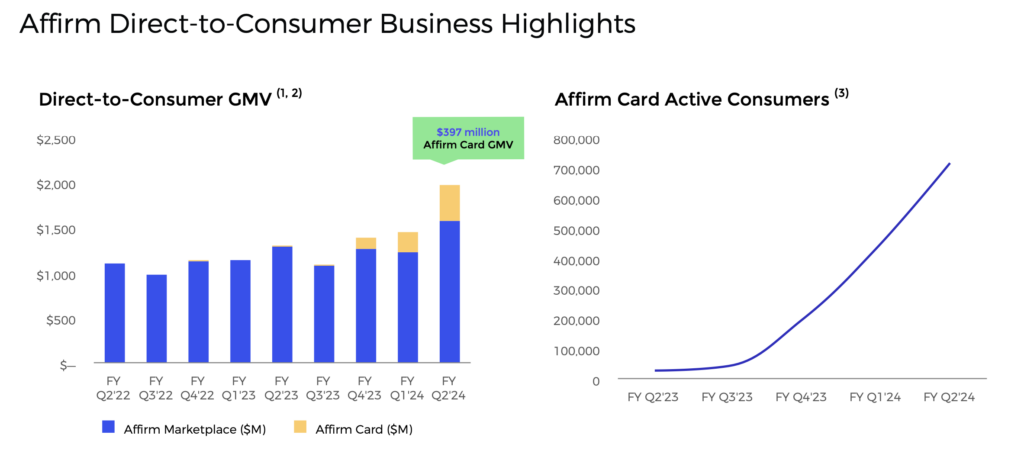

Affirm introduced the Affirm Card in 2021 but in the last 12 months usage has significantly picked up. There are now more than 700,000 consumers with the debit card that can used to turn any purchase into a “pay over time” purchase. Almost $400 million in purchases were made on the Affirm card in the last quarter.

What was curious about this earnings call is that there was no prepared statement. CEO Max Levchin simply said, “As is our custom, the better the results, the fewer words we use to comment on them. This time around, I feel good enough to go directly to the Q&A.”

So, the Q&A section was the entire earnings call and the large group of analysts peppered Levchin and CFO Michael Linford with questions. They discussed the integration and performance of their BNPL services with major retailers, strategic moves to navigate the evolving regulatory landscape, and plans for international expansion. There was also a focus on technological advancements to improve underwriting and fraud detection and insights into how consumer behavior trends are shaping product offerings. Additionally, Affirm’s approach to managing credit risk and its impact on future profitability was a highlight.

Investors were not that pleased, despite the solid results. Affirm’s stock has had a great last six months, it is up over 200%. And even though the company beat expectations it was not good enough for investors and the stock price was down more than 12% in after-hours trading.